TREND|| During night stock, HRB slumped by 5%. How does stainless steel react?

Last week, stainless steel dived high. From 17th to 19th May, simulated by the boosting price of futures, spot prices also increased. However, the ferrous stocks declined which influenced the stainless steel market to go down.

304: The price difference between futures and spot remains large. The price of the spot is estimated to drop.

Macroeconomic:

Last week, the Standing Committee of the National People's Congress (NPCSC) again mentioned bulk commodities. As pointed out by the Standing Meeting of the State Council, the negative effect brought by the increasing prices of bulk commodities must be highly emphasized, since that this year, some bulk commodities have kept rising in price and consecutively broken the record high.

Measures were taken including strengthening the supervision on the spot market, fighting against unusual transactions and malicious hype, etc.

From the policy side, ferrous stocks got deeper influenced, but because the futures market of ferrous commodities slumped, the stainless steel market will not easily escape from this trend. On 21st, during the night stock, the ferrous commodities crashed down again. Until closing, ferrous HRB cut down by 5.29%, iron ore dropped by 6.77%.

Based on the Futures market:

For now, the discount of stainless steel futures price is as large as about US$236/MT which maintains at the record high. The price difference between futures and spot is expected to be narrowed down. The spot price might fall closer to the price of futures.

Based on Spot market:

Last week, the inventory of 300 series in the Wuxi market increased by 8,600 tons, to 306.3 thousand tons. Lately, prices have declined as the demand dropped.

From the perspective of production cost, the cost of hot-rolling 304 is about US$2,201/MT, while in the spot market, the hot-rolling product price is US$2,685/MT. Mills have a quite satisfactory profit margin. In the future, it is possible that the production volume will go up and the supply will be abundant, but the market will face heavy inventory.

As for the warehouse receipt transactions, the stainless steel futures, contract 2105 officially entered settlement last week. People said that contract 2105 has 22.3 thousand tons of settlement resources which mostly are newly signed and can make a supplement to the spot market.

201: Short-term supply is abundant but the price support is weak.

The inventory of 200 series in the Wuxi market is 2,600 tons less than last week and the decrease this time is the fifth consecutive drop. Besides, Baosteel Desheng has changed its production to plain carbon steel last week.

430: "Dual Controls" policy on energy and power comes back. The production cost remains high.

Raw material:

On 17th May, Wulanchabu City issued a document, according to the calculations of the National Development and Reform Commission and the Statistics Department, that from May to June, the electricity consumption of high-energy-consuming enterprises shall not exceed 7.58 billion kilowatts. Because of the policy, the production of high chrome in May is lower than the expectation. The high carbon ferrochrome increased by US$314/MT within one week, reaching US$1,164/50 base ton.

Market:

Last week, the inventory of 400 series in Wuxi market increased by 1,600 tons, making the volume maintain high. For now, the price of 430/2B in Wuxi market by Tisco and Jisco maintains at US$1,635/MT. However, because of the sharp drop in the iron ore price, the 400 series market is greatly influenced.

Summary:

300 series: It is estimated that 304 spot product will decrease by US$16~31/MT, and the price of cold-rolling 304 in Wuxi market will be around US$2,650/MT. From the longer-term, the overall trend is still expected to fall, because the profit margin remains high and the output of 300 series will be enlarged. Plus that the macro factors keep forcing the price to go down, the price will keep falling.

200 series: Although the inventory volume keeps declining, in a short period, it has enough supply. The price is also weakening but it may arise in the future because mills will decrease the output and change to producing other goods, the cost of raw materials will support the price as well.

430: In a short time, some factors can lift the price as well as can cut down the price. It is believed that around 28th May, the transaction price of 430/2B is stable, maintaining at about US$1,635/MT.

MARKET|| Latest News!“Open 3, Close 3”; it is afraid that your orders won’t arrive on time.

Being short for "Open 4, close 3", the power rationing policy, steel mills open 4 days a week and remain closed for the rest 3 days, is effective in Foshan and some regions on 21st May. It is upgraded from "open 6, close 1", and "open 5, close 2".

However, the latest policy has not affected many factories yet. Only some pipe producers need to take the "open 4, close 3" policy. Other steel mills in Foshan mainly execute opening 6 days or 5 days a week.

The latest news on 24th May, in some area in Foshan market, the power ration measure has been upgraded to "open 3, close 3" which is slightly different from the before actions. The latest version forces the factories to stop for three days after working for three days.

We summarized several influences due to the power ratio policy:

POSTPONE: Lower production; orders delay.

Last week earlier, many strip mills in Foshan suffer by "closed 2 days a week" and clients urged for prompt orders. With the latest news, steel mills have no other solutions but to decrease the output. A company in Foshan announced that:

1. Reduce production. It is expected that the overall output will be reduced by about 20% (monthly storage volume will be reduced by 8,000-10,000 tons);

2. Adjust the thickness ratio. Reduce the production ratio of thickness above 1.5mm and below 0.8mm.

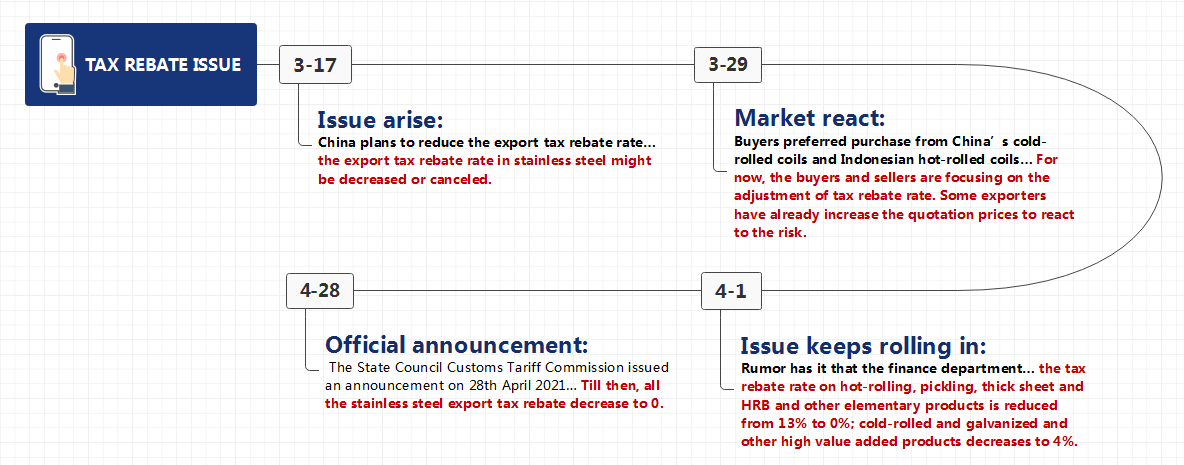

OBSTACLE: Tax on stainless steel export.

On 19th May, only 19 days after the tax rebate issue, the premier of the State Council mentioned the implementation of the increase in export tariffs on certain steel products. The market is agitated, typically the exporters. Even rumor has it that the tax may be effective on first June. Enterprises that accept orders are urging for quicker and earlier processing and delivery.

"Everybody is pushing the orders. But the power ration policy makes it harder for manufacturers to gear up. What else can you do except for waiting? What's worst, although products are completed, the container is not enough…", said an exporter.

After mentioning the implementation of the increase in export tariffs on certain steel products, countless exporters fail to have a good night. Experiencing the recent turbulences, people start to throwback to the old days…

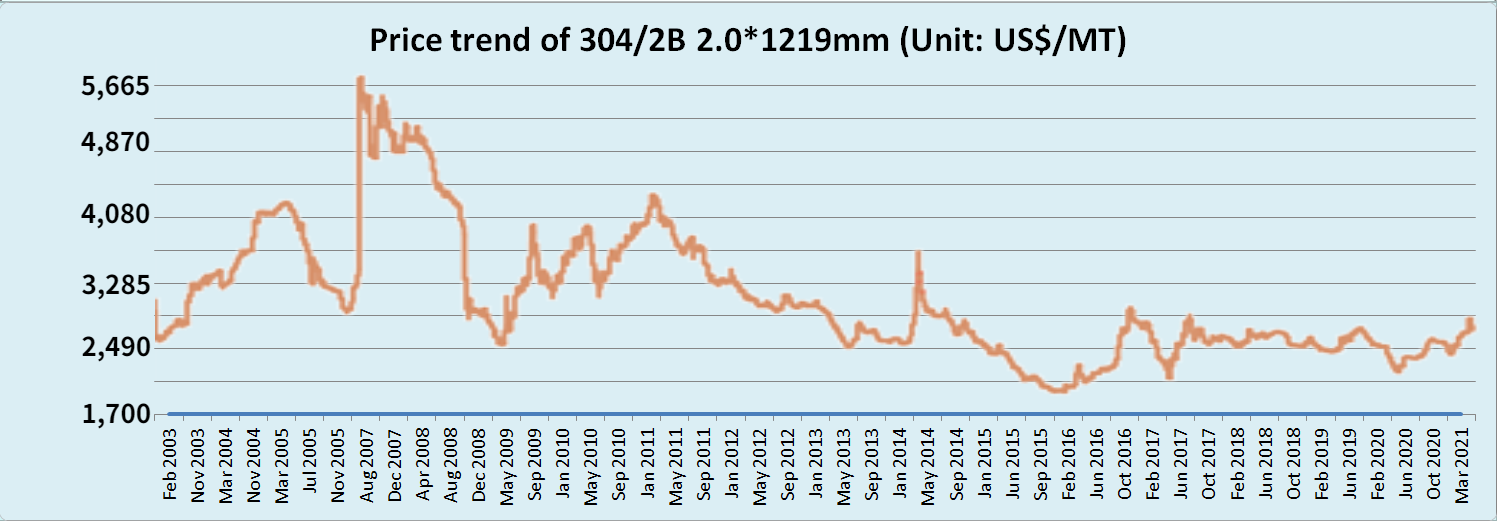

TB|| When SS304 was US$6,500/MT, are you in the industry?

A manager of a stainless steel sheet enterprise in Foshan told us, "Remember that when I just entered the stainless steel industry, iron was about US$1,000/MT, copper was about US$9,000/MT and SS 304 was US$6,500/MT, SS201 was US$3,500/MT. While now, iron remains, cooper rises to over US$11,000/MT, what about stainless steel?"

The story of the stainless steel industry begins with "once upon a time…", and we will never get back to it although iron and copper maintain. Seeing the market in Foshan now, the highest spot price of 304 coil is only US$2,745/MT. When the market was better, the price was only US$2,810/MT.

In Wuxi market, a week before, hot-rolling 5-feet 304 was quoted to US$2,810/MT. Only when we are facing difficulty, can we review the past and find out the huge difference. The biggest problem the industry facing is the tax rebate issue and the following imposition of export tax on steel products.

When the negotiation and solution to the cancellation of tax rebate both settled down in recent two weeks, when people thought that this outbreak issue finally came to the end of the play, the last thing they won’t believe is that the imposition of tax is on the way.

"There had no patch term when the tax rebate issue was announced. On 28th April, it was proclaimed, but it takes effect on 1st May", said a CEO of an exporting company, “Now there is news about the imposition of export tax on steel products. It seems similar to the early process of the abortion of export tax rebate. I am now more cautious and even afraid of accepting new orders. For the previous orders, I also feel panic—— always urging the products to deliver and nobody knows what accident will happen. You know, when the tax rebate was canceled, all orders in April were influenced. "

Q:

"The biggest problem is steel. Stainless steel only takes a small portion, it might not be included. The State mentions ‘some steel products’ only, so if the export tax is to increase, it should be about steel, the biggest problem. Stainless steel may be neglected. "

A:

"Hold on, hold on. Stainless steel is also raw material-oriented. Nickel and chrome both rely on import. Moreover, last time about the cancellation of export tax rebate, 'some steel products' is also used in the term."

A CEO who experienced "the imposition of export tax on stainless steel" reviews the document declared by the State Council Tariff Commission on 27th December 2007 with us.

It was about the imposition of tax and effect on 1st January 2008. Generally, the part involving the export tax rebate of stainless steel is levied at 5%, 10%, and 15% respectively.

Other people think that the country’s decision is more important because the macro-benefit is a protection of our own interest.

A participant told, "In last March, when the pandemic was serious, the government increased the tax rebate rate to 13% on stainless steel products. Thanks to this, many exporters have gained much profit. I don't think the process of imposition of tax will not be too rush like the tax rebate issue. It will depend on the recent export situation. "

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China