2019 becomes past tense. The price of nickel fluctuated in the last year. Sharp rise and flop stirred the stainless steel market without any preparation. Let’s take a flashback to the 2019 nickel market and get prepared for the next.

1 The changes of nickel price in 2019

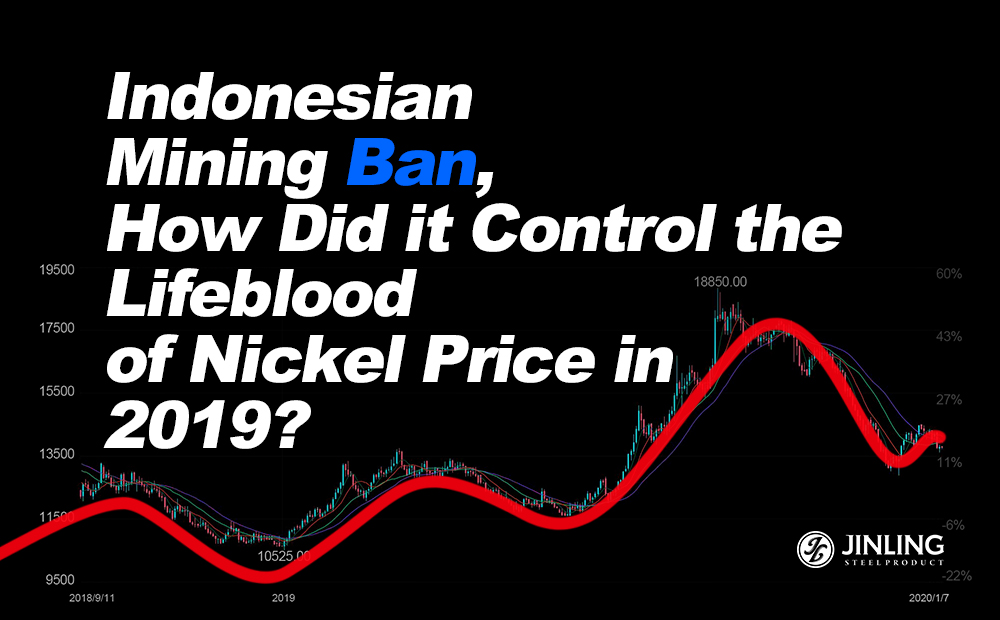

The nickel price trending of 2019 can be divided into three phases. At the beginning of 2019, the price also began its rising tendency which increased by US$3,500 in total until the mid-March, closely reached USD14,000/ton. However, the price soon went backward, based on which many people suggested that the London nickel price would fell below US$11,000/ton and returned to the original price.

It didn’t become truth at last. From July to September, the London nickel was in its highlight of the year. Rumor had it that a Chinese mega would buy in a large quantity of nickel to boost the nickel price up. Meanwhile, news about Indonesian nickel ores mining ban was spread around in the market. Affected by these positive reasons, the nickel price was dragged to soar from US$12,000/ton to US$19,000/ton. Increased by US$7,000, most of the speculators were lost.

Since October, because the LME nickel inventory reduced almost 100 thousand tons within less than 2 months. Due to the investigation of nickel by the exchange plus the high-stock stainless steel, many speculators gathered to compress the nickel price which dropped by US$5,000 in this phase.

2 Changes brought by the Indonesian mining ban

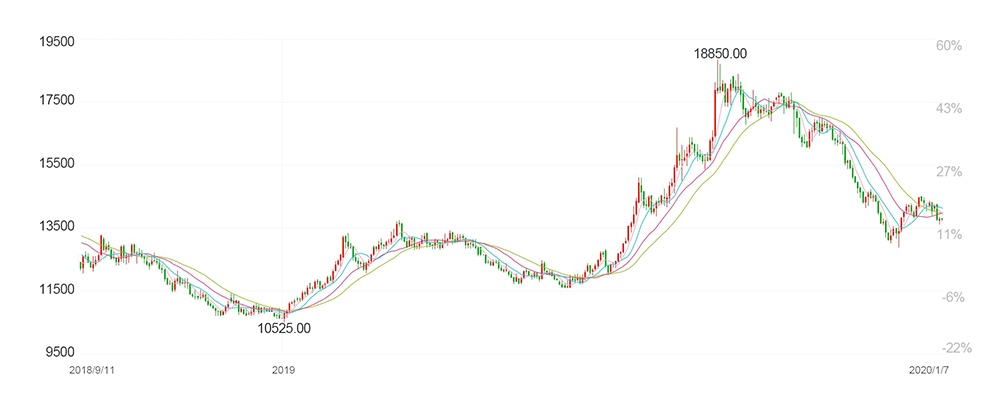

The focus of the 2019 nickel market is doubtlessly the Indonesian nickel ores mining ban. An official announcement from ESDM came at the beginning of September, saying that nickel ore content below 1.7% is no longer allowed for export since the end of December 2019. On December 31st, 2019, Indonesia has stopped exported nickel ore and the rest quota is not allowed to export.

The supply to Chinese nickel ores will reduce largely out of the ban. Nevertheless, with the exhaustion of the high-quality mine in Philippine and the high-output ferronickel in China, it is a destiny that China will be short of nickel ore.

According to our statistics, in 2020, the Chinese nickel-iron equivalent metal supply will decrease by around 154.1 thousand tons and the output will fall to 425 thousand tons.

Coping with the ban, Chinese enterprises have speeded up the plans of the Indonesian ferronickel. Tsingshan, Delong and other businesses finished their key plans, and Jinchuan, Xinhai, and other businesses will fasten their pace in the Indonesian market. It is predicted that in 2020 the output of Indonesian ferronickel will increase by 170 thousand tons, which can make up the lack of the Chinese ferronickel.

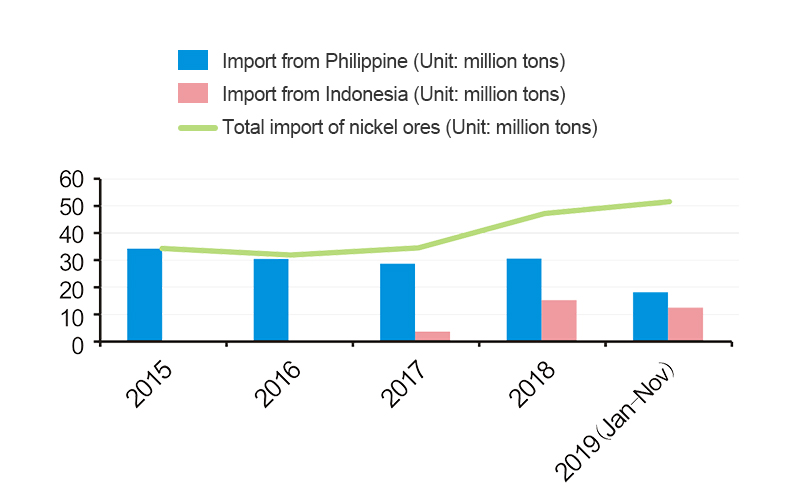

3 The demand for nickel metal

Based on the 2019 stainless steel annual rising rate, in 2019 the output if stainless steel grew by 3.909 million tons and the rising percentage was 13.9%. The output was about 32 million tons. Tsingshan Group, Baosteel Desheng, Jiangsu Delong and Henan Jinhui. As for different series, the output of 200 series amounted to 10.6581 million tons, which increased by 1.4211 million tons compared with the prior year. About series 300, it was 16.406 million tons, which was 2.392 million tons higher than last year. The output of 400 series was 4.9359 million tons. The increase of series 200 and 300 were larger in output and the demand for nickel is still expanding in the stainless steel market.

The stainless steel crude steel output of China’s enterprises above designated size (Unit: million tons)

*Remark: Enterprises above designated size is defined as enterprises whose annual main business income is RMB 20 million (US$2.9 million) and above

But about new energy demand, because of the cut of the subsidy in the new energy vehicle industry, the demand did not impress much in 2019. Since June, the battery-grade nickel sulfate enterprises reported the poor sales and the demand for nickel in the new energy was about 120 thousand tons.

It is predicted that in 2020 China’s output of stainless steel will be around 33 million tons which will be 1 million tons more than 2019, of which 200 series, 300 series, and 400 series will increase by 300 thousand tons, 550 thousand tons and 150 thousand tons in output respectively. It can be calculated that in the stainless steel industry, the nickel demand in China in 2020 will rise by 54 thousand tons.

Besides, Delong’s one-million-ton stainless steel project is going to carry out in Indonesia in 2020. It can be calculated that the nickel demand will increase by 40 thousand tons. Overall, there will be 94 thousand tons of nickel that will be needed by China and Indonesia in 2020.

4 The outlook of 2020 nickel market

From a macro perspective, agreement on the text of the economic and trade agreement in the first stage of Sino-US trade negotiations is a positive sign, indicating a better prospect in finance and commodity.

Moreover, recently, the Central Economic Work Conference predicted that the currency will be lax in 2020. In the conference, it was said that the currency policy shall be flexible, maintain reasonable liquidity. The growth of monetary credit and social financing scales shall be compatible with economic development and reduce social financing costs.

Around the world, the major economies cut interest rates. The Federal Reserve cut interest 3 times in 2019 and European Central Bank announced lower interest and restarted the debt purchase plan in mid-September. Many people regard that there may be a cut in interest in 2020, and the capital will run freely.

As for the industry, after Indonesia bans nickel ore mining, China will have a large deficiency in ore, resulting in a significant decrease in ferronickel. Though the new output of Indonesian ferronickel can make up China’s gap, it is not enough for the new demand of China’s and Indonesia’s stainless steel. Stainless steel is a strong supporter of the nickel price.

In the end, in 2020, the nickel price will remain its trend and go up. London nickel price may locate between US$12,000/ton and US$20,000/ton.

--------------------------------------------------------------------Indonesian Mining Ban, How Did it Control the Lifeblood of Nickel Price in 2019?-------------------------------------------------------------------------