2020 is a historical year. We went through stock bankruptcy, 4 circuit breakers of the US stock, the oil price down to minus, etc. Facing the pandemic and the volatile international environment, the stainless steel industry in China still kept the momentum.

Based on four perspectives(macroeconomic environment, supply, demand, and imports and exports), this article is dedicated to presents the development of the 300 series market in 2020 and makes a forecast about 2021.

1.Macroeconomic environment

In 2020, many countries introduced a series of large-scale plans for monetary assistance. As for China, gross domestic product (GDP) broke through the 100 trillion RMB (about USD 16 trillion) for the first time, marking a milestone for China’s economy.

2.Supply

2.1 About the production

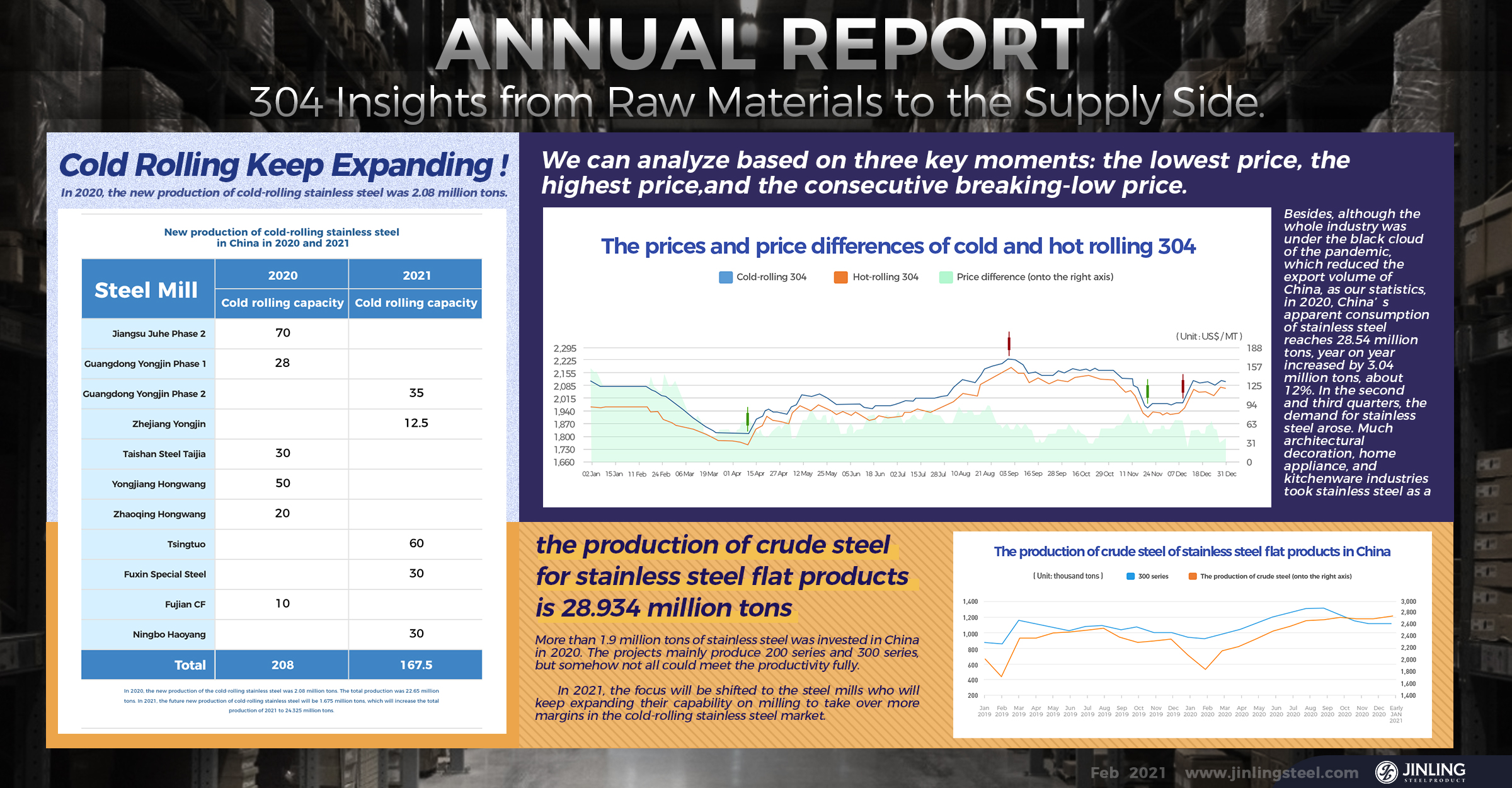

As our statistics, in China, 2020, the production of crude steel for stainless steel flat products is 28.934 million tons, 1.5 million tons more than last year, and the increasing percentage is 5.5%. For 300 series, the production of the crude steel is 13.2621 million tons, year on year increases by 1.28 million tons which rises 10.7%.

2.1 About productivity

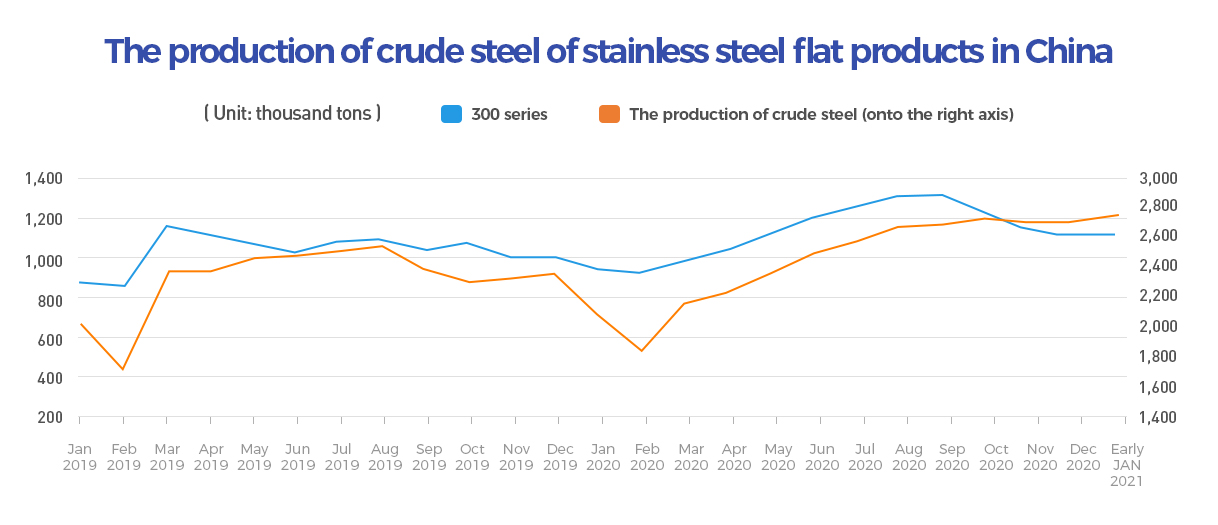

More than 1.9 million tons of stainless steel was invested in China in 2020. The projects mainly produce 200 series and 300 series, but somehow not all could meet the productivity fully.

In 2021, the focus will be shifted to the steel mills who will keep expanding their capability on milling to take over more margins in the cold-rolling stainless steel market. For now, we can notice that cold-rolling manufacturing has already increased. In the future, there will be more projects in the cold-rolling area for the merger, reorganization, and cooperation.

In 2020, the new production of cold-rolling stainless steel was 2.08 million tons. The total production was 22.65 million tons. In 2021, the future new production of cold-rolling stainless steel will be 1.675 million tons, which will increase the total production of 2021 to 24.325 million tons.

Five-Tandem Rolling Project by Chengde and Haian Stainless Steel will be put on the agenda in 2021. The 400,000-ton stainless steel cold-rolling project in Changzhou, by Jiangsu Delong, will also open tenders in public, and the cold-rolling stainless steel project by Guangxi Liusteel will also add 350,000 tons of No.1 surface products and increase the cold rolling capacity by 120,000 tons; Shizong, where Yunnan Tiangao is located, will also launch a 1450 stainless steel cold rolling equipment. Jiangsu Zhanshuo plans to attract investment for a new project with an annual output of 800,000 tons of stainless steel cold rolled plates...

3.Demand

The market trend and inventory changes can be taken into consideration.

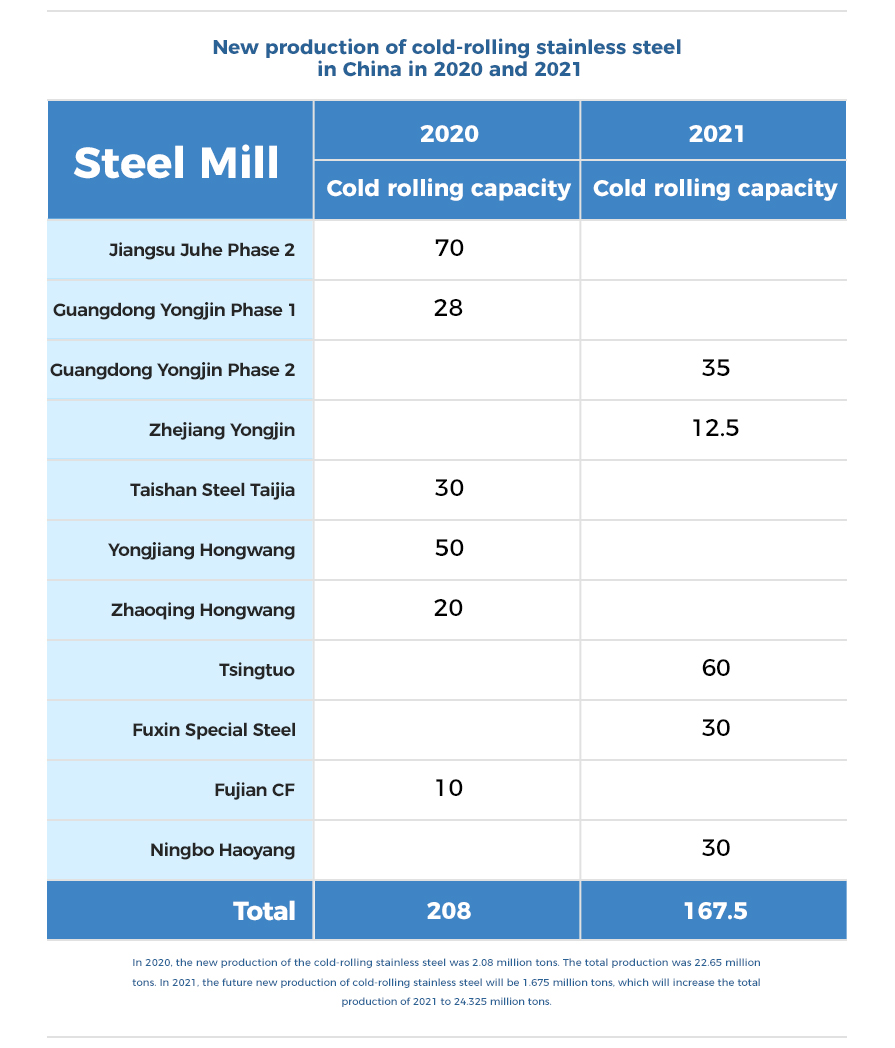

We can analyze based on three key moments: the lowest price, the highest price, and the consecutive breaking-low price.

During the first quarter of 2020, the inventory was at its highest level of the year, which directly affected the price. The lowest base price of the 4-feet mill-edge 304/2B was down to US$1,775/MT which is the lowest price in the recent 5 years. The price kept increasing in the later 6 months consecutively, and up to US$2,195/MT (cold-rolling product by the private-own mill) in September, reaching its highest price. Because of the increasing trend, the mills were encouraged to increase the investment and production and so in September, the inventory started to accumulate. In the fourth quarter, Tsingshan pushed down the price purposely to take over the margins of the 300 series market. Within 7 workdays only, the price was cut down by US$188/MT. However, due to other complicated factors such as environmental protection, power and gas rationing, busy logistics, and changing stock market, the price soon increased again, accumulated increasing by US$235/MT. Meanwhile, most steel mills postponed the delivery.

Besides, although the whole industry was under the black cloud of the pandemic, which reduced the export volume of China, as our statistics, in 2020, China’s apparent consumption of stainless steel reaches 28.54 million tons, year on year increased by 3.04 million tons, about 12%. In the second and third quarters, the demand for stainless steel arose. Much architectural decoration, home appliance, and kitchenware industries took stainless steel as a substitute.

What was unexpected is the unconventional price of the hot-rolling stainless steel. The hot-rolling products were sharply decreased in the market, owing to the steel mills that spent their productivity in the cold-rolling 304 products. Typically in the fourth quarter, a giant private-own steel mill took over the cold-rolling 304 markets, which limited the hot-rolling products. This operation pushed up the prices of the hot-rolling products right away. The flour was chasing up the bread! The steel mills that have hot-rolling production as their advantage to take the chance, and thereby, the production origins of the cold-rolling 304 became monotonous.

4. The imports and exports of raw materials and stainless steel

4.1 Overview of the import and export of nickel iron and nickel ore:

From January to November 2020, the nickel ore imports to China totaled 35,929,600 tons, decreasing by 30.63% compared to the same period of 2019. The ban of mines in Indonesia implemented in 2020 resulted in a large decrease in the import volume from Indonesia to China. Meanwhile, some mines in the Philippines have gradually dried up and the mining volume is limited, so the nickel ore supply for China has dropped significantly throughout 2020.

From January to November 2020, the total import of ferronickel to China was 3.103 million tons, increased by 81% year-on-year. The proportion of Philippine nickel ore imported to China decreased, as well as the proportion of Indonesian nickel-iron imported to China increased significantly.

4.2 Overview of the import and export of stainless steel

From January to November, China’s total import volume is about 1.5877 million tons, increased by 55.18% compared to the same period of last year; China’s total export volume is 3.0371 million tons, 9.35% less than last year.

5. 2021 Forecast

5.1 Macroeconomics: The global monetary policy is loose, and in inflation, so people are keen to invest, which is a positive effect on commodities. Therefore, there will be more money invested in the stainless steel market and the stainless steel futures stock as well. It may change the 304 stainless steel industry which is now in a monopoly pattern.

5.2 Indonesia will continue the ban on ore in 2021, while the high-grade nickel ore in the Philippines has gradually dried up because of the mining in recent years. The supply of high-grade nickel ore for China has gradually decreased, which will inevitably continue to affect the production of ferronickel. Fortunately, the Indonesia Nickel iron will make the deficit up. Since Tsingshan, Delong, Liqin, and Xinhai will have new production lines in 2021 and 2022, a large number of Indonesian ferronickel will be delivered to China. So will the stainless steel, because the stainless steel project in Indonesia will put into production. The import volume will increase significantly.

5.3 Price and cost: Compared with domestic ferronickel, Indonesia's ferronickel has a cost advantage. From the comparison of nickel ore, the production cost of ferronickel in Indonesia is over 50% lower than that in China. Therefore, using the Indonesian ferronickel will largely cut down the cost of production of 300 series and make larger profit margins. In 2021, steel mills with cost advantages may suppress the price of 304 in order to seize market share.

5.4 Predicted production capacity: This year, the cold-rolling production capacity is forecasted to reach 1.675 million tons and the total production capacity will be 25.045 million tons. In 2021, Guangqing, Tisco, Desheng, Delong, and other steel plants will begin new production on steelmaking. If all production is realized, the production capacity may increase to 51.31 million tons. And China’s stainless steel crude steel output is expected to reach 37 million tons, increasing by 3.01 million tons over the same period last year, that is about 8.9%.

5.5 Demand: With the increasing domestic stainless steel production, higher increasing percentage, and the increasing imports volume, while export growth is limited due to foreign trade barriers, the stainless steel apparent consumption in China will continue to increase. In 2021, China’s apparent consumption of stainless steel is expected to reach 31.74 million tons, 3.2 million tons more than the same period last year, and the increasing percentage will be 11.2%.

5.6 The future of stainless steel companies: Among the 300 series production companies, those with cost advantages will continue to expand their business territory. The cold-rolling processing plants without billets will be taken over or convert the business to producing 200 series, 400 series, or special steel or carbon steel, silicon steel, etc. Only the stainless steel mills with advanced technology will survive in the future. Therefore, the stainless steel industry will change the status now and improve productivity as a whole.

----------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------------