304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,120/MT(plus taxes) which is US83/MT lower than last month and the declining percentage is 3.58%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,160/MT(plus taxes) which is also US$83/MT lower than last month and the declining percentage is 3.52%.

304/2B: This month, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$2,035/MT(plus taxes) which is US$103/MT lower than last month and the declining percentage is 4.55%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$2,035/MT(plus taxes) which is US82/MT lower than last month and the declining percentage is 3.69%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,935/MT(plus taxes) which is US$116/MT lower than last month and the declining percentage is 5.36%. Furthermore, the average price of 4.0*1520*C in the Foshan market is US$1,985/MT which is US$84/MT lower than last month and the declining percentage is 3.84%.

316L/2B: This month, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,050/MT(plus taxes) which is US$82/MT lower than last month and the declining percentage is 2.45%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,085/MT(plus taxes) which is US$84/MT lower than last month and the declining percentage is 1.54%.

316L/No.1: This month, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,820/MT(plus taxes) which is US$145/MT lower than last month and the declining percentage is 4.59%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,855/MT(plus taxes) which is US$125/MT lower than last month and the declining percentage is 3.92%.

LH/2B: This month, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,110/MT(plus taxes) which is US$34/MT lower than last month and the declining percentage is 2.93%. Besides, the tax-inclusive average price of the Foshan market is US$1,095/MT(mill edge) which is US$23/MT lower than last month and the declining percentage is 2.03%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,165 which is US$5/MT lower than last month and the declining percentage is 0.39%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,155/MT(plus taxes) which increases by US$5/MT from last month, and the rising percentage is 0.29%.

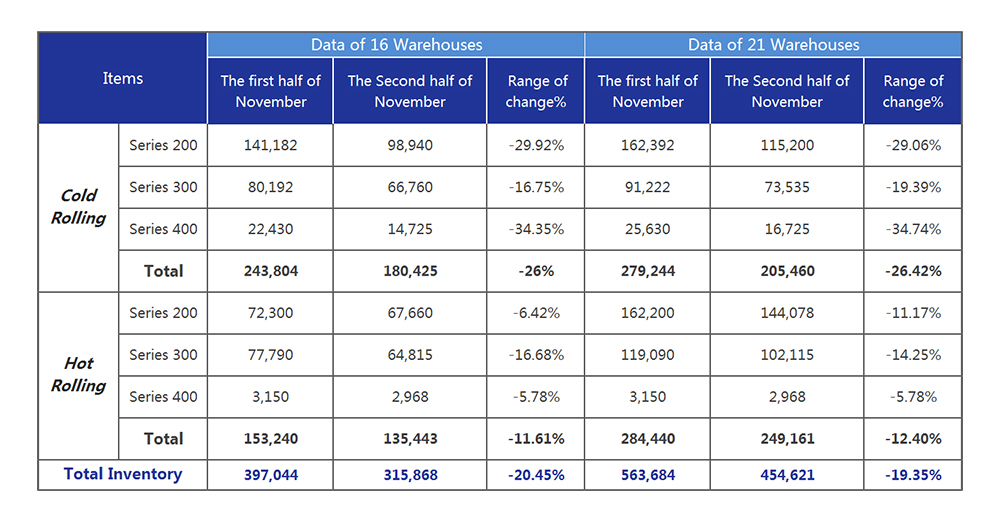

Decreased by 19.35%, Foshan stainless steel inventory kept declining in the second half of November compared to the first half.

Statistical Analysis Table of Stainless Steel Stock in Foshan on the second half of November 2019 (Unit: ton)

Analyzed from statistics:

The total inventory amount is about 454,621 tons, of which:

Series 200 inventory decreases to 259,278 tons which are 65,314 tons less than the first half month and the declining percentage are 20.12%;

Series 300 inventory decreases to 175,650 tons which is 34,662 tons less than the first half month and the declining percentage are 16.48%;

Series 400 inventory decreases to 19,693 tons which are 9,087 tons less than the first half month and the declining percentage is 31.57%;

Analyzed from different series:

Although the inventory of series 200 decreased, it was still in a high position. In Beihai Chengde, Hongwang and Ansteel Lisco, the inventory of cold-rolled stainless steel decreased noticeably while a small quantity was on arrival in Baosteel and less change in other mills. The inventory of hot-rolled stainless steel mainly decreased in Beihai Chengde, Tsingshan and some other mills in Guangxi province.

Both cold and hot rolled stainless steel of series 300 decreased in inventory. The inventory of cold-rolled stainless steel decreased more and mostly in Beihai Chengde. It also decreased in Hongwang and Yongjin. However, there were arrivals in Beihao Chengde and Ansteel Lisco. Hot-rolled stainless steel decreased majorly in Tsingshan and Beihai Chengde, and there was a small decrease in Fuxin inventory, while Ess increased its inventory.

Cold-rolled and hot-rolled series 400 inventory reduced as well, which happened in Tisco and Jisco, but Ansteel Lisco had an obvious increase and the production of other places remained as before. As for hot-rolled stainless steel, the inventory reduced mostly in Tisco and Lisco.

Reasons for inventory change in November:

a. Tisco’s warehouse moved so its inventory had to be cleared out. There must be a decreased inventory in almost every warehouse which is in the lowest level of inventory in the past same period.

b. This month, all series had a decrease in both cold and hot rolled. Except for Delong remained and LIsco increased both in cold and hot rolled, others decreased at various rates.

c. In the second half of November, cold and hot rolled 304 had a rebound and triggered transactions. Although it was not at the best price, the rigid demand has consumed some inventory.

d. The root cause is that steel mills have limited inventory recently. The current cold-rolled inventory is being consumed, while hot-rolled items changed from future sales to spot sales. The sales mode changed and the competition between mills created a chance for the downstream.

316L decreased by US$57 per day and US$229 per month. How is it going in December?

November ended, but it was not a happy ending. The stainless steel market fluctuated.

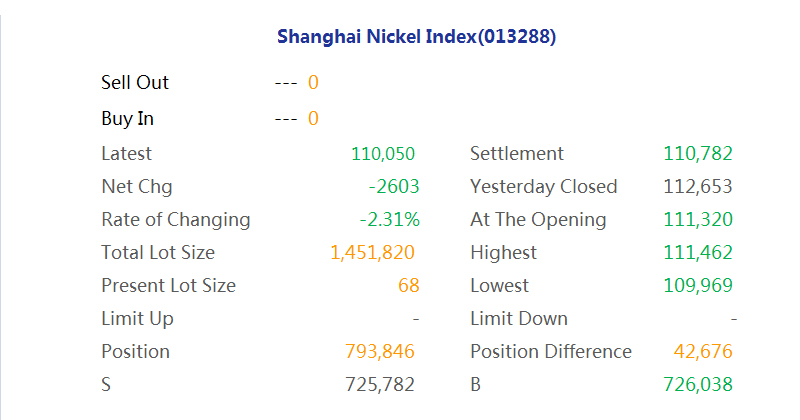

Both London nickel and stainless steel decreased largely in price. Yesterday, London nickel dropped by US$370 to less than US$14000. The market holds a negative opinion. The price of 304 reduced by US$57/ton generally. Some intermediaries cut down the price again, making the price lower. Moreover, 316L decreased significantly by US$57, which shock the market.

Why did the nickel price keep decreasing?

London Nickel3(LMNDE)<Daily Line>

a. The supply of importation increase significantly, crashing the nickel market

According to customs data, nickel imported to China amounted to 6,853,700 tons in October, and the ferronickel import amounted to 168,800 tons. It decreased compared to September, but nickel import increased by 22.8% and ferronickel import increased by 85.6% compared to the same time as last year. Moreover, because of mining forbidden in Indonesia in 2020, nickel and ferronickel import to China will maintain at a high level in November and December, keeping crashing the domestic market in a near future, which is negative for the nickel.

b. Off-board capital flew into the market, leading to malicious short selling.

After the London nickel index had fallen to less than 14000, people sold into corrections. Massive capital flows into the Shanghai nickel market. As of midday closing, all contracts had been increased by 42,500 lots, and large-scale off-board funds actively entered the market.

304 daily decreased by US$15/ton, US$30/ton...

In the Wuxi market, the base price of 304 cold-rolled mill edge coil of private-own mills was US$1,950/ton which decreased by US$15/ton compared to yesterday, while the base price of hot-rolled mill edge stainless steel from private mills was US$1,860/ton which was US$30/ton less.

With such a declining trend in price, it is a trail to the mills undoubtedly.

Hongwang cold-rolled 304 dropped by US$7 to US$1,950/ton. Tisco cold-rolled 304 declined by US$14/ton to US$2,055/ton.

Ess’s guiding price decreased by US$14 to US$1,905/ton. Tisco hot-rolled 304 was US$1,965/ton which dropped by US$14/ton.

316L daily dropped by US$57!

The decrease of 304 seems to be adaptable, but how about 316L?

Yesterday, it was estimated that the price of the private-owned market must be declined as it was at a high price of US$2,760/ton when Tsingshan opened quoting at US$2,735/ton. It didn’t fall out of the expectation that the market price was sable at US$2,735/ton in the afternoon.

Surprisingly, is it out of the effect of the large decrease in London nickel price? It resulted in a US$57/ton drop on Wuxi hot-rolled stainless steel from private-owned mills early in the today morning, which was ranging from US$2,705/ton to US$2,715/ton.

Cold-rolled 316L decreased by US$129/ton and the decline of hot-rolled 316L reached US$229/ton. With such an overwhelming ending of November and the final month of 2019 arrived, for the last straw, how many will you put on the camel?

-----------------------------------------------------------------------------------------------Stainless Steel Market Summary in China-------------------------------------------------------------------------------------------------