-304/2B:

The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,195/MT(plus taxes) which is US34/MT higher than last month and the rising percentage is 1.50%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,235/MT(plus taxes) which is also US$34/MT higher than last month and the rising percentage is 1.47%.

-304/2B:

This month, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$2,130/MT(plus taxes) which is US$25/MT higher than last month and the rising percentage is 1.12%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$2,105/MT(plus taxes) which is US23/MT higher than last month and the rising percentage is 1.04%.

-304/No.1:

The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,040/MT(plus taxes) which is US33/MT higher than last month and the rising percentage is 1.54%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,060/MT(plus taxes) which is US20/MT higher than last month and the rising percentage is 0.95%.

-316L/2B:

This month, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,125/MT(plus taxes) which is 24USD/MT higher than last month and the rising percentage is 0.72%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,165/MT(plus taxes) which is 27USD/MT higher than last month and the rising percentage is 0.79%.

-316L/No.1:

This month, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,950/MT(plus taxes) which is US$17/MT higher than last month and the rising percentage is 0.53%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,970/MT(plus taxes) which is US$15/MT higher than last month and the rising percentage is 0.49%.

-LH/2B:

This month, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,140/MT(plus taxes) which is US$1/MT higher than last month and the rising percentage is 0.10%. Besides, the tax-inclusive average price of the Foshan market is US$1,150/MT(mill edge) which is US$18/MT higher than last month and the rising percentage is 1.66%.

-430/2B:

The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,170, which is US$30/MT higher than last month and the rising percentage is 2.58 %. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,155/MT(plus taxes) which is US$12/MT higher than last month and the rising percentage is 1.06 %.

0.64% Increase, Weakly Increasing Situation of Stainless Steel Inventory in Foshan at the End of October!

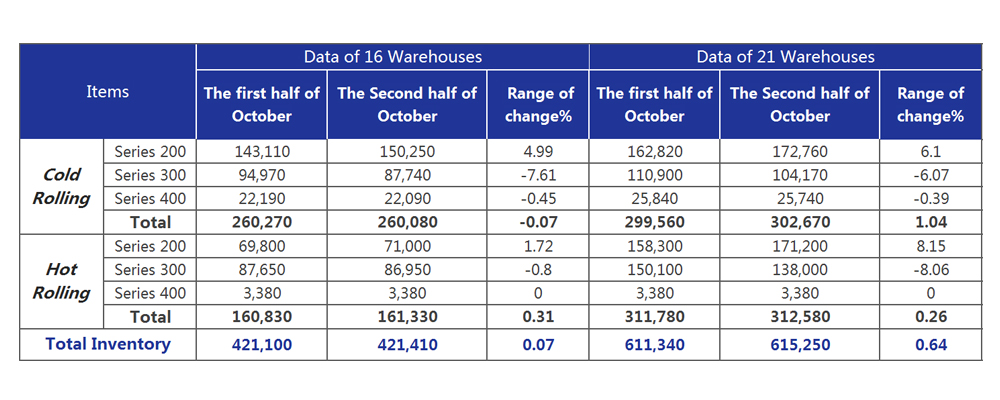

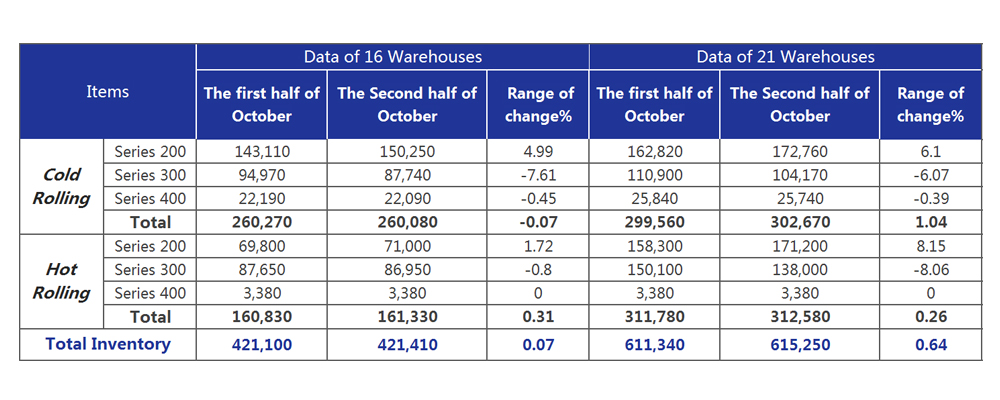

According to the Foshan Market News on November 1st, in the aspect of the inventory, there is an increase in the stock of 21 warehouses mainly. In the table below, the data shows a comparison between the first half and the second half of October. Data collecting dates are based on October 30th and October 31st for cold rolled steel and hot rolled steel respectively.

Statistical Analysis Table of Stainless Steel Stock in Foshan on the second half of October 2019 (Unit: ton)

From the data above, the total inventory of 21 warehouses in the second half of October amounts to 615,250 tons, of which the inventory of series 200 rose to 343,960 tons, increasing by 22,840 tons compared to the first half month and the rising percentage was 7.11%. As for the inventory of series 300, it decreased by 18,830 tons to 242,170 tons, which was 7.21% lower; the inventory of series 400 fell to 29,120 ton, 100 ton less than the first half month and the decreasing percentage was 0.34%.

Analysis based on Series:

Inventory of series 200 is still of vital importance. The inventory of cold-rolled steel increased obviously on Hongwang, Beihai Chengde and Foshan Chengde and there was a slight increase in Ansteel Lisco and Baosteel. In the case of increasing inventory of hot rolled steel, Qingshan and Chengde took the main parts, while the change of inventory was less prominent in other origin resources.

Both cold and hot rolled steel inventory of series 300 had decreased. The amount of cold-rolled inventory dropped more, mainly in Chengde, Hongwang, and Yongjin. For hot rolled steel, there were small reductions in Qingshan and Chengde while small increases showed in Lisco and Ess.

Series 400 had a small reduction on cold-rolled steel in Tisco, but less change in Jisco and Lisco comparatively. Inventory of hot rolled steel tended to be maintained.

Reasons for Increasing Inventory:

1. Although there was a reduction in series 300 and 400 in inventory this time, the increasing range of series 200 was larger than the decreasing range of series 300 and 400, the total inventory still had a rising tendency.

2. Increasing inventory of Chengde’s cold and hot rolled steel led to the rise of series 200, typically J5. Hot rolled steel inventory of Qingshan rose as well and other steel mills had a limited consumption. Moreover, it was in a weak price in both 201 cold and hot rolled steel this month, particularly the price of cold-rolled steel fell much, so the transactions are postponed and the inventory was stuck. Nevertheless, downstream manufacturers lose faith in 201, so they purchase according to the market needs, even worse, they are unwilling to have stock because of the pessimistic attitude towards the future market.

3. Reduction in cold and hot rolled steel of series 300 was mainly reflected in Tsingshan and Chengde. Due to the limited amount of cold-rolled steel, although Lisco and Yangjiang Hongwang has arrived in the market, it was still in a suspending state and difficult to change the overall situation. On the other hand, Delong maintained its inventory. The major reason is that the nickel was being hyped, which caused unstable transactions in the market and part of the inventory is consumed. Lastly, the downstream like traders hold negative opinions towards the future market so they refused to accumulate and fewer products in stock.

Raw Materials|| Terrible Result that High Production is Back to the Stage.

In recent days, domestic bidding policies of high carbon ferrochrome by mainstream steel mills have been implemented continuously. In November 2019, Tsingshan Group maintains the same bidding purchasing price of high carbon ferrochrome as it did in October. As to the delivery date before December 10th, FOB Tianjin decreases by 20 USD/ 50 base tons.

For now, the inquiry and transaction are bland in high chromium retail market and factories have less willingness to sell at a low price, so the price of high chromium is in a stable state.

Based on the supply side, in October, the production of high chromium kept rising at a high level of more than 500,000 tons. Finding from the custom data, importing the amount of ferrochrome of September shrank to 189,300 tons, whose decreasing percentage was 16.90%.

However, the importing amount of chrome ore grew dramatically to 1,502,500 ton and the rising percentage was 28.96%. If the transaction of high chromium is to be bland, the price of high chromium will probably tend to be weak and fall.

-------------------------------------------------------------------------Stainless Steel Market Summary in China------------------------------------------------------------------------------------------

The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,195/MT(plus taxes) which is US34/MT higher than last month and the rising percentage is 1.50%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,235/MT(plus taxes) which is also US$34/MT higher than last month and the rising percentage is 1.47%.

-304/2B:

This month, the average price of 2.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$2,130/MT(plus taxes) which is US$25/MT higher than last month and the rising percentage is 1.12%. What's more, the average price of 2.0*1240*C(mill edge) in the Foshan market is US$2,105/MT(plus taxes) which is US23/MT higher than last month and the rising percentage is 1.04%.

-304/No.1:

The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,040/MT(plus taxes) which is US33/MT higher than last month and the rising percentage is 1.54%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,060/MT(plus taxes) which is US20/MT higher than last month and the rising percentage is 0.95%.

-316L/2B:

This month, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,125/MT(plus taxes) which is 24USD/MT higher than last month and the rising percentage is 0.72%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,165/MT(plus taxes) which is 27USD/MT higher than last month and the rising percentage is 0.79%.

-316L/No.1:

This month, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,950/MT(plus taxes) which is US$17/MT higher than last month and the rising percentage is 0.53%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,970/MT(plus taxes) which is US$15/MT higher than last month and the rising percentage is 0.49%.

-LH/2B:

This month, the average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,140/MT(plus taxes) which is US$1/MT higher than last month and the rising percentage is 0.10%. Besides, the tax-inclusive average price of the Foshan market is US$1,150/MT(mill edge) which is US$18/MT higher than last month and the rising percentage is 1.66%.

-430/2B:

The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,170, which is US$30/MT higher than last month and the rising percentage is 2.58 %. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,155/MT(plus taxes) which is US$12/MT higher than last month and the rising percentage is 1.06 %.

0.64% Increase, Weakly Increasing Situation of Stainless Steel Inventory in Foshan at the End of October!

According to the Foshan Market News on November 1st, in the aspect of the inventory, there is an increase in the stock of 21 warehouses mainly. In the table below, the data shows a comparison between the first half and the second half of October. Data collecting dates are based on October 30th and October 31st for cold rolled steel and hot rolled steel respectively.

Statistical Analysis Table of Stainless Steel Stock in Foshan on the second half of October 2019 (Unit: ton)

From the data above, the total inventory of 21 warehouses in the second half of October amounts to 615,250 tons, of which the inventory of series 200 rose to 343,960 tons, increasing by 22,840 tons compared to the first half month and the rising percentage was 7.11%. As for the inventory of series 300, it decreased by 18,830 tons to 242,170 tons, which was 7.21% lower; the inventory of series 400 fell to 29,120 ton, 100 ton less than the first half month and the decreasing percentage was 0.34%.

Analysis based on Series:

Inventory of series 200 is still of vital importance. The inventory of cold-rolled steel increased obviously on Hongwang, Beihai Chengde and Foshan Chengde and there was a slight increase in Ansteel Lisco and Baosteel. In the case of increasing inventory of hot rolled steel, Qingshan and Chengde took the main parts, while the change of inventory was less prominent in other origin resources.

Both cold and hot rolled steel inventory of series 300 had decreased. The amount of cold-rolled inventory dropped more, mainly in Chengde, Hongwang, and Yongjin. For hot rolled steel, there were small reductions in Qingshan and Chengde while small increases showed in Lisco and Ess.

Series 400 had a small reduction on cold-rolled steel in Tisco, but less change in Jisco and Lisco comparatively. Inventory of hot rolled steel tended to be maintained.

Reasons for Increasing Inventory:

1. Although there was a reduction in series 300 and 400 in inventory this time, the increasing range of series 200 was larger than the decreasing range of series 300 and 400, the total inventory still had a rising tendency.

2. Increasing inventory of Chengde’s cold and hot rolled steel led to the rise of series 200, typically J5. Hot rolled steel inventory of Qingshan rose as well and other steel mills had a limited consumption. Moreover, it was in a weak price in both 201 cold and hot rolled steel this month, particularly the price of cold-rolled steel fell much, so the transactions are postponed and the inventory was stuck. Nevertheless, downstream manufacturers lose faith in 201, so they purchase according to the market needs, even worse, they are unwilling to have stock because of the pessimistic attitude towards the future market.

3. Reduction in cold and hot rolled steel of series 300 was mainly reflected in Tsingshan and Chengde. Due to the limited amount of cold-rolled steel, although Lisco and Yangjiang Hongwang has arrived in the market, it was still in a suspending state and difficult to change the overall situation. On the other hand, Delong maintained its inventory. The major reason is that the nickel was being hyped, which caused unstable transactions in the market and part of the inventory is consumed. Lastly, the downstream like traders hold negative opinions towards the future market so they refused to accumulate and fewer products in stock.

Raw Materials|| Terrible Result that High Production is Back to the Stage.

In recent days, domestic bidding policies of high carbon ferrochrome by mainstream steel mills have been implemented continuously. In November 2019, Tsingshan Group maintains the same bidding purchasing price of high carbon ferrochrome as it did in October. As to the delivery date before December 10th, FOB Tianjin decreases by 20 USD/ 50 base tons.

For now, the inquiry and transaction are bland in high chromium retail market and factories have less willingness to sell at a low price, so the price of high chromium is in a stable state.

Based on the supply side, in October, the production of high chromium kept rising at a high level of more than 500,000 tons. Finding from the custom data, importing the amount of ferrochrome of September shrank to 189,300 tons, whose decreasing percentage was 16.90%.

However, the importing amount of chrome ore grew dramatically to 1,502,500 ton and the rising percentage was 28.96%. If the transaction of high chromium is to be bland, the price of high chromium will probably tend to be weak and fall.

-------------------------------------------------------------------------Stainless Steel Market Summary in China------------------------------------------------------------------------------------------