The economists of Bloomberg, Orlik and Niraj Shah wrote that the global economic recession has begun, which is concluded by the Bloomberg economic research on the review of high-frequency data. The rising unemployment, fewer passengers take the public transportation, empty commercial street, crashed consumer confidence, plunging metal prices, all of these are a sign of the abrupt economic pause. One of the highlights is consumers panic buying, boosting a short-term sales increase of necessities.

Shutdown—S&P GSCI Metal Price Index

Source from Bloomberg

Metal consume is closely relative to the growth of the world GDP. Thus, metal price is assumed to be a high-frequency index of the rise and down of the global economy. The fitting of the two is so high that Bloomberg economic research used S&P GSCI Metal Price Index in the nowcast index. Since March, the index has knocked off 13%, indicating the sharp decline of economic activities in the market.

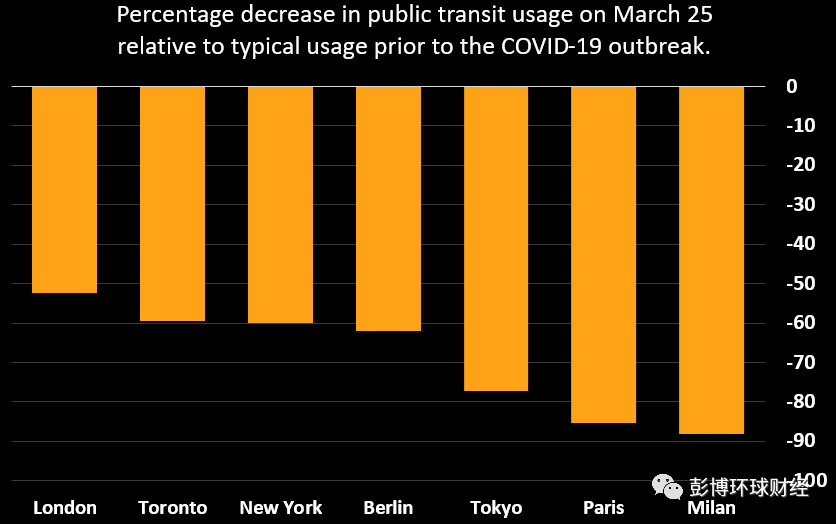

Empty Car—Public Transportation Usage

Source from Moovit

The number of people using public transport is taken as a proxy for economic activity, which has crashed down, Data from Moovit collects the daily usage of public transportation in several main cities, showing a global decline. The first country to lockdown has the largest decreasing degree in the number of passengers taking the public transportation. The decrease in Italy closes to 90%. The same track also appears in other countries.

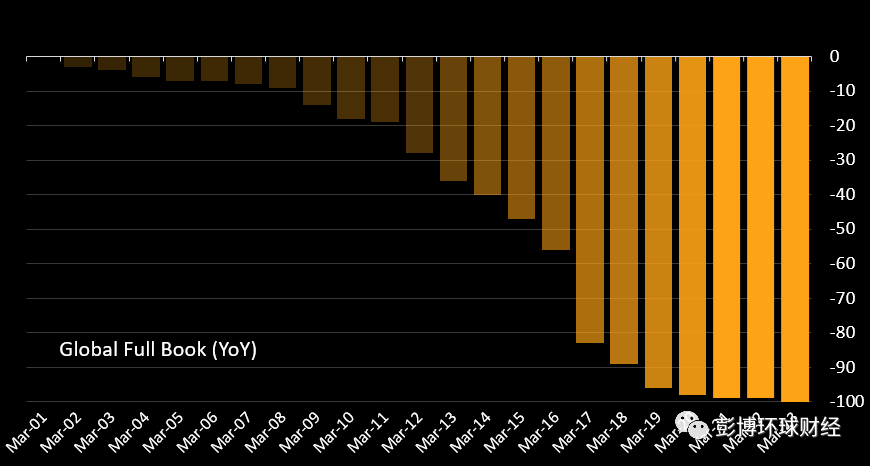

Dining—Reservation of Restaurants

Source from OpenTable

Service industry—restaurants, hotels, theaters and tourist attractions that make a profit from consumers—are firstly and directly hit by the social distancing. Indicated by OpenTable data, the number of people dining out is near zero. The reservation application is available in 6,000 restaurants in the US, Germany, the UK, and other countries or regions.

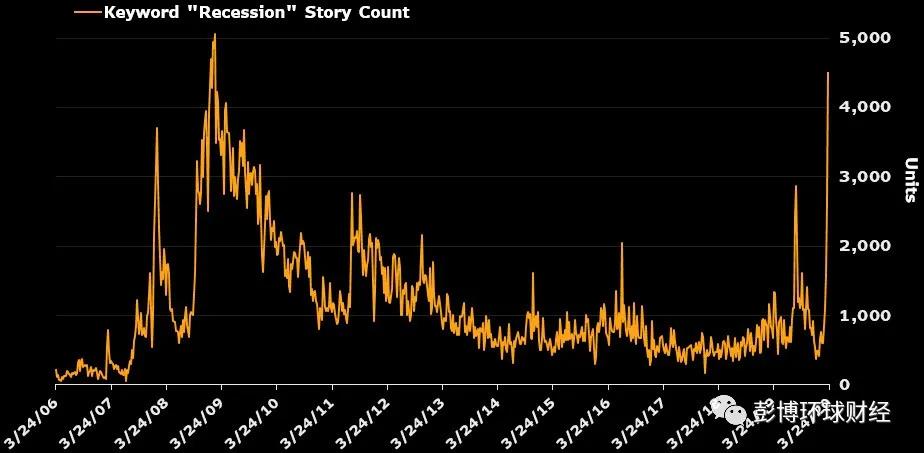

Discussion about the Economic Recession—News Trending of “Economic Recession”

Source from Bloomberg

News reflects and accelerates the people’s expectations toward the global economy. Last week, the word “recession” has shown up for about 4,500 times on Bloomberg end. Compared to the beginning of the year, this number increases 10 folds and closes to a peak of 5,000 times during the 2008 financial crisis.

Job Hunting—The weekly application of unemployment benefits in the US

Source from the United State Department of Labor

In the State, the number of weekly applications provides a real-time status of the labor market. The latest number is 3.3million makes itself rank to the historically high level, which is a sign that the small enterprises and gig economy are weakened by the anti-virus measures. Almost all economic activities are suddenly stopped, and it results in a sharply increasing number of the unemployed.

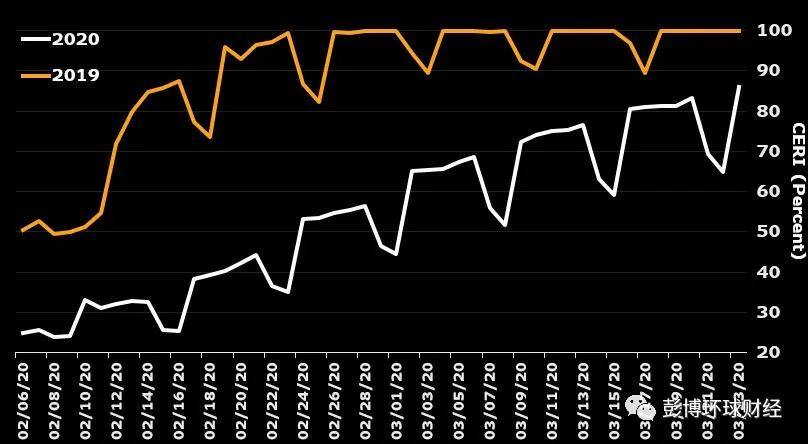

Getting Back to Work— Chinese Economy Recovery Index

Sorce from WeBank AI

China is getting back to work, but there is still a huge gap from the normal situation. According to WeBank Chinese economy recovery index, Chinese economic activity is about 85% of the normal level. Since mid-February, rising from 30%, the recovery is prominent. However, there is still a long way to go.

Stagnation— Sales of Real Estate in the First-Line Cities of China

Source from CRIC

Chinese real estate industry is a key force to domestic economic increase, to the demand for global iron ions and other building materials. The real estate institution, CRIC, gives weekly data about Beijing, Shanghai and other first-line cities, showing that the sales of real estate decline, sinking to the half before the outbreak, and there is almost no re-bounce sign.

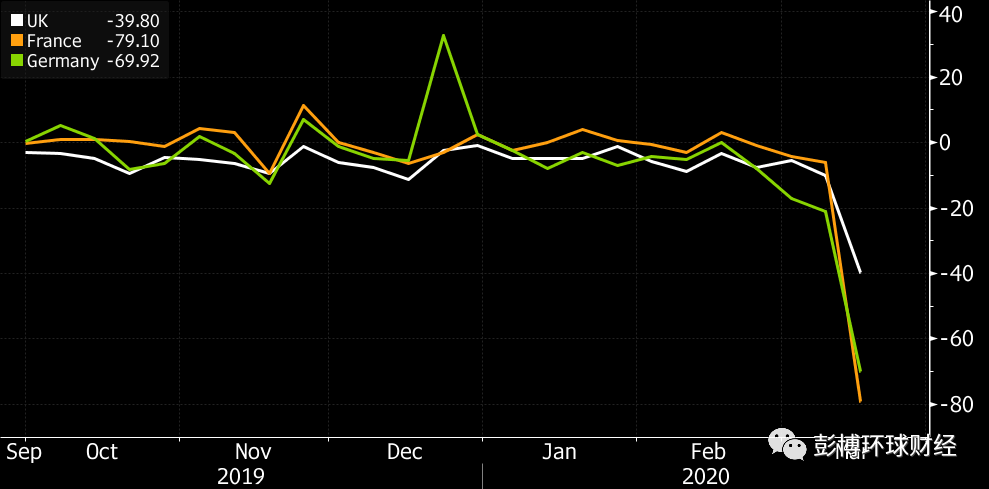

Avoiding Stores—Passenger Volume in European Commercial Streets

Source from ShopperTrak

The number of shoppers in European major commercial streets cuts down. Illustrated from the ShopperTrak data, in the past week, German passenger flow decreased by 70% compared to the one week before, France declined 80%. The UK dropped 40% which does not seem that disaster-like, but because the government has required the people to stay at home in the future three weeks, it is predicted that the decline will expand.

Panic Buying—Daily Shopping Index of Japan

Source from Nowcast, Bloomberg Economy

Not all data are in a downturn, but even if there is an increasing data, it also forebodes troubles. In Japan, the daily CPINow sales data shows that, in early March, the purchasing volume from supermarkets and convenience stores is 15% higher than one year before. Unfortunately, the increasing sales volume of necessities reflects the panic buying before the measure of lockdown, but not out of the confidence or higher consuming ability.

Good Luck Vanished— Australian Consumer Confidence

Source from ANZ Roy Morgan Research

Australia has been known as a “lucky country”, part of his good luck is there is not a recession in the lately 30 years. But his good luck seems to vanish, with the pandemic outbreaks in Australia, as well as China’s economy is shrinking significantly, which is the exporting destination of Australian iron ions. The weekly consumer confidence index by ANZ Roy Morgan drops drastically, indicating the influence is working on it.

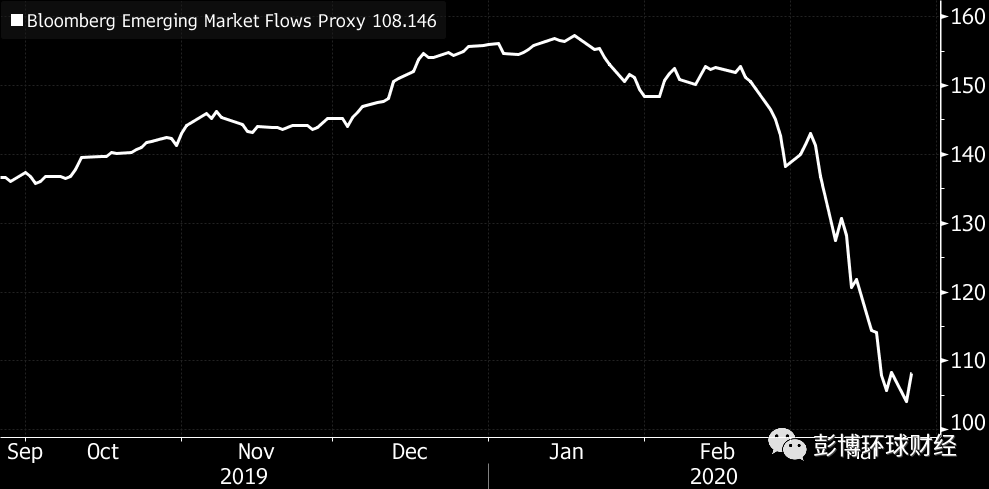

Hard Braking: Capital Flows in the Emerging Market

Source from Bloomberg

For many emerging markets, the virus means multiple setbacks as a result that the economy is facing the domestic epidemic outbreak, shrinking global demand and the breakdown of capital inflows. The surrogate index of Bloomberg’s emerging market capital flow provides the high-frequency data of capital inflows. Since March, the index has fallen largely, indicating the exhausting external financing.

-This article sourced from Bloomberg Terminal-

-------------------------------------------------------------------------------------------global recession---------------------------------------------------------------------------------------------------------------