304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,190/MT(plus taxes) which is US$6/Mt lower than that of last week, and the decreasing percentage is 0.27%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,235/MT(plus taxes) which decreases by US$6/MT, and the decreasing percentage is 0.26%.

304/2B: The average price of 2.0*1240*C (mill edge) of Hongwang in the Wuxi market is US$2,070/MT(plus taxes) which is US$12/MT less than last week and the decreasing percentage is 0.57%. Besides, the average price of 2.0*1240*C (mill edge) of Hongwang in the Foshan market is US$2,050/MT(plus taxes) which decreases by US$40/MT compared with last week and the decreasing percentage is 1.86%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,015/MT(plus taxes) which decreased by US$19/MT compared with last week and the declining percentage is 0.87%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,035/MT(plus taxes) which cuts down by US$6/MT compared to last week, and the declining percentage is 0.29%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,990/MT(plus taxes) which increase by US$6/MT compared with last week and the increasing percentage is 0.19%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,035/MT(plus taxes) which increases by US$12/MT compared with that of last week, and the increasing percentage is 0.38%.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,785/MT(plus taxes) which is US$34/MT less than last week and the decreasing percentage is 1.14%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,840/MT(plus taxes) which falls US$19/MT compared to last week and the decreasing percentage is 0.61%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,235/MT(plus taxes) which is US$14/MT more than last week and the rising percentage is 1.11%. Besides, the tax-inclusive average price of the Foshan market is US$1,245/MT(mill edge) which is US$19/MT higher that last week and the rising percentage is 1.47%.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,200/MT(plus taxes) which is US$14/MT higher than last week and the rising percentage is 1.15%. Besides, the tax-inclusive average price of the Foshan market is US$1,220/MT(mill edge) which increases by US$22/MT and the increasing percentage is 1.75%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,430/MT(plus tax), which is US$22/MT higher than last week and the rising percentage is 1.47%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,385/MT(plus taxes) which increased by US$31/MT and the rising percentage is 2.18%.

Raw Material|| Transaction continues to cap the climax. Boon news comes one by one.

At the end of the year, boon news gathers to boost the market. The high ferronickel market transaction continues to cap the climax. Last weekend, Tisco bought the raw material of high ferronickel at US$167/MT (tax inclusive, to the factory). It is said that this purchase includes several suppliers. At the same price, US$167/MT (tax inclusive, to the factory), Ess also completed a deal of high ferronickel.

According to the latest customs data, in November, China has imported 385.3 thousand tons of ferronickel which is 68.23% higher compared to the same period of 2019, and compared to last month, it increases by 48.49%.

Influenced by the imported ferronickel, in November, the high ferronickel price in China has been through a continuous drop. Earlier in November, the quoted price of high ferronickel by the Chinese main-stream suppliers was US$186/nickel. But after times of large decreases, at the end of November, the ex-factory price of high ferronickel has fallen to US$158/nickel. The decrease in one month reaches US$28/nickel and the declining percentage was as high as 14.94%.

However, when it came to December, Chinese ferronickel factories faced with a great deficit. They were unwilling to ship out products at such a low price and even worst, they reduced and stopped production. As for another major raw material supplier, Indonesia where the pandemic again worsened and workers of Delong Indonesia stroke, the ferronickel price in China has begun to climb up. So far, the quoted price by the main-stream suppliers is over US$170/nickel.

Now, the Philippines is still in the rainy season, which affects China’s nickel ore import volume to decrease. As the Custom Bureau reported, in November China has imported 3.57 million tons of nickel ore, 43.53% lower than November of 2019 and decreased by 29.87% compared to last month. In the future, it is believed to keep decreasing.

Until last weekend, the stock of laterite nickel ore in the major ports of China is about 8.8 million tons which is 370 thousand tons less than the week before. Compared to the same period of last year, the inventory cut down by 5.5 million tons.

The nickel ore inventory in China declines largely, which supports the price to bounce back. And when the Chunyun (It refers to the transporting period during the Chinese Spring Festival when people travel back to their hometowns and it usually generates the largest transporting volume in China.) begins in January, it is required to have a greater capacity towards China’s transportation, which will boost up the freight and thereby the higher freight will make space for a higher ferronickel price.

(Nickel stock decreases, freight increases, raw material cost will go up)

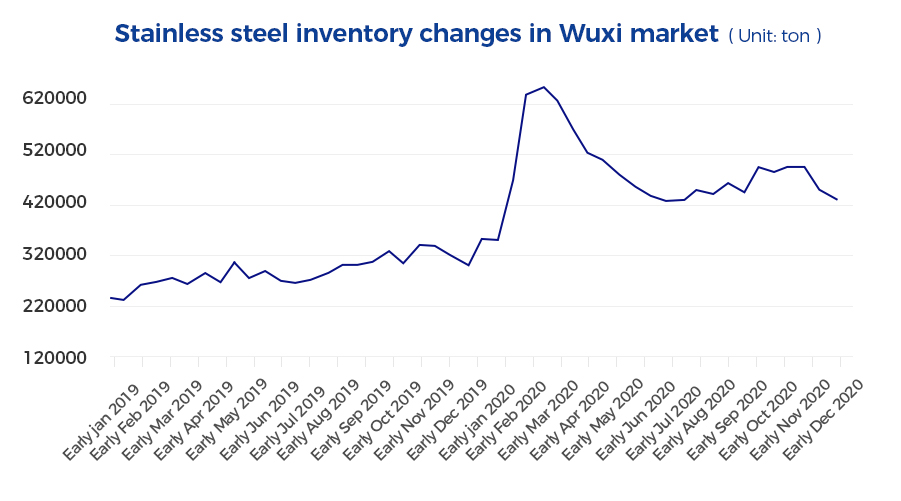

Inventory|| Decreasing! The SS inventory decreased by 20,000 tons in later December!

In late December 2020, the stainless steel inventory in Wuxi market was 426,700 tons, decreased by 17,100 tons from the first half of December, and the declining percentage was 3.85%. For the cold-rolling products, the inventory decreased by 6.75% compared to the data in early November, while the inventory of the hot-rolling products increased by 0.11% from the previous month.

The inventory of December keeps the decreasing momentum. Lately, the policy of limit electricity usage has been implemented in many places in China, aiming to reduce the supply pressure on grid to maintain normal supply of heating to homes and public places, while the harsh winter affects the zones; most of the steel mills need to be overhauled, which brings out reducing production. These result in a reduction in the supply side. As the news reported, a giant stainless steel mill based in Eastern China will cut down 40,000 tons of production in December. Considering the logistics, the new products in the market are limited. In addition, some giant steel mills sold short in the stock market, and in the future, they will take part in the settlement, and thus the resources to the market will be greatly limited.

In recent times, the market demand has turn better, plus that the policies such as environmental protection and limited electricity will affect production, so it is predicted that the inventory will maintain the falling trend lately in the stainless steel market.

-----------------------------------------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------------------------