Reviews of the stainless steel market last week:

On Monday (22nd, March), as soon as the stock market opened, Tsingshan and Delong increased the price by US$15/MT; the transactions turned well. From Tuesday to Friday, most of the prices remained and the consumption rate speeded up. In the past two weeks, steel mills kept shouting out increasing the price, thereby the inventory of 200 series was consumed by 11 thousand tons. This situation affected the flat product market which was used to stay low to went up in the quotation. As for the traders, they showed less intention to reduce the price of 304 thanks to the lowering inventory.

201: Steel mills are sending out signs of the price increase. The inventory has been consuming.

The price of iron ore has remained high, while the price of low nickel ore of the Philippines and China stay steady. In April, the bidding price of electrolytic manganese by DS steel mill rises by US62/MT, which influenced the production cost of 201 to rise as well. But with more high ferrochrome factories back to work or increase the production volume, which can make up the deficit caused by the supply shortage of Inner Mongolia. Therefore, the price of ferrochrome is going down now.

From the perspective of cost, when the price was boosted by the steel mills, the stock price of 201 also got influenced and increased. With this scheme, steel mills changed from the dilemma of cost over price to a profitable margin of US$46/MT- US$62/MT. The reason for the high price is that the raw materials used in the production in April has already confirmed earlier when the costs were high. This perfectly makes an excuse for the steel mills to increase the production and the price of 201.

Arrivals of 201:

A steel mill producing 201 reduced the arrivals from 2 ships per week to 1 ship per week. Besides, another steel mill reduces the production volume by 40-60 thousand tons because of the equipment failure, whereas de facto, people are skeptical about it whether it is another scheme of the steel mill.

Demand:

Seeing that the price of 201 bounces back and starts increasing, buyers become proactive about purchasing and some buyers even stockpile the products. But in a long run, Southern China is stepping into the rainy season during April and June, when the demand for the decorative plate and tube made by 201 will reduce.

304: The inventory is reducing, but the price will remain in a short time.

Raw material:

Last week, the price of ferronickel and ferrochrome both decreased. Steel mills start purchasing ferronickel recently, and the guidance price of high ferronickel is about US$169/nickel – US$172/nickel which is US$14/MT lower than the last term. The quoting price was US$6/MT lower to US$172/MT. As for the ferrochrome, during last week, the price was reduced by US$1,323/50 base ton.

Based on the prices of ferronickel and ferrochrome now, the cost of 2.0 mm product by the Chinese CR private-own steel mills is about US$2,195/MT. Compared with the present stock price of the same standard, US$2,230/MT can make a profit margin. If based on the prices before, the cost of CR 2.0mm product is around US$2,230/MT which is equivalent to the present stock price. From this point of view, the price support from raw materials is declining.

But from the perspective of the market such as inventory and traders, mostly the situation tends to increase the price. Last week, the inventory of 300 series decreased by 8.5 thousand tons to 342.6 thousand tons, which is the first decrease after CNY. In recent times, the price has been rising, and the transaction warms up. Most traders are consuming the inventory products. The demand is expanding, which will further support the price to rise. For now, most of the resources are owned by the mills, which means that people in the market won’t rush selling out.

Besides, the resources of warehouse receipt are also in a smooth sell. Most of the resources are sent to the southern Chinese market for rolling. For now, the discount of futures stock maintains at around US$185/MT which is rather high. Large steel mills rarely make settlements in short sales. The pressure in contract settlement is reducing in recent months, which gives strong support to the stocks market.

430: Cost reduced, the price follows.

Raw material:

In March, the government of Inner Mongolia started the investigation on the special alloy enterprises involving five low-titanium ferrochrome plants, about 20,000 tons of products. This investigation did not influence largely thanks to the power rationing policy in the previous time. In March, the production volume in Inner Mongolia is about 210,000 tons.

Transaction:

The steel bids of March have not yet been completed by the large high-chromium factories, and there is no spot in inventory. Smaller factories have a small number of spot goods, and the quotation is low. Some factories said that their products need to be ordered in advance, and the delivery will take one week later.

In April, the new bidding phase will begin after the Qingming Festival (from 3rd April to 5th April). The power rationing policy will get loose in Inner Mongolia, and there might be more large furnaces to start, so will other plants in other areas. Therefore, the bidding price might be reduced.

Focus:

How much will the power ratio go down in Inner Mongolia decides the increasing speed of the high-chrome production volume in April. This policy will affect the trend of the future price of high chrome as well as the bidding price.

The output of 400 series increased, and the monthly output of Chengde’s 400 series was around 15,000 tons. Baosteel Desheng is expected to produce more than 1,000 tons in April. TISCO supplied Baosteel Desheng with 15,000 to 2 million tons of 410S that is unwrought and the supply of 400 series stainless steel was sufficient. This week, the market inventory increased slightly by 1,000 tons, dragging down prices.

Last week, the market price of 430/2B decreased by US$8/MT to US$1,540/MT. Traders said that the products are added up, making the delivery insufficient, so they will make space for delivery first next week. The price is predicted to cut slightly, about US$15/MT - US$23/MT, to US$1,520/MT – US$1,525/MT.

In a short term, the decreasing price of high carbon ferrochrome will affect the 400 series to go down in price. In the second season, the supply of 400 series is steady and the demand is recovering. Previously, in the NPC & CPPCC National Committee annual sessions, the central government mentioned the construction project, which lifts the confidence in the steel industry and good for the price of 400 series to stay strong.

Market Summary:

In a near future, there may be a small highlight in purchasing. More traders will output CR 201 products. The price of the CR 201J2 might be adjusted to around US$1,265/MT. After April, it is predicted that the costs of raw materials and the reducing production of steel mills will put up the price of 201. But in long run, the supply of raw materials will expand, which can release the pressure of high prices. When the demand of 201 declines, the price will probably be decreased.

The orders of 304 to steel mills in April are closed to the end. For now, the spot inventory is ample; steel mills deliver in an order of mixing low and high price products; the market trend mostly follows the prices of steel mills. The CR 304 by the private-own mills is about US$ 2,195/MT. In the future, the nickel ore supply in China domestic will be added up when the rainy season in the Philippines is over. At that time, the output of Chinese ferronickel plants will be increased as well. Plus, the ferronickel supply from Indonesia will give a punch to the cost of raw material, so there will have a certain negative influence on the stainless steel market.

The reducing price of the high carbon ferrochrome influences the 400 series market, but in the second season, the supply is stable. Also, the buyers are gradually enlarging purchases. Especially, as we mentioned above about the construction in the “two sessions” by the central government, the prospect toward steel industry is rather bright, which is beneficial to the 400 series to have a stronger price.

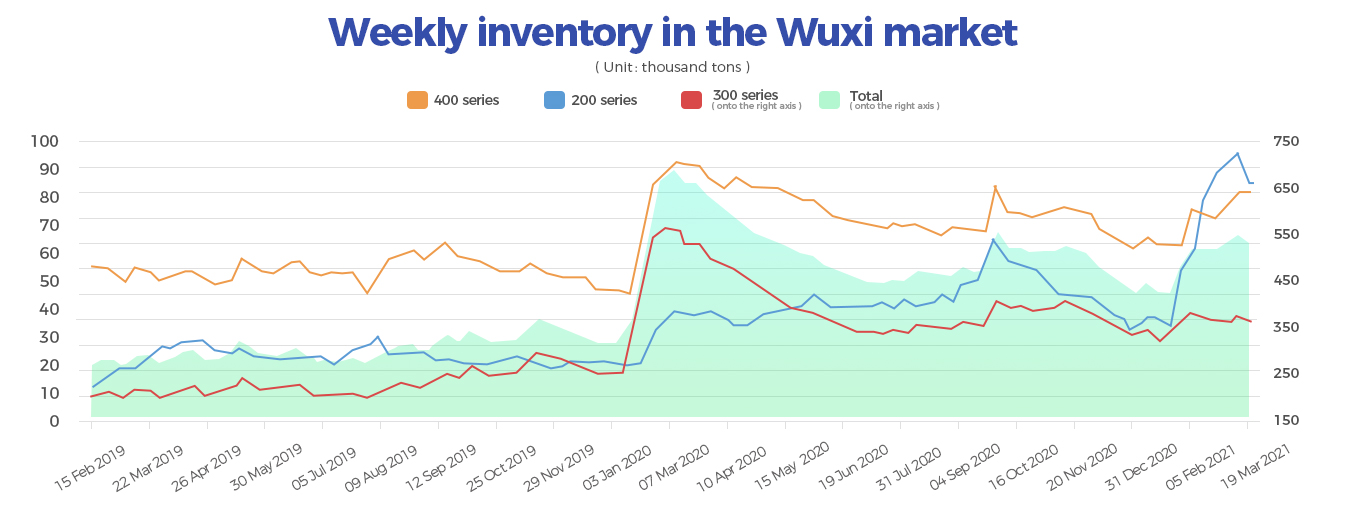

Inventory || Decreased by 20,000 tons, a sign of increasing price?

According to the latest inventory statistics, the total inventory volume of the sample warehouse in the Wuxi market is 495.1 thousand tons, 18.5 thousand tons less than last week. Thereinto, the inventory of 200 series decreased by 10.9 thousand tons to 77.3 thousand tons; 300 series reduced 8.5 thousand tons and left 342.6 thousand tons in stock; whereas 400 series increased by 1thousand tons, to 75.3 thousand tons.

Global || Ever Given was free! 500 cargo ships are waiting in line. Future Supply is still tight.

The 224,000-ton giant ship ran aground, cutting of the world’s important waterway.

On 23 March local time, a cargo vessel, Ever Given, of Evergreen Marine Corp, a shipping company of Chinese Taipei, ran aground in the new channel of the Suez Canal, blocking down the Canal in both directions.

On 24th March, Egyptian Suez Canal Authority announced that the freighter is 400 meters long, 59 meters wide, with a transport capacity of 224,000 tons. The freighter departed from China and planned to go to Rotterdam, the Netherlands, and entered the Suez Canal on the 23rd.

After being stranded for nearly 6 days, the EVER GIVEN vessel successfully resurfaced at about 4:30 a.m. local time on March 29th. And at around noon on March 29, local time, in the chance of the high tide, the rescue was carried out again, and the hull was successfully straightened.

The latest statistics show that the number of ships waiting to pass through the Suez Canal has increased to about 500, including dozens of livestock carriers. According to expert analysis, it takes about a week for all the backlogged ships to pass through the border.

Suez Canal: An important marine channel connecting Europe and Asia

The Suez Canal is one of the most important waterways in the world. It is located on the west side of the Sinai Peninsula in Egypt. It connects the Mediterranean Sea and the Red Sea, the shortest waterway connecting Asia and Europe, and an important international shipping channel that runs through three continents, Europe, Asia, and Africa.

The Suez Canal is 193 kilometers long, 24 meters deep, and 205 meters wide. It was invested and excavated by the French in 1859 and officially opened to navigation on November 17, 1869.

To improve the passage capacity of the Suez Canal, the Egyptian government has excavated a new channel parallel to the original channel, which was officially opened in August 2015.

In addition to oil, the sea cargo traffic between Europe and Asia mainly takes the Mediterranean—Suez Canal—Red Sea—Mand Strait—Strait of Malacca. Without passing through the Red Sea, the only way is to bypass the Cape of Good Hope in South Africa, which takes more time and costs.

Suez Canal is a transit route for trading stainless steel and other goods.

As a vital shipping route in the world, the blockage of the Suez Canal has a major impact on the global market.

To the stainless steel industry in China, the imported raw materials such as chrome ore, ferrochrome, nickel, and other export goods have to pass Suez Canal. It is said that the ferrochrome imported by Delong goes through the Canal.

According to Chinese customs data, in 2020, 12,800 tons of ferrochrome were imported from Turkey; 86,000 tons of chrome ore were imported in January 2021, and 25,000 tons of chrome ore were imported in February, and 8,500 tons of ferrochrome imported from Turkey in January and 4,500 tons imported in February.

According to data from the Suez Canal Authority, about 19,000 ships passed through the port last year, on average, that is 51.5 ships per day, and the gross tonnage reached 1.17 billion tons. Approximately 12% of world trade flows depend on this canal. Last year, the Canal earned 5.61 billion U.S. dollars for Egypt.

The fastest response is the oil market—— US crude oil futures rose 6%

Oil transportation mainly relies on tankers. The impact of this accident on refined oil is relatively greater, which will boost oil prices in the short term. The US crude oil futures rose by 6% in one night. More commodities will follow suit.

Although the blockage is finished, the capacity pressure remains unabated globally.

The stranding of "Ever Given" cut off the Eurasian artery and affects more than hundreds of ships. Now the vessel is rescued but awaiting after this, will be claims valued multi-million dollars.

Besides, Maersk emphasized that even if the canal is re-opened, the impact on global transportation capacity and container supply remained huge. The current congestion and backlog of ships will further appeal to more problems such as the intensive supply chain, which may take weeks or even months to resolve.

Lars Jensen, chief executive of Seintelligence, said that the risk of congestion in European ports is extremely high, and meanwhile, it has increased the time for empty containers in Asia to return. He predicted that in the next 2-3 months, the container shipping market will suffer a strong impact.

Charlotte Cook, the chief trade analyst at VesselsValue, analyzed: “We will pay close attention to port congestion because we see an increase in cargo going to Europe, especially some major container ports in Northwestern Europe. Our trade flow data shows that the past 6 months, Rotterdam, Felixstowe, and Antwerp were the three major destination ports for container ships passing through the Suez Canal, and it is expected that these ports will usher in heavy congestion."

------------------------------------------------------------------------------Stainless Steel Market Summary in China------------------------------------------------------------------------------