On the first transaction day after the National holiday, the financial and commodity market have been flourish. On October 9th, the domestic A-share market increased greatly. Shanghai Index increased by 1.68%, and Shenzhen Index increased even higher by 2.96%; LME nickel spiked to US$525/MT, breaking the key line of US$15,000/MT, reached US$15,175/MT. Compared with the increase during the Asian-stock market term, the stainless steel futures price rose by US$65/MT and increased to US$2,070/MT.

When the nickel price keeps increasing, the market also conveys good news.

Positive news gathered to boost the nickel market.

According to related news reports from foreign media, Tesla is negotiating with mining giant BHP Billiton on a nickel supply deal. The electric car manufacturer's goal is to increase production to avoid the tightening supply.

The negotiation on the price between the two parties has been put on hold, and the automaker and BHP Billiton have not yet to reach a final agreement. During the negotiation, Tesla is working to increase the nickel content in car batteries to improve performance and promote internal battery production.

Besides, the strike in Indonesia also supports the nickel price increased. In a short term, it is of a large possibility that LME nickel will keep increasing in price which is predicted that it will surpass US$15,300/MT.

LME nickel increased and stainless steel futures followed suit.

Stimulated by the increasing LME nickel price, the stainless steel futures was high in opening price and kept increasing during the day. Stainless steel contract 2012 once increased to US$2,065/MT, close to the key point of US$2,070/MT. Until the closing stock at noon, the price has increased by US$44/MT and closed at US$2,055/MT. Anticipated from the stainless steel futures index, with a half-day, the positions increased by 1,200 plots and there are signs that more investments are flowing in. Therefore, in a short period, the increasing force will maintain.

The increase appeared in both LME nickel and the stainless steel futures markets, then what about the stainless steel stock market?

Steel mills remained the prices, showing a strong willingness to take orders.

Currently, there was feedbacks about the explosive orders in steel mills. On last Friday, the total order volume of a steel mill in Eastern China reached nearly 20,000 tons. Even more, after the noon, the mill stopped quoting.

Although the LME nickel price increased greatly, the transaction of 304 tended to be plain. Steel mills, contemporarily, did not increase the opening price or close the stock, but remain steady quotation and are willing to accept orders.

304 stock product price increased by US$8/MT. Low willingness to decrease the price.

During the holiday, resources were keeping arriving at the market, but people are keen to stock up. Thus, the increasing inventory will not affect the price much for now.

On October 9th, in the Wuxi market, the cold-rolled 304 of Delong and Chengde increased the price to US$2,055/MT (US$2,120/MT in 2.0 slit edge). Other specifications were sent out at US$2,065/MT (US$2,140/MT in 2.0 slit edge). In the hot-rolled market, the mill-edge 5-feet products of ESS and GQMT were increased to US$2,040/MT.

What will happen in the future market?

About futures: So far, with so many positive factors in the international market, the LME nickel met an increasing trend in a short term. However, as the less effect of the Indonesian strike issue on the market, plus the smaller stainless steel price’s growth, it not easy for the stock price to increase. That is to say, the increase of the stainless steel stock price is limited.

Some say: The cost is high. Although the increase is small, a sharp drop is not an easy thing. For now, the cost of cold-rolled 304 of the private-own mills is around US$2,055/MT – US$2,075/MT, while the mill-edge 4-feet stock price quoted at around US$2,055/MT – US$2,075/MT. The gross profit per ton ranges from minus US$15/MT to US$8/MT.

But some clients say: The pandemic has not vanished yet, and it is heard that some mills stock up in a great amount, so the risk is high and the possibility of stock out is small. Also, the impact of the strike in Indonesia has gradually weakened, and Indonesian nickel and iron production is still being consumed rapidly. Recently, the fourth electric furnace of YASHI INDONESIA INVESTMENT., a subsidiary of Zhenshi Holding Group, has successfully produced iron, marking that Yashi' s annual production of the 300,000-ton ferronickel project has been put into production fully. Also, the Indonesian Delong ferronickel project maintains the progress of adding two new units every month. In the later period, the Indonesian ferronickel supply will be richer, and the high cost of nickel will be reduced.

Production|| Ramping up! The production is 20,000 tons more, balancing the 300 series’ s supply.

During this year, the stainless steel demand has stayed good and steel mills also produced at their full productivity. The production has kept breaking the new highest. Until September, the production has increased in a consecutive seven months. However, due to the current full production of steel companies, the production growth rate has slowed down.

Will the production continue to increase in October?

Production in September also increased.

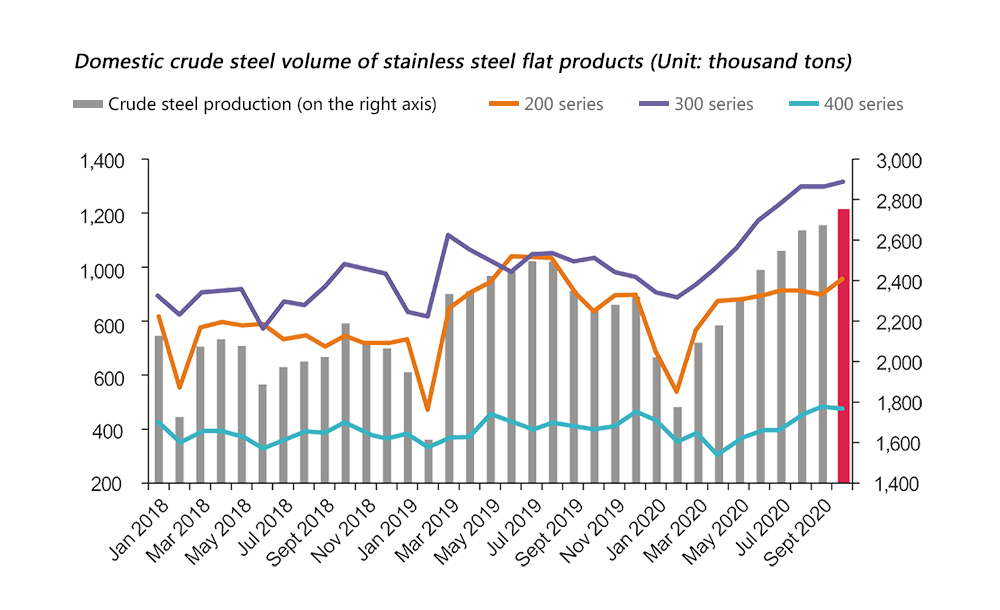

In September, the domestic crude steel volume of stainless steel flat products continued to increase by 24,000 tons from the previous month, reaching 2.686 million tons, which has an increase of 0.9%; compared with the same period last year, it increased by14%, 330,000 tons. The main reason was that the output of wide coils increased significantly MoM, with an MoM increase of 38,000 tons or 1.8%.

Compared with the previous production growth rate, the rate slowed down in September, because the stainless steel plant was more full production.

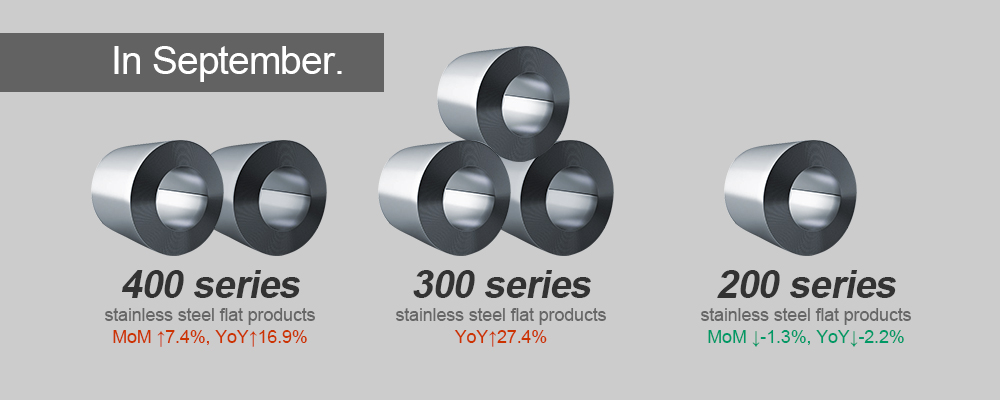

400 series production increased much in September.

Tisco's maintenance was completed in September, and the output of the 400 series increased significantly. In September, the crude steel volume of 400 series stainless steel flat products was about 483,000 tons, increased by 33,000 tons from the previous month, which is 7.4% higher; compared to last September, it increased by 70,000 tons that are 16.9%.

The volume of the 300 series increased by only 3 thousand tons to 1.303 million tons from the previous month; compared with last year in the same period, it increased by 281,000 tons which are 27.4%. The current supply of the 300 series is in a balance.

The volume of the 200 series decreased by 1.3%, 12,000 tons to 900,000 tons from the previous month; it decreased by 20,000 tons from the previous year, and the decreasing percentage is 2.2%.

The reason for the lower production of the 200 series is that most of the 200 series products are for civilian use, and demand has not been good this year.

200 series production increased in October.

Because both Zhongjin and Jinhai were in maintenance in September, after October, the production will back on track, so the output will gradually expand.

It is estimated that in October, the volume of 200 series stainless steel flat steel crude steel is about 962,000 tons, which increases by 6.9% month-on-month (an increase of 62,000 tons) and increased by 15% year-on-year. Compared with last month, 300 series production increased by 1.4% (an increase of 19,000 tons), which has an increase of 27% year-on-year. As for the 400 series, the production decreased by 1.7% compared with last month but increased by 19% compared with that of last October.

-------------------------------------------------------------------------------Stainless steel Market Summary in China--------------------------------------------------------------------------------------