Ⅰ Review of 2019 stainless steel market

1. Overview

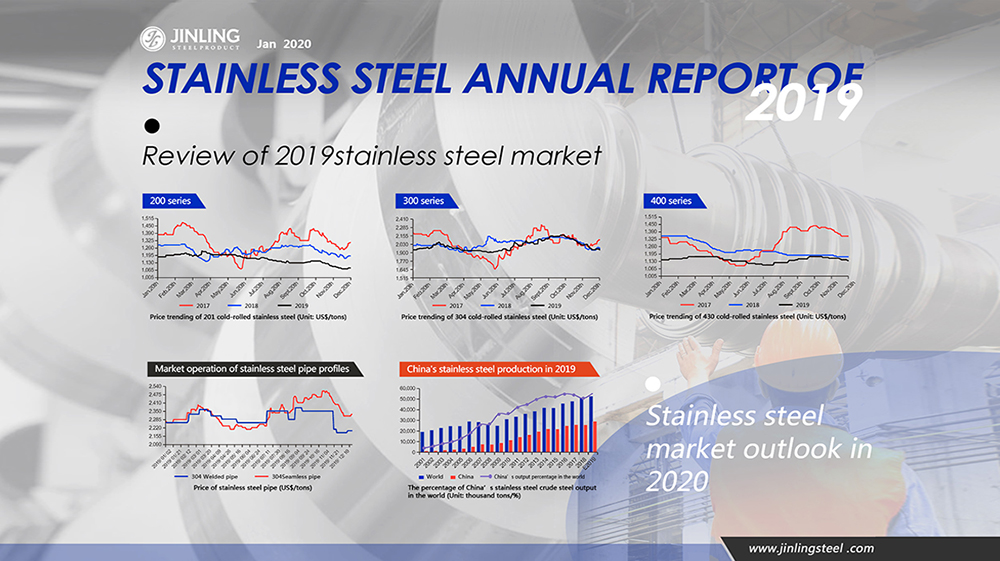

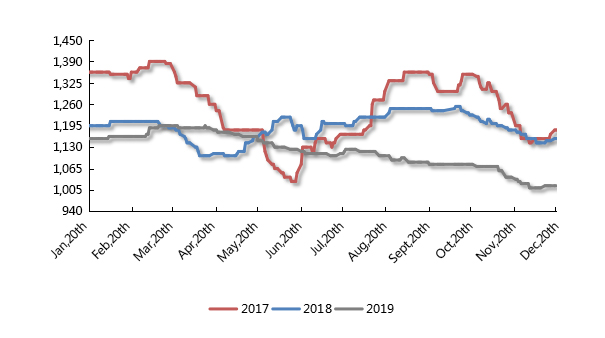

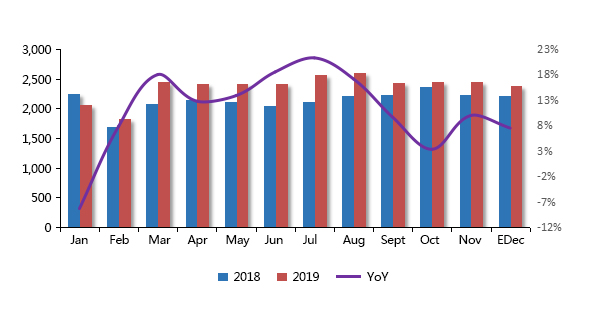

The past year was a year unpredictable. Under the stimulation from various news, there were multiple large ups and downs. Although the relation between the price of stainless steel and nickel has weakened, the price of stainless steel was unavoidable changed along with the price of nickel to a certain extent. Typically, influenced by Indonesian policies against nickel ores in the second half of the year, the price of stainless steel soared significantly and then kept dropping. Another influence on the stainless steel market caused by some mills’ operations. Until mid-December, the total decrease of 304 hot-rolled stainless steel amounted to 29-43US$/ton and private-owned enterprise 304 cold-rolled stainless steel dropped by 71USS$/ton. However, different from the decreasing stainless steel price, the nickel price increased largely compared to last year, which led to a higher cost in stainless steel production and a smaller profit margin. But it did not affect the mills’ productivity and the output kept increasing to new heights even though there was little new capacity in 2019. In 2019, it was predicted that the total output of the 32 main mills in China was 28.5378 million tons increased by 10.93% compared to last year and the increasing range of 200 series was the largest. Regarding demand and supply, because of the unmatched demand which was way less than supply, the inventory kept rising. As for the price, the price of 201 cold-rolled stainless steel was located between US$1,080-1,235/ton and 304 cold-rolled stainless steel was ranging from US$1,900-2,180/ton.

Price comparison between stainless steel and London nickel (Unit: US$/ton)

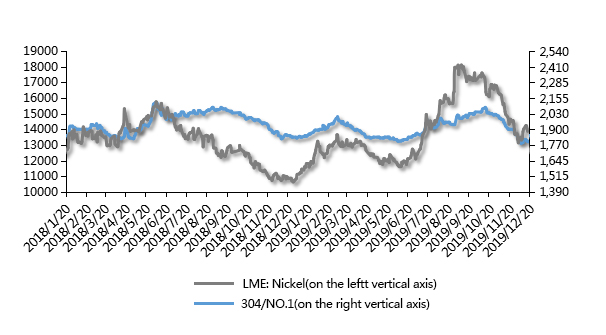

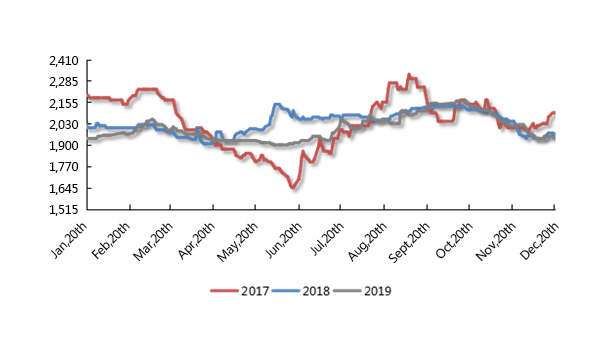

Price comparison between 304 hot-rolled and cold-rolled stainless steel (Unit: US$/ton)

2. The overview of the stainless steel coil market

2.1 200 series

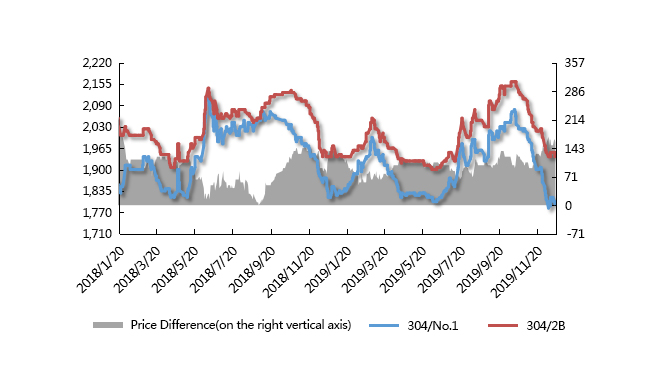

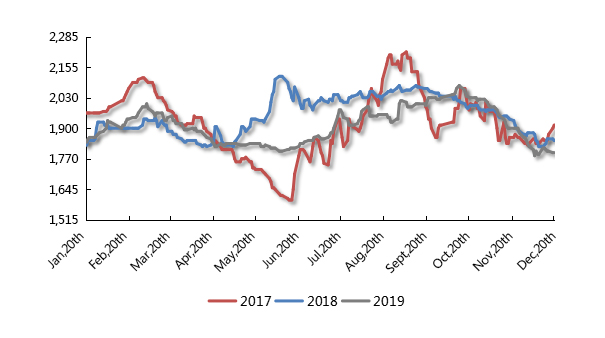

200 series: In 2019, both 201 cold and hot rolled stainless steel was in a downside tendency. For the 201 cold-rolled stainless steel, its price range was from US$1,080 to 1,235/ton. For the 201 hot-rolled stainless steel, its price was around US$1,010/ton and US$1,195/ton, which fell much compared to the price of 2017 and 2018. The reason was the imbalance of supply and demand. The output of 200 series crude steel had a rise in 2019, resulting in an increasing inventory in the market. Later that the production of 200 series was cut down at large amounts by the mills due to the rising cost of the raw material price, but the downstream demand failed to catch up with the output from the mills, which caused the downside price in the late-term market.

Price trending of 201 cold-rolled stainless steel (Unit: US$/ton)

Price trending of 201 hot-rolled stainless steel (Unit: US$/tons)

2.2 300 series

300 series: In the first quarter of 2019, the trend of stainless steel prices followed closely with the change of London Nickel, which grew gradually in general. Entering the second quarter, a slack season, with the larger crude steel output, the price of stainless steel dropped significantly and the quotation of 304 cold-rolled stainless steel decreased to the lowest point in the year at US$1,900/ton. However, in the next quarter, it was the “golden September”. The inventory left from the last quarter was consumed in the third quarter making the price of 304 cold-rolled stainless steel went up to US$2,150/ton. Stepping into the fourth quarter, in the beginning, the transaction price was still at a high level but it faded along with the weaker end purchasing capability, so the market was back to normal. As follow, the price of steel declined and the quotation of 304 hot-rolled stainless steel decreased to US$1,785/ton which was the lowest point of the year.

Price trending of 304 cold-rolled stainless steel (Unit:US$/ton)

Price trending of 304 hot-rolled stainless steel (Unit: US$/ton)

2.3 400 series

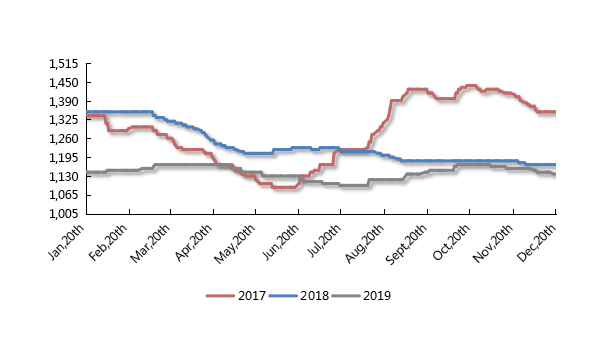

400 series: In 2019, 400 series maintained at a lower price. 430 cold rolling was priced between US$1,100/ton and US$1,170/ton. One reason was the relation between supply and demand. Another was the price of high carbon ferrochrome. These limited the mills’ output, failing to change the market and there was also a limited consumption of the end buyers. Later of the year, some mills have taken an increase in 400 series output in the new capacity plan which will lead to fierce competition in the future.

Price trending of 430 cold-rolled stainless steel (Unit:US$/ton)

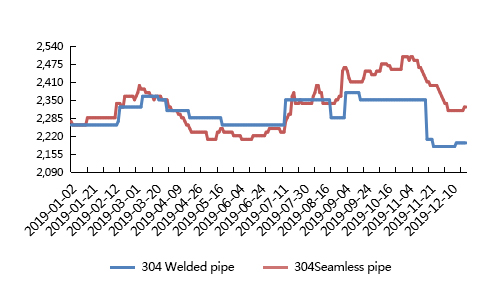

3. The overview of the stainless steel pipe market

Pipe: The trend of the pipe market developed as the coil and round steel market. In the first quarter, because of the increasing price of the raw material, the producers boosted the price. But after the holidays, the working recovery was slow, so it was a lack of buying motivation. In the second and third quarters, the eagerness of transactions affected the market. The quotation tended to be various, but due to the market competition did not make out a satisfying transaction result. In the second quarter, there was environmental governance in the Wenzhou area and the factories stopped producing, but it did not bring a relaxing moment to the market. Moreover, the “golden September” in the third quarter disappeared in 2019. What’s worst, with the profit margin squeezed, the cost was over price in Foshan’s decoration pipe factories.

In the last quarter, thanks to the lower price of the raw material and stockpile at the end of the year, the transaction got better though it was still less than 2018. To a certain extent, it was kind of assuaging the producers and traders.

Price of stainless steel pipe (US$/ton)

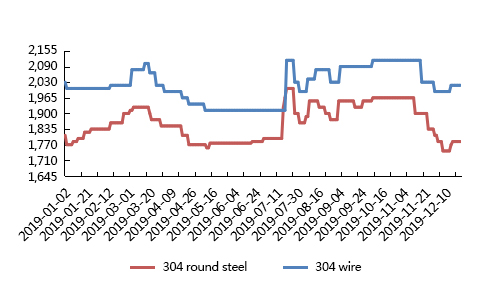

Section bar: In the first quarter, influenced by the rising price of wasted stainless steel and nickel, section bar price fluctuated and went up. The increasing price of bar wire of Tsingshan and other main mills on the opening up, pulling up the market attitude. Early of the year, many buyers stocked up to prepare for the works before the Chinese New Year. After the Chinese New Year, the operating of the market was postponed as well as the full stock of downstream was settled before holidays, the transaction resulted in poor. In March, due to the tax adjustment, the end purchase had a re-rise but the actual demand was not strong enough. In the second and third quarters, the market was in a declining tendency. Compressed by raw materials and the downstream users, the mills gradually lost their bargaining power, resulting in lower profit in total. According to the market feedback, although the profit margin was squeezed, the orders of the year were full and the mills are hoping better for the next year.

Price of stainless steel section bar (US$/ton)

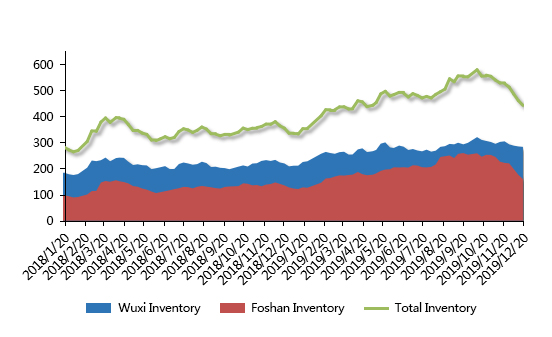

4. Stainless steel market inventory of 2019

According to the market data, in 2019, the inventory of Wuxi and Foshan ranged from 400,000 tons to 600,000 tons (Spring festival is excluding), which reached the highest point of the year in the fourth quarter. Analyzed from the series, the inventory of 200 series increased from 17.46% at the beginning of the year to now 28.16%; the inventory of 300 series declined from 64.39% at the beginning of 2019 to now 61.36%; the inventory of 400 series also decreased from 16.17% at the beginning of the year to 10.48% now. Generally, the price of stainless steel and the market change kept in a positive correlation. That is to say, if the inventory decreases to a certain amount, there must be a rebound and increase. Likewise, if the stainless steel price is declining for a long period, which weakens the stock-up willingness of the market traders, there will be a decrease in market inventory and result in heavy stock in the factories.

Market inventory of stainless steel (Unit: thousand tons)

Inventory changes of stainless steel in series (Unit: thousand tons)

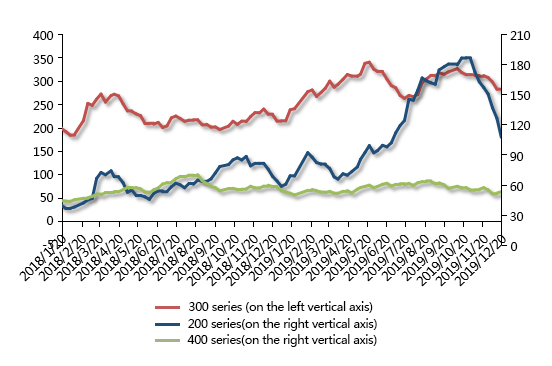

5. China’s stainless steel output in 2019

5.1 China’s output of stainless steel crude steel

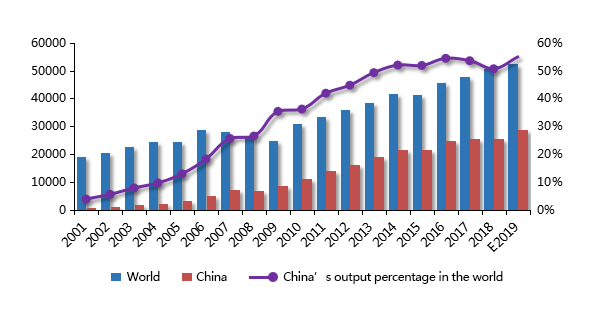

In 2019, it was predicted that global stainless steel crude steel output was 52,710,000 tons which increased 3.19% compared to last year; for China, in 2019, the output of stainless steel crude steel was to be 28,953,000 tons which was increased by 12.54% and China would take up to 54.93%.

The percentage of China’s stainless steel crude steel output in the world (Unit: thousand tons/%)

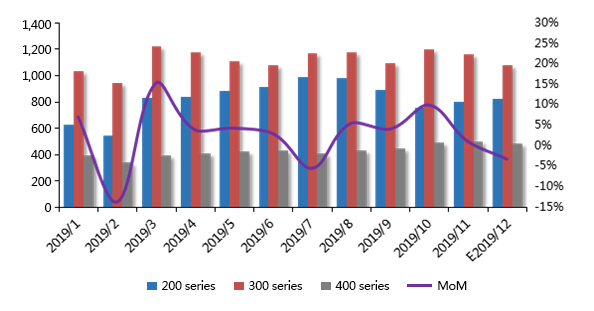

From the stainless steel data about China, in 2019, there were 28,953,000 tons stainless steel crude steel produced by the main 32 stainless steel mills, which were 3,227,000 tons more than last year and 12.54% higher in the same caliber, of which Cr-Ni steel (300 series) was 13,810,000 tons which were 1,100,000 tons more than 2018 and the increasing percentage was 7.79%. It took 47.7% of all the crude steel output, which was 1.75% less than last year (2018). 5,168,700 tons Cr steel (400 series) was produced, which increased by 503,000 tons compared to last year and the rising percentage was 9.73%, taking 17.85% of the total output, which was 0.88% less than last year. Cr-Mn steel (200 series) was 9,774,400 tons and it increased by 1,426,600 tons whose rising percentage was 14.6%, took 34.45% of the total amount and increased by 2.63% compared to last year. In 2019, it was predicted that all three series of stainless steel would maintain to increase. As for right now, the rising percentage was faster than it was expected, so the new capacity was able to realize and most of the mills were in high operating starts in the second half of 2019. Domestic 300 series crude steel output slid in 2019 as well as the 300 series because loads of 300 series stainless steel were transported to China from Indonesia. While 400 series crude steel output had the largest increase which was 14.6% more than last year.

China’s stainless steel crude steel output (Unit: thousand tons)

China’s stainless steel crude steel output (Unit: thousand tons)

5.2 The output of Indonesian stainless steel crude steel

Based on the stainless steel website’s statistics, in 2019, the output of Indonesian stainless steel crude steel was 2,220,700 tons, increasing by 2,193,000 tons that are 1.26% more than last year, mainly of which was 300 series as well as a small quantity of 200 series.

Indonesian stainless steel crude steel output (Unit: thousand tons)

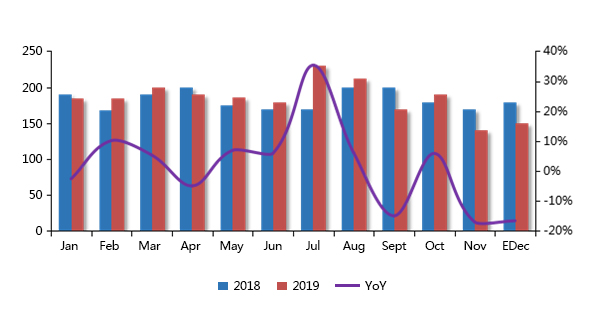

6. China’s imports and exports about stainless steel

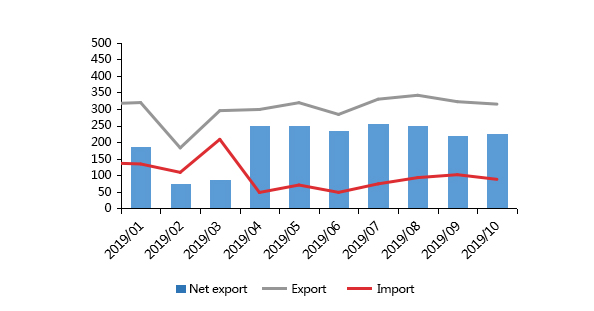

From January to October of 2019, the export of stainless steel was 3,007,100 tons, which decreased by 21.16% compared to 2018 in which it was 3,814,400 tons. Between January and October, China's export of coil was 2,227,900 tons, less by 23.02% compared to 2,894,300 tons of 2018. About the import of coil, it was 666,300 tons in 2019 and 1,241,300 tons in 2018, which decreased by 46.32%. The major reason for this was the negative international trading environment. The ongoing anti-dumping and countervailing duty has gone worst, which stroke much at stainless steel export. Worse still, the bad business environment, regional risks, and sociopolitical risk all led to the weaker China's stainless steel output which started to slide into a declining tendency. The importing amount was 973,300 tons which were 56.05% lower than 2,214,600 tons of last year. Except for the change of the demand and supply structure in China, the other reason for the downside import mainly rose in Indonesia where it was unstable in stainless steel productivity. On the other hand, the Chinese government has imposed an anti-dumping tax on some stainless steel products originated in Indonesia since April 2019.

China’s imports and exports about stainless steel (Unit: thousand tons)

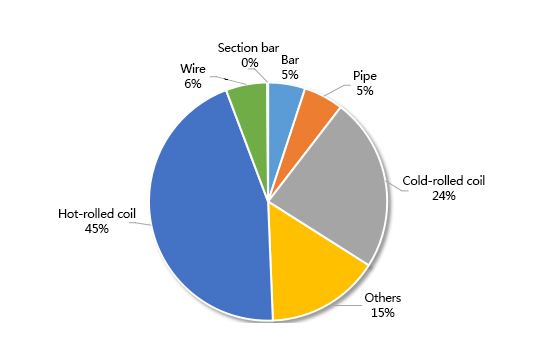

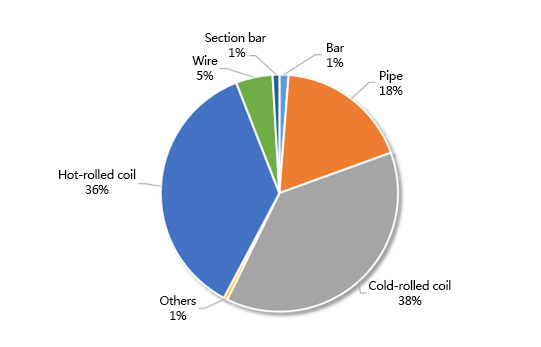

Percentage of importing stainless steel products from Jan 2019 to Oct 2019

Percentage of exporting stainless steel products from Jan 2019 to Oct 2019

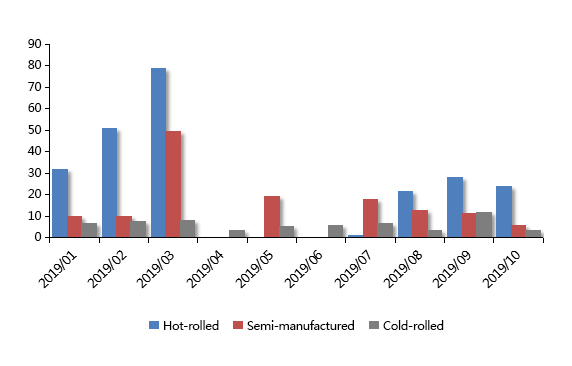

From January to October of 2019, the stainless steel import to China from Indonesia decreased to around 440,400 tons from 1,014,800 tons of 2018. In October, the imports of hot-rolled products were 24,070 tons which were 14.3% less than September when it was 28,080 tons. As for the import of cold-rolled products, it decreased month-on-month by 67.6% from 11,890 tons of September to 3,850 tons of October. About the semi-manufacturing steel embryo whose import was 6,160 tons in October, it was 46.5% lower than 11,510 tons in September.

Data of stainless steel imports from Indonesia (Unit: thousand tons)

II Stainless steel market outlook in 2020

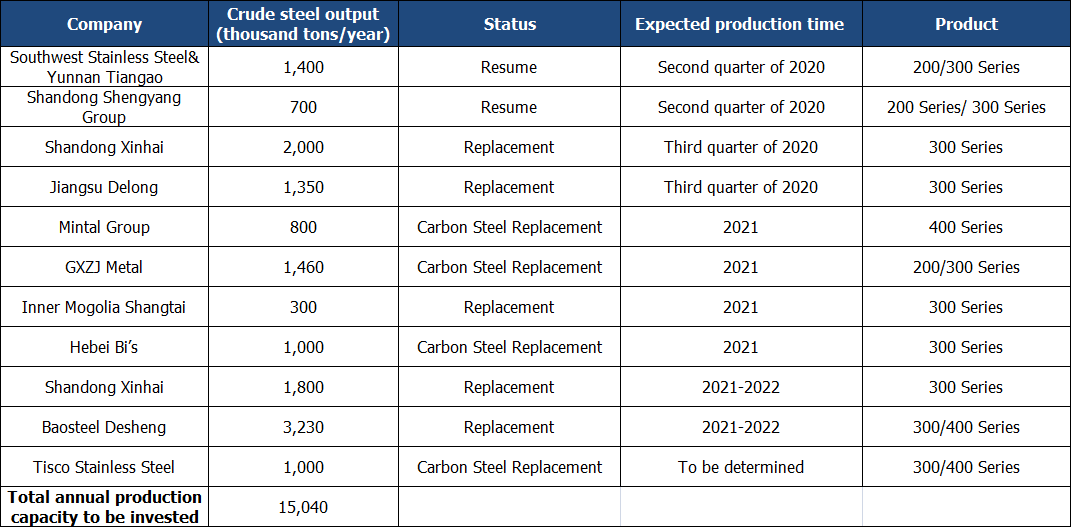

1. The expected new capacity of stainless steel in 2020

It is analyzed that in 2020, China's new stainless steel capacity to be put into production is 5.45 million tons. The mining forbidden policy by Indonesia was brought forward earlier, which triggered the anxiety against the future market. The peak of the stainless steel production plan of China in 2020 will be probably postponed and the production of 300 series stainless steel in 2020 is still unclear. It is predicted that the new output of Chinese stainless steel will be 1,250,000 tons in 2020, of which there will be 150,000 tons of 200 series and 1,100,000 tons of 300 series. As for the stainless steel total output of 2020 in China is expected to be 29,790,000 tons. From the perspective of different series, it is estimated that the output of 200 series will be 10,000,000 tons, 300 series will be 14,690,000 tons and 400 series will be 5,100,000 tons.

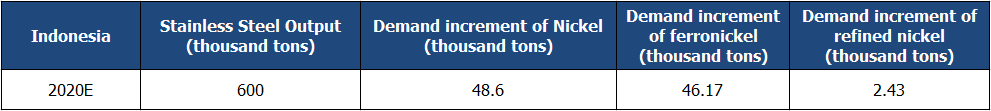

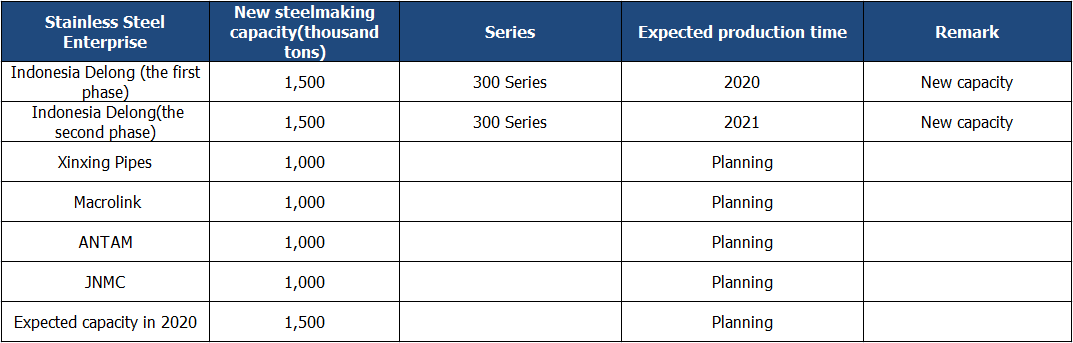

2. Analysis of Indonesian stainless steel and the raw material supply

By now, the first phase of the Delong Indonesian stainless steel project has started but affected by domestic anti-dumping policy and the against of the cheap Indonesian steel by European area, the production progress will be possibly postponed. It is estimated that only 600,000 tons of new stainless steel output will be added to Indonesia. 2,820,000 tons of 300 series stainless steel in the year will for 228,400 metal tons of nickel. Generally, Nickel imports to China from Indonesia will keep rising in 2020.

In 2020, new stainless steel capacity by Indonesia will be 1,500,000 tons whose majority will be 300 series stainless steel.

3. Summary

The stainless steel pattern of high supply, large inventory and low demand in 2019 will be hardly broken in a foreseeable future. The stainless steel cost will remain at a high level because of the expensive nickel and other raw materials, which results in a small profit margin in the whole industry. On the supply side, the capacity and output will be in an increasing trend both in China and Indonesia in 2020, but the actual output is still not clear yet. On the demand side, the usual demand will maintain increasing and in the meantime, the increasing demand from emerging industries will become a hot spot. However, China’s economy is to be in a challenge in 2020 as the prediction. On the import and export side, with the increase of stainless steel production put in Indonesia, export to China will also increase in 2020, but export from China will be a further constraint.

----------------------------------------------------------------------------------------------Stainless Steel Annual Report of 2019---------------------------------------------------------------------------------------------------------