This year, the production limit has been the hottest topic in the stainless steel industry after the abolishment of the export tax rebate issue. The stainless steel prices are affected. Take the CR 304 of the private-owned mills as an example. The price is hyping from US$2,645/MT to over US$3,275/MT. The futures even once rose to limit rarely.

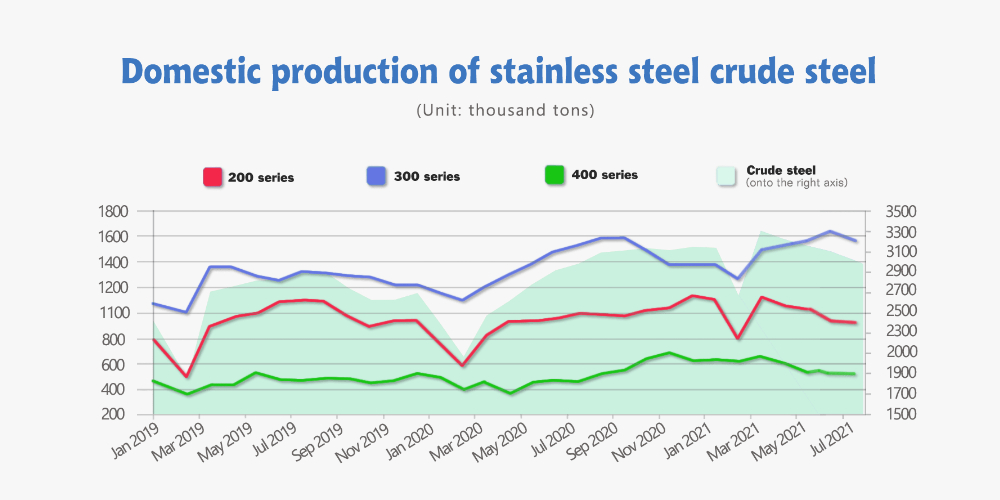

In August 2021, the crude steel output of China’s stainless steel enterprises above the designated size was 3.049 million tons, increasing by 30,400 tons that are 1.01% higher from the previous month; YoY decreasing by 49,000 tons, 1.58% lower. The output of September is yet to update, and we will keep an eye for you.

The production limit in the steel industry is only an epitome of the “DUAL CONTROL” policy. Almost, if your businesses are related to China, you cannot get rid of this topic. Whatever your businesses are about the second or third industry, you shall highly pay attention in the term which is becoming a new normal in Chinese economic development.

DUAL CONTROL

"What is it?"

“Dual control” is an abbreviation of Dual control of energy consumption intensity and the total amount which was first proposed in the Fifth Plenary Session of the 18th Central Committee of the Communist Party of China on October 26, 2015. It aims to set energy consumption total and intensity control targets according to the administrative regions of provinces, autonomous regions, and municipalities directly under the Central Government, and supervise and assess local governments. Energy-saving indicators are incorporated into the performance evaluation indicator system of ecological civilization and green development to guide the transformation of development. Decompose energy consumption dual control targets for key energy-consuming units, carry out target responsibility evaluation and assessment, and promote them to strengthen energy-saving management.

BACKGROUND:

The reasons why China brings the policy up are related to the modes of economic development. China has been an energy-oriented country for years and coal takes a major role in Chinese energy structure which results in low energy efficiency. From 2006 to 2020, the total national energy consumption increased from 2.86 billion tons of standard coal [7Mcal/kg(29300.6kJ/kg)] to 4.98 billion tons of standard coal, increasing by 2.12 billion tons of standard coal in 14 years. Besides, China has been high in energy intensity, which means that China pays a high price or cost of converting energy into GDP. In 2020, China’s GDP ranks second in the world, but the energy per unit of GDP is 1.5 times over the world averaged level.

This year is not the beginning for Beijing to take action to change the state quo. The concept of reducing energy use can be earliest found during the period of the Eleventh Five-Year Plan (years of 2006-2010), announcing the goal to reduce the energy per unit of GDP by 20%. During the period of the Twelfth Five-Year Plan (years of 2011-2015), Beijing firstly brought up “Dual Controls” and set up an aims and assessment system. In the Thirteenth Five Year Plan (2016-2020), Beijing intensified the policy. Now, in the early stage of the Fourteenth Five Year Plan (2021-2025), the country plans to reduce the energy per unit of GDP by 13.5%. However, the global economy is recovering quickly in the post-pandemic era, which makes the works more challenging.

In 2020, President Xi proposed, “China will strive to reach the peak of carbon dioxide emissions by 2030, and strive to achieve carbon neutrality by 2060.”The “Dual control” has become a driving force for China to develop in low carbon since then.

We extract from the government website page about the aim of dual control, “promote the clean, low-carbon, safe and efficient use of energy, force the adjustment of the industrial structure and energy structure, and help achieve the goal of carbon peak and carbon neutrality”.

DUAL CONTROL

"Why it is especially harsh in 2021?"

Dual control is not the only case in China. “More than 130 countries have set or are considering setting a target of reducing their greenhouse gas (GHG) emissions to net-zero by 2050.”

Controlling carbon emissions is a global issue, and every country has its own emission reduction targets, such as Japan.

“As an interim goal, Prime Minister Suga announced in April 2021 that by 2030 Japan would reduce emissions 46% relative to 2013 levels. This was a dramatic departure from the previous targets of reducing emissions by 26% by 2030 and 80% by 2050 under the Paris Agreement. But it's in step with other large GHG emitters, such as the European Union and Canada, that have also embraced more aggressive targets.”

——“How Japan could reach carbon neutrality by 2050”McKinsey

As for China, this year, reducing carbon emission might be the hardest in recent 10 years.

Until now, China's energy structure is dominated by thermal power, and 70% of China's electricity comes from coal power.

The worst is that the cost of power generation is extremely high now. A major reason is that China stops importing coal from Australia in December 2020. After banning the import of Australian coal, China increased its imports of coal from the United States, Canada, Russia, Colombia, and the Philippines. However, the cost of importing these coals is higher than that of Australian coal.“The top three greenhouse gas emitters — China, the European Union, and the United States — contribute 41.5% of total global emissions, while the bottom 100 countries only account for only 3.6%. Collectively, the top 10 emitters account for over two-thirds of global GHG emissions.

The world cannot successfully fight climate change without significant action from the top 10 emitters.”

——The World’s Top Three Emitters Contribute 16 Times the Greenhouse Gas Emissions of the Bottom 100

To restrict the expansion of thermal power, The Bank of China said that starting from the fourth quarter of 2021, it will no longer provide financing for new overseas coal and coal-fired power projects.

With the demand for electric power getting higher, meanwhile the cost and chance of thermal power which is the main power supply in China, the economic development that relies on energy seem to be a bad deal.

In the economy in 2021, the increasing price of the commodity is an unavoidable topic. However, the “made in China” used to be known for low price and the gross profit of the manufacturers is low. Facing the boosting commodity price, Chinese manufacturers are on the disadvantaged side. What Chinese manufacturers must do is an industrial improvement, giving up the energy-oriented development. However, in the post-pandemic era, China has recovered from economic paralysis quickly, and more and more orders flood into Chinese manufacturers.

“After the epidemic, the economy was in a recovery channel, and the "dual control" dilemma appeared in many places. In terms of industrial production, the year-on-year growth rate of the added value of my country's industrial enterprises above designated size has been significantly higher than the same period in history this year, and the monthly growth rate in the second quarter has also remained above 8%. In terms of imports and export, the global economic and trade environment is gradually improving. The International Monetary Fund predicts that the global economy will grow by 6% this year, which is conducive to the growth of my country's imports and exports. Since the beginning of this year, the year-on-year growth rate of my country's imports and exports has remained above 20%.”

The prices of commodities are rising and the market is facing severe inflation.

“On September 9, the National Bureau of Statistics of China released August price data: August CPI was 0.8% year-on-year (previous index was 1.0%) and 0.1% month-on-month (previous index was 0.3%); August PPI was 9.5% year-on-year (previous index was 9.0%) ), 0.7% month-on-month (previous index was 0.5%).”

The deficit between PPI (producer price index) and CPI(consumer price index) has widened, and the soaring commodity has spread to downstream manufacturing, but China's manufacturing export profits are low. Through energy control, Beijing plans to force China's industry that relies on high investment, high energy consumption, high emissions to upgrade and improve.

DUAL CONTROL

"How does it affect the steel industry?"

1. Stainless steel Crude steel output is limited, which cannot surpass the output of 2020, 30,139,000 tons (Mainland China). From January to June 2021, the output of stainless steel crude steel reaches 16,243,000 tons, YoY increasing by 20.82%.

2. Factories have to be closed. Except for the high price of the commodity, the dual control prolongs the producing period, increases the costs of the raw material supply. Almost all industries in China have been facing electric power control. In some regions that surpass their designated energy consumption goal, the factories receive “close 5, open 2”, which means that the factory has to shut down 5 days in a week to avoid the peak time of electricity consumption to make sure the electric use limit of the local jurisdictions cannot be broken.

In other industries such as the ceramic industry, which is also an energy-oriented industry, some companies have already met the output quotation of 2021. In this circumstance, they have to stop working for the rest months and bring the spring holiday much earlier.

Guangdong and Jiangsu are two major provinces of stainless steel production. These two provinces are on the red list which records the largest electric consumption in China, and thereby the duty of reducing electricity use is of extra load on Guangdong and Jiangsu. Ordinary factories in Dongguan, Guangdong were out of power for 4 days. As for the energy-oriented factories stopped working for a week. Over 1,000 enterprises in Jiangsu "opened for two and stopped for two". Taizhou, Nantong, and other places in Jiangsu are on day-off for 20 days because of the power cut.

3. Steel mills earn more profit. Under the “dual control” policy, many steel companies are reducing production and even stop production. Crude steel and pig iron output in July and August dropped a lot. Meanwhile, the cost of iron ore steel drops, directly leading the production costs to decline. With lower cost, longer production term, the steel price, and profit margin increase.

Statistics show that crude steel production in August fell by 13.2% year-on-year, pig iron production fell by 11.1% year-on-year, and steel production fell by 10.1% year-on-year. The price of iron ore, which was under pressure by steel companies reductions in production and decreased sharply, which is the largest decline during the year in Chinese commodity. During the Mid-Autumn Festival holiday, the SGX TSI CFR China Iron Ore (62% iron powder) swap closed down 8% on September 20, once hitting $90/ton, which was a 15-month low.

DUAL CONTROL

"When is the end?"

We believe this is becoming new normality in China. “Dual control” is only a beginning in the next stage of Chinese industry.

China National Development and Reform Commission:"… to achieve the carbon peak goal by 2030, the "Plan" puts forward the target requirements in three stages: the first stage is to 2025, the dual control system of energy consumption will be more complete, the allocation of energy resources will be more reasonable, and the utilization efficiency will be greatly improved. The second stage is that by 2030, the dual control system of energy consumption will be further improved, the intensity of energy consumption will continue to decline sharply, the total energy consumption will be reasonably controlled, and the energy structure will be more optimized. The third stage is that by 2035, the optimal allocation of energy resources and the comprehensive conservation system will become more mature and finalized, which will strongly support the realization of the goal of reduction of carbon emissions steadily after reaching the peak."