China's shipping industry is in the best period of recovery in history.

On 7th April, Shanghai International Shipping Research Center released a report on China's shipping prosperity for the first quarter of 2021.

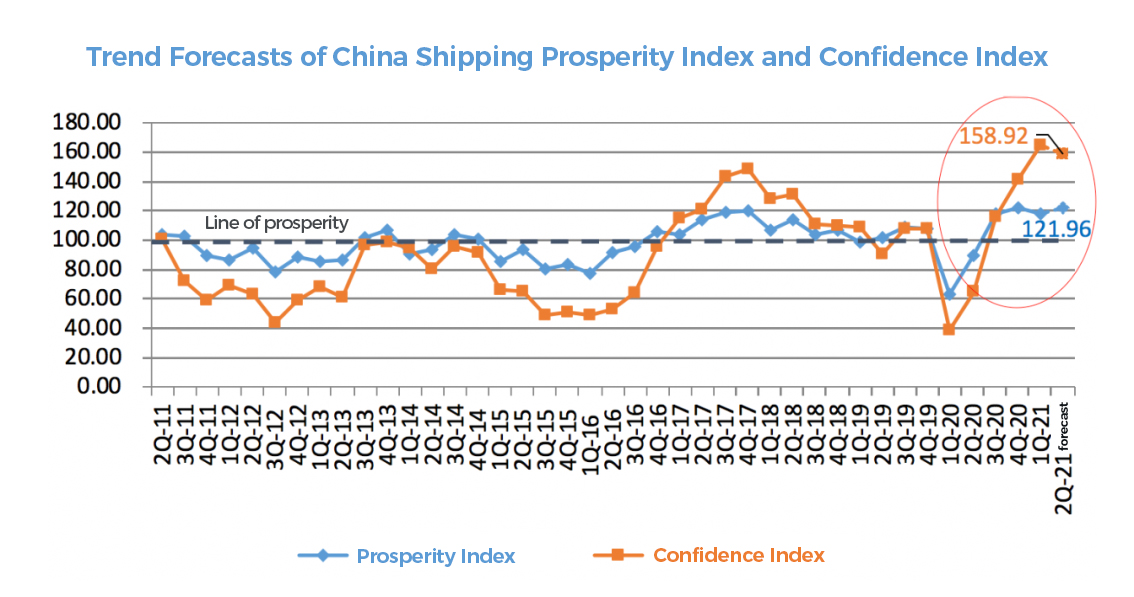

During the reporting period, China's shipping prosperity index reached 117.92 points, entering a relative prosperity range; China's shipping confidence index was 165.08 points, increased sharply by 23.93 points from the previous quarter, entering a strong prosperity range, setting a record high.

(Shipping prosperity refers to the prediction of the future development of the industry, while the shipping confidence regards to people’s faith in the industry.)

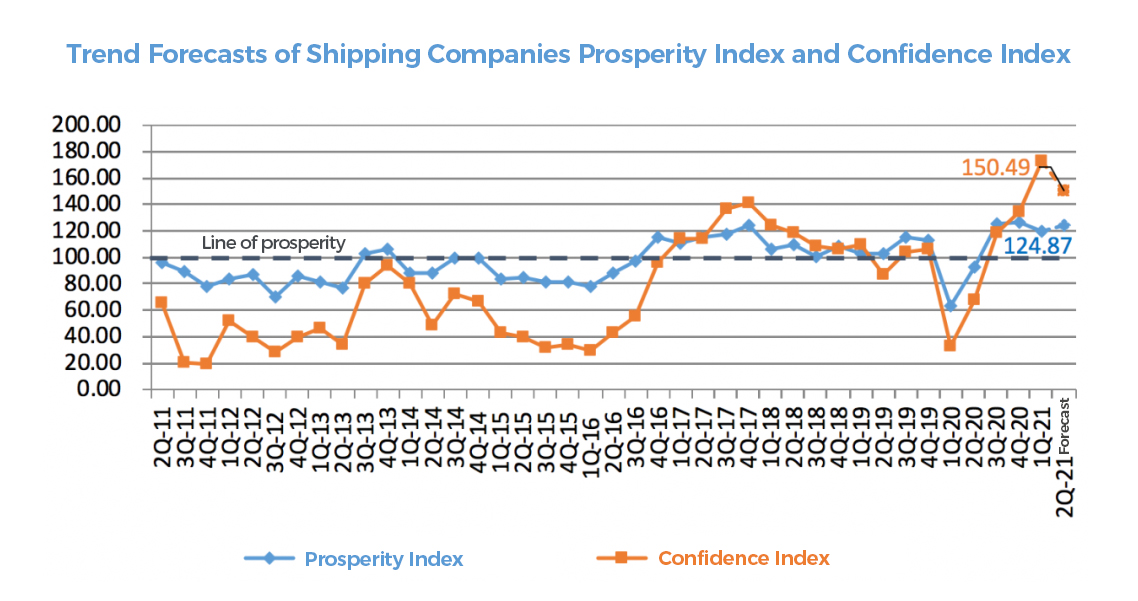

In the first quarter, the confidence of the shipping companies increased largely.

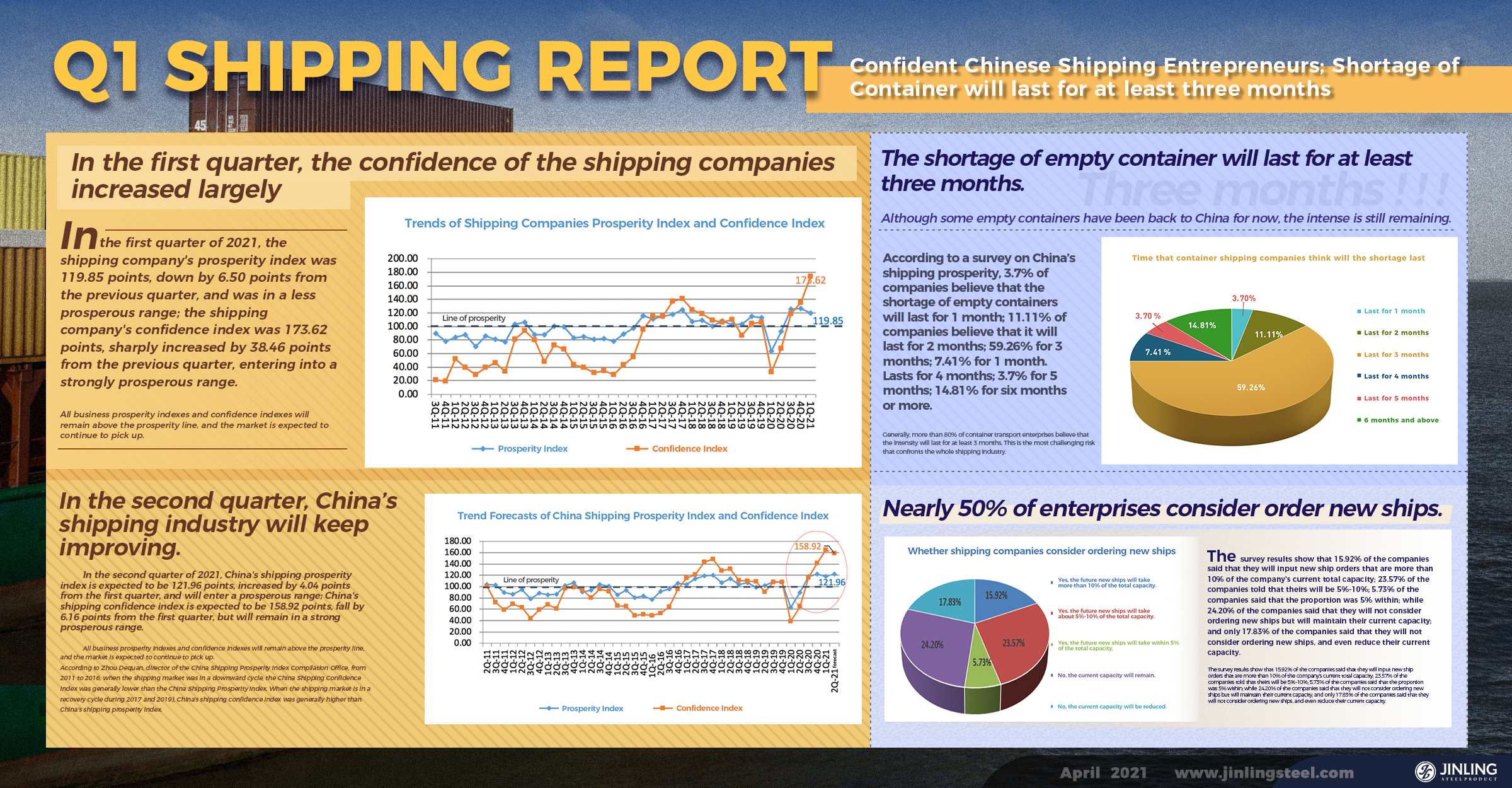

In the first quarter of 2021, the shipping company's prosperity index was 119.85 points, down by 6.50 points from the previous quarter, and was in a less prosperous range; the shipping company's confidence index was 173.62 points, sharply increased by 38.46 points from the previous quarter, entering into a strongly prosperous range.

Ship transportation companies continue to increase their capacity, the utilization of space continues to improve, and freight revenue keeps increasing. Although operating costs have risen sharply, companies still maintain a high level of profitability. Loan liabilities are reduced, labor demand continues to increase, working capital is abundant, corporate financing is easy, shipowners' willingness to invest in transportation capacity is gradually strengthened, and the anti-risk capabilities have steadily increased.

The container shipping market continues to be booming.

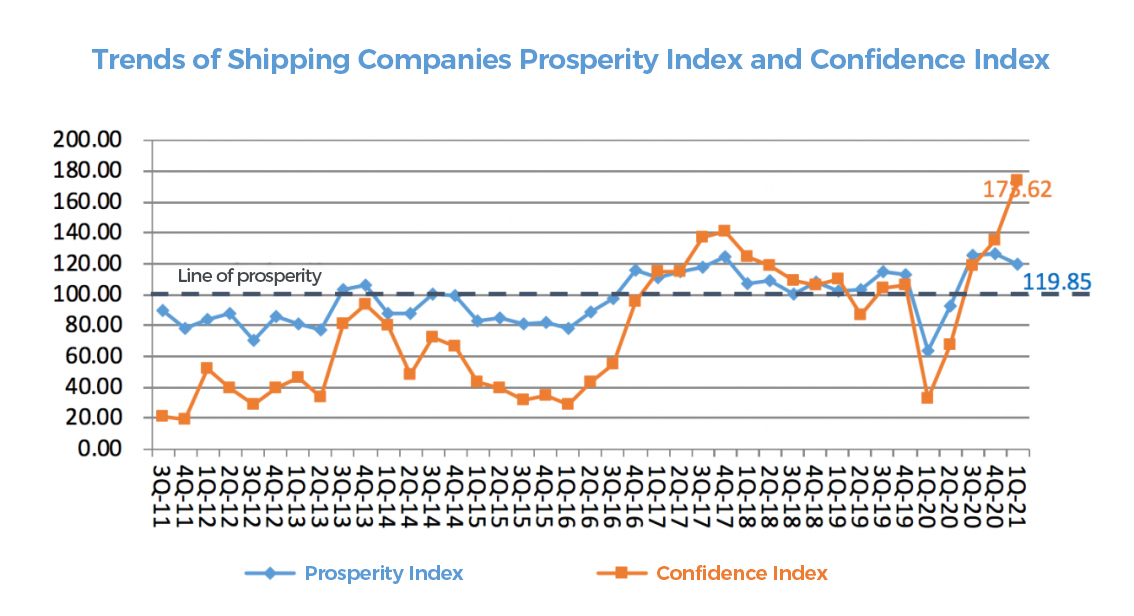

In the first quarter of 2021, the prosperity index of container shipping companies was 115.46 points. Although it dropped by 37.60 points from the previous quarter, it was still in a prosperous range; the corporate confidence index was 181.79 points, rose by 9.10 points from the previous quarter, increasing from a prosperous range to an extraordinary boom range.

From the perspective of various operating indicators, although the capacity of container transport companies has decreased, the utilization rate of corporate space and the level of freight rates has declined, while the operating costs have continued to rise, but the corporate profitability has kept growing. Corporate liquidity is abundant, corporate financing difficulty and loan liabilities continue to decrease, corporate capacity investment willingness keep rising, labor demand continues to increase, and corporate anti-risk capabilities are strengthened.

Dry bulk shipping companies also recovered greatly.

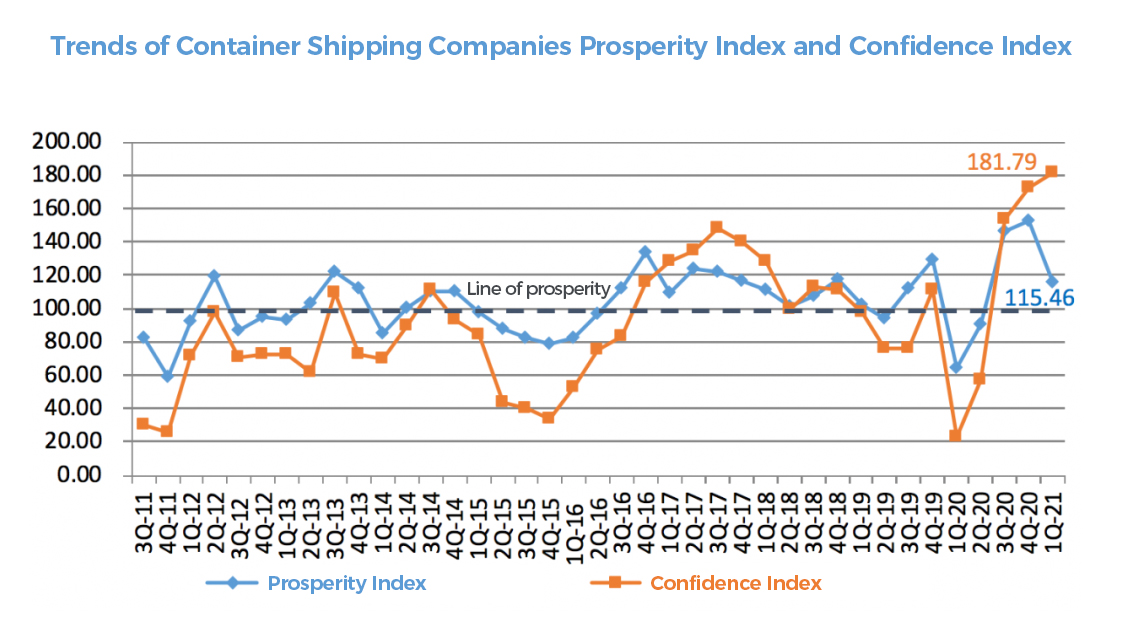

In the first quarter of 2021, the dry bulk shipping company's prosperity index was 113.80 points, dropped by 4.76 points from the previous quarter, and remained within the less boom range; the dry bulk shipping company confidence index was 183.58 points, sharply increased by 41.72 points from the previous quarter, entering the prosperity zone. The overall operating conditions of dry bulk shipping companies have improved, so the corporate confidence index has continued to rise.

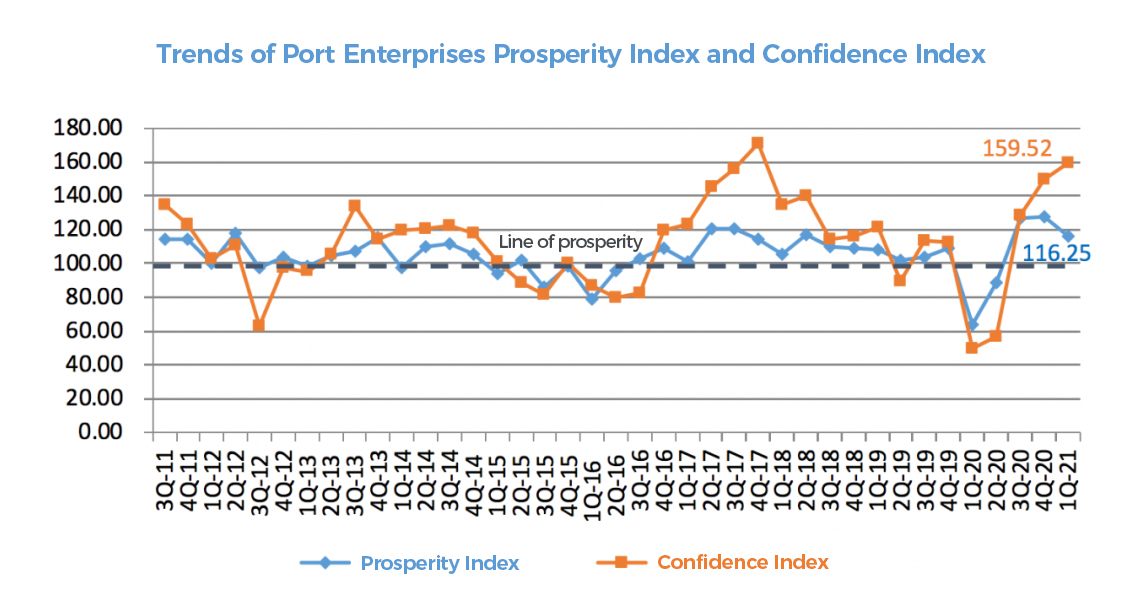

Besides, in the first quarter of 2021, the port enterprise prosperity index was 116.25 points, slightly dropped from the previous quarter, from a relatively prosperous range to a less prosperous interval. The overall operating conditions of port enterprises were relatively good; the port enterprise confidence index was 159.52 points, a slight decrease from the previous quarter It rose by 9.43 points and remained in a relatively strong economic range. Port entrepreneurs are confident and optimistic about the overall operation of the industry.

From the perspective of various operating indicators, although port throughput and berth utilization continue to rise, port charges and corporate profits continue to grow, but operating costs still remain high. Port companies have abundant liquidity, and the difficulty of corporate financing is low. Meanwhile, the labor demand of port companies has increased, but new berths and machinery investment increased slightly from the previous quarter, thereby the corporate liabilities also increased.

In the second quarter, China’s shipping industry will keep improving.

In the second quarter of 2021, China's shipping prosperity index is expected to be 121.96 points, increased by 4.04 points from the first quarter, and will enter a prosperous range; China's shipping confidence index is expected to be 158.92 points, fall by 6.16 points from the first quarter, but will remain in a strong prosperous range.

All business prosperity indexes and confidence indexes will remain above the prosperity line, and the market is expected to continue to pick up.

According to Zhou Dequan, director of the China Shipping Prosperity Index Compilation Office, from 2011 to 2016, when the shipping market was in a downward cycle, the China Shipping Confidence Index was generally lower than the China Shipping Prosperity Index. When the shipping market is in a recovery cycle during 2017 and 2019), China's shipping confidence index was generally higher than China's shipping prosperity index.

According to the above pattern, since the fourth quarter of last year, China's shipping confidence index has been significantly higher than China's shipping prosperity index, and China's shipping industry is now in the best period of recovery in history.

Entrepreneurs continue to be optimistic about the shipping industry.

According to the China Shipping Prosperity Survey, in the second quarter of 2021, the business prosperity index of shipping companies is expected to be 124.87 points, an increase of 5.02 points from this quarter, entering a relatively prosperous range; the confidence index of shipping companies is expected to be 150.49 points, a decrease of 23.13 points from the current quarter. , The confidence index remained in a strong business range.

As for the prosperity index of container transportation companies, it is expected to be 125.87 points, and the confidence index is expected to be 137.71 points, both entering the prosperous range; the prosperity index of dry bulk transportation companies is expected to be 123.49 points, and the confidence index of dry bulk transportation companies is expected to be 162.00 points. Also, it is above the prosperity line.

Generally, it is expected that in the second quarter of 2021, the operating conditions for shipping companies will improve, and entrepreneurs are optimistic about the future.

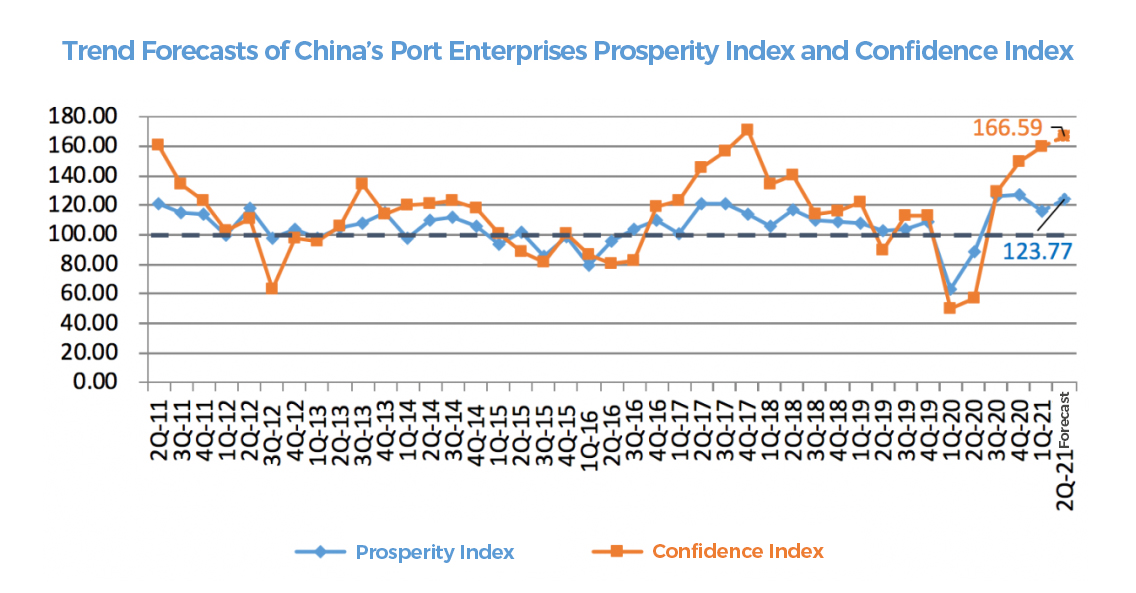

Port enterprises also shows an optimistic prediction.

According to the China Shipping Prosperity Survey, in the second quarter of 2021, the port enterprises' prosperity index is expected to be 123.77 points, increasing by 7.52 points from the first quarter. It will improve from a less prosperous range to a prosperous range and its operating conditions will continue to improve; the confidence index is expected to be 166.59 points, up by 7.07 points from the first quarter, still maintaining a strongly prosperous range.

On the whole, Chinese port companies are optimistic about their business conditions, and port entrepreneurs are confident in the future development of the industry.

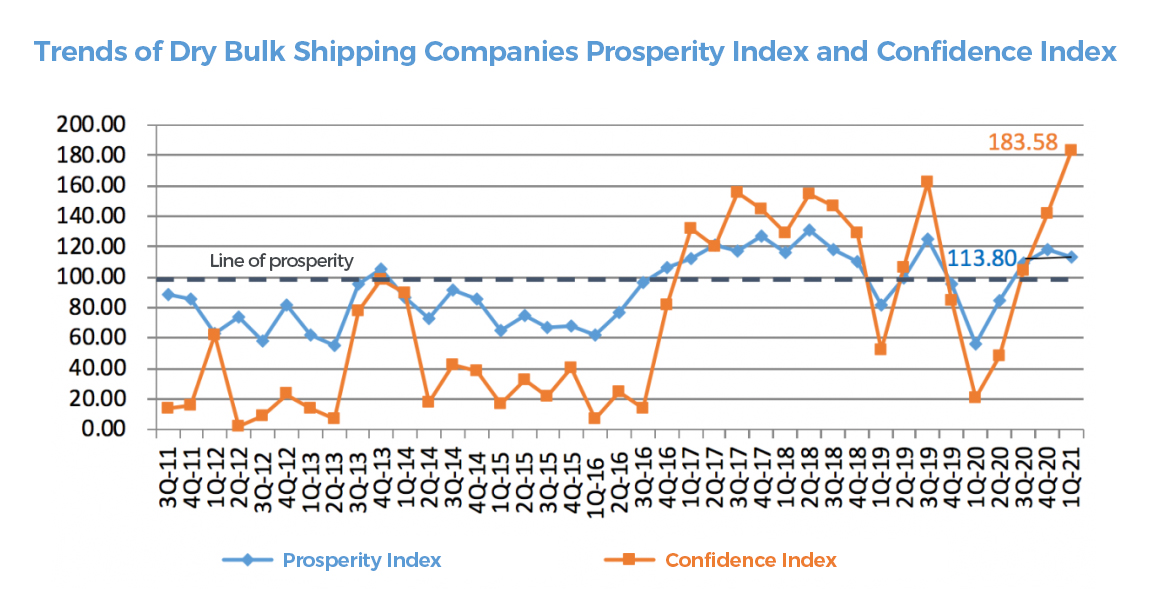

Shortage of Container||The shortage of empty container will last for at least three months.

Although some empty containers have been back to China for now, the intensity is still remaining.

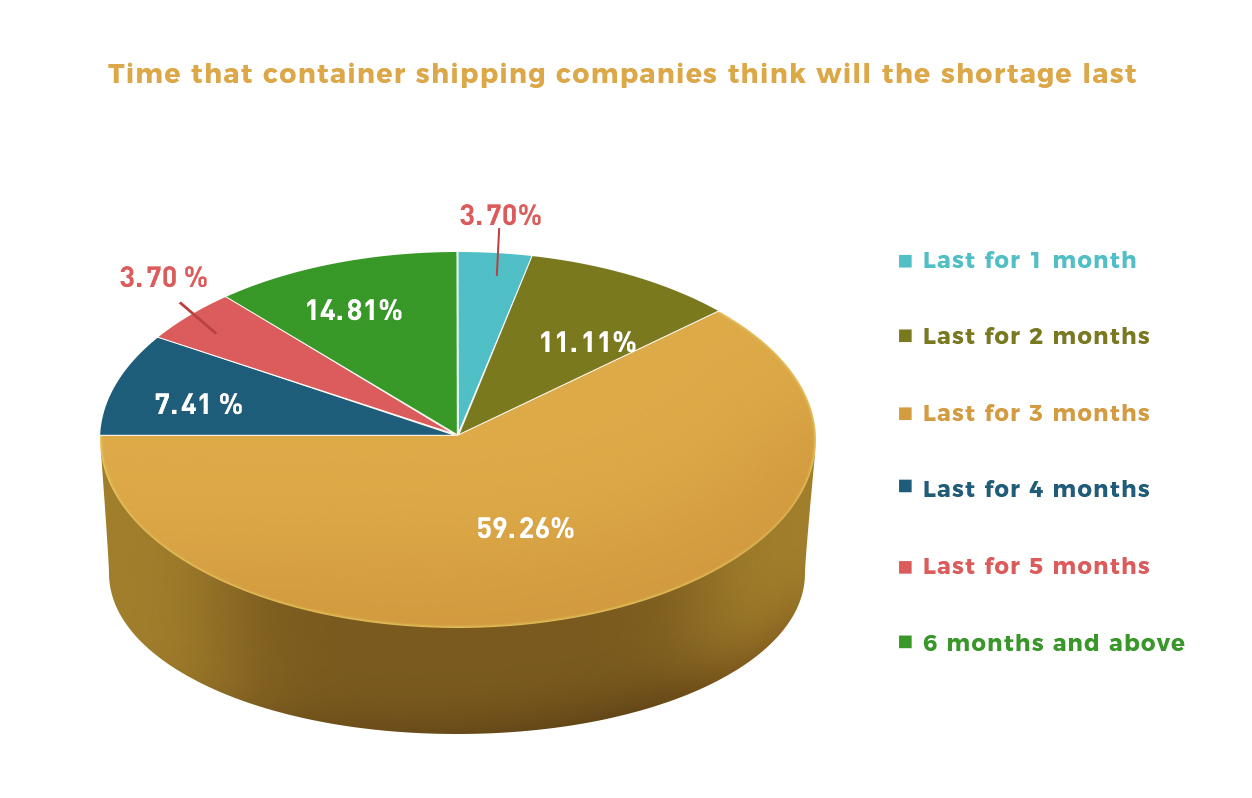

According to a survey on China’s shipping prosperity, 3.7% of companies believe that the shortage of empty containers will last for 1 month; 11.11% of companies believe that it will last for 2 months; 59.26% for 3 months; 7.41% for 1 month. Lasts for 4 months; 3.7% for 5 months; 14.81% for six months or more.

Generally, more than 80% of container transport enterprises believe that the intensity will last for at least 3 months. This is the most challenging risk that confronts the whole shipping industry.

Nearly 50% of enterprises consider order new ships.

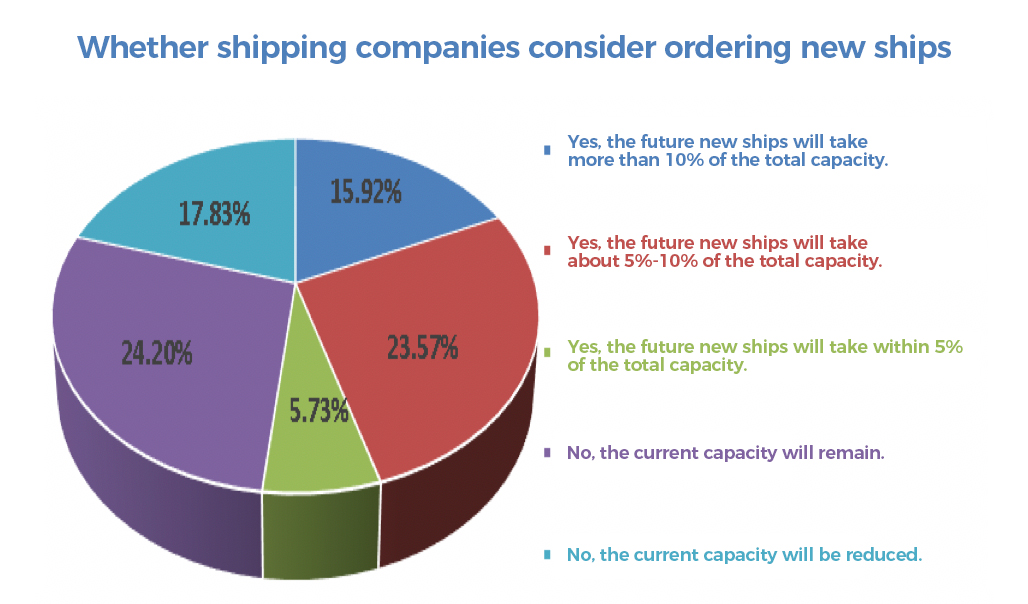

Having experienced the booming market in the last half of the year, some shipping companies have decided to order new ships to enlarge their capacity. The China Shipping Prosperity Index Compilation Office of the Shanghai International Shipping Research Center has conducted relevant investigations on the future capacity of shipping companies in 2021.

The survey results show that 15.92% of the companies said that they will input new ship orders that are more than 10% of the company's current total capacity; 23.57% of the companies told that theirs will be 5%-10%; 5.73% of the companies said that the proportion was 5% within; while 24.20% of the companies said that they will not consider ordering new ships but will maintain their current capacity; and only 17.83% of the companies said that they will not consider ordering new ships, and even reduce their current capacity.

Considering that about a half of companies thinking to improve their capacity, what needs to be reminded is that in the future, the market capacity will increase significantly. If it is realized, the larger capacity will influence the market freight. Enterprises should take appropriate prevention and control in advance.

------------------------------------------------------------------------------------Q1 Shipping Report------------------------------------------------------------------------------------