304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$2,525/MT(plus taxes) which rose US$55/MT in a week. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$2,565/MT(plus taxes) which increases by US$55/MT within the week.

304/2B: The average price of 2.0*1240*C (slit edge) of Hongwang in the Wuxi market is US$2,360/MT(plus taxes) which is US$47/MT higher compared to the beginning price in the week. Besides, the average price of 2.0*1240*C(slit edge) in the Foshan market is US$2,380/MT(plus taxes) which increases by US$16/MT within the week.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$2,415/MT(plus taxes) which increased by US$16/MT in a week. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$2,415/MT(plus taxes) which increased by US$31/MT within the week.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$3,400/MT(plus taxes) which increased by US$102/MT during the week. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$3,390/MT(plus taxes) which increases by US$78/MT in the week.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$3,280/MT(plus taxes) which is US$94/MT higher than the price in beginning of the week. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$3,290/MT(plus taxes) which increased by US$94/MT during the week.

201/2B: This week, the average price of 1.0*1240*C(mill edge) of Hongwang in the Wuxi market is US$1,390/MT(plus taxes) which rose US$16/MT in the weeek. Besides, the tax-inclusive average price of the Foshan market is US$1,410/MT(mill edge) which is US$24/MT higher that in the beginning of the week.

J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,335/MT(plus taxes) which increased by US$8/MT in the week. Besides, the tax-inclusive average price of the Foshan market is US$1,370/MT(mill edge) which increased by US$16/MT during the week.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,590/MT(plus tax), which increased by US$24/MT during the week. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,570/MT(plus taxes) which increased by US$31/MT in the week.

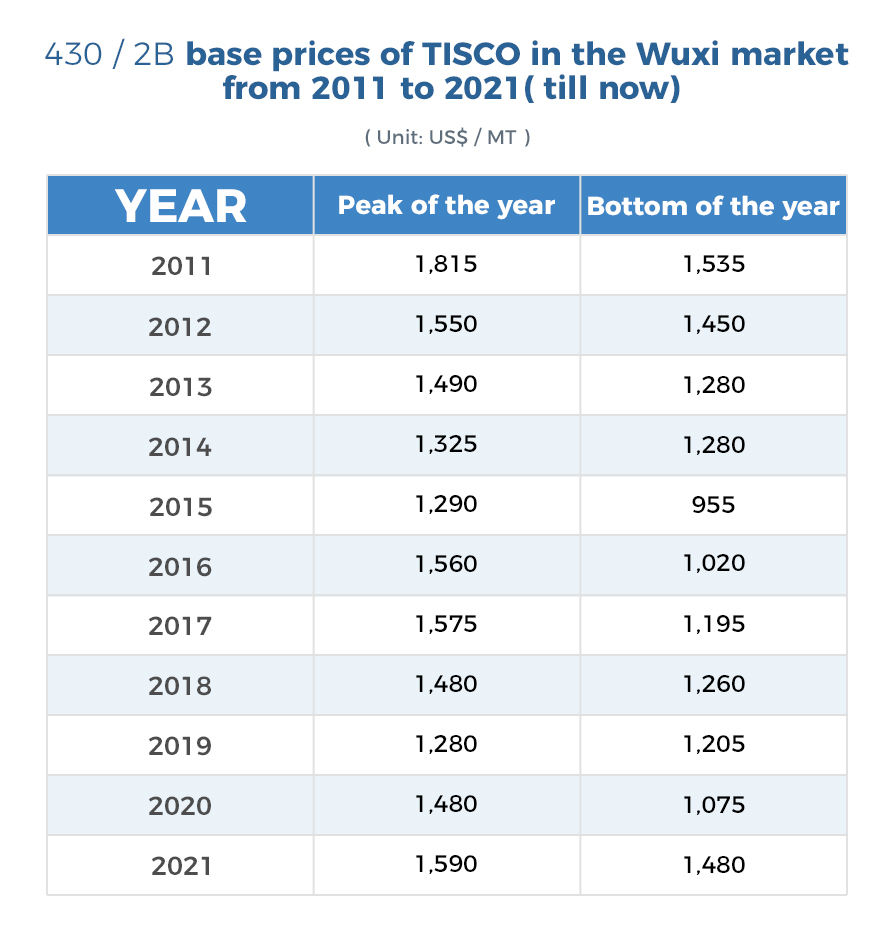

430 has increased by $588/MT. It is still rising.

The last Wednesday (24th Feb), the cold-rolling 430 of TISCO quoted US$1,585/MT of the opening price which increased by US$31/MT. JISCO followed suit, updated the opening price for the second time in the week, also quoting US$31/MT higher, maintaining the same price of TISCO, US$1,585/MT. Traders could no longer hold the price and began to increase the quotation to US$1,605/MT.

Based on the price of US$1,605/MT, in the table below, together, we take a throwback to the 10-year process of 430.

From the history, the highest price during the decade was back in 2011, which was US$1,815/MT. Also, for the contemporary price, US$1,605/MT, the last time it appeared was also ten years ago, in 2011.

As for the lowest price of the cold-rolling 430, in the recent ten years, it appeared in August 2015, when it was only US$955/MT.

So far, it is reasonable that people are panic about the high price. Moreover, the price of 430 has been increasing for consecutive 9 months. Compared to the US$1,075/MT last May, the price for now is US$1,605/MT, which is US$530/MT higher!

After the holiday, the price of stainless steel has been increasing. The reason is the rising raw material cost.

Market Forecast of March|| Orders full? Foreign trade superior?

After a week of continuous increase, steel mills have been back to work, but the downstream buyers have not taken action yet, so the enthusiasm for the hot rolling stainless steel faded and the price shows a downward trend. As February ended, how will the stainless steel price go in March?

Macroeconomy:

The FED continues to maintain a loose policy lately, but due to the recently released economic data which shows a positive tendency and the effective epidemic control, the market shows strong expectations for an earlier tightening capital budget; in China, to prevent the high inflation, it is of the high possibility of tight monetary policy this year. Most believe that, from a global view, the monetary policy will be tightened in the second quarter. Other views believe that the current global economy has not yet recovered fully from the pandemic and thus the monetary policy will remain loose.

Raw materials:

Influenced by the increasing freight and the continuous rainy season in the Philippines, plus that the downstream ferronickel plants are actively purchasing, the transaction price of nickel ore has risen sharply. The CIF price of nickel ore of 1.5% contradiction rose to US$80 /MT in the foreign stock, nickel ore of 1.8% contradiction price rose to over US$105 /MT. The sharp increase in the price of nickel ore will further boost the price of China’s ferronickel.

In China, with the “dual controls” policy (energy rationing in coal and electricity to improve the energy industry) taken in Inner Mongolia, the production of high chromium in Inner Mongolia has dropped sharply, which has also boosted the production in other high chromium producing areas. As we know, in addition to two production lines in Guizhou Province, in Guangxi Province, there are also has six production lines. At present, some production lines have been starting. The monthly output of high chromium will reach approximately 14,000 tons.

Some said, based on the recent purchase volume of a South China Steel Plant in late February, which reaches over 10 thousand tons with a transaction price of US$188/nickel, compared to the purchase price in January, it may push up the production cost of stainless steel by almost US$157/MT. It seems to be consistent with the price increase of 304 stainless steel.

Besides, although the high chromium production in other areas has been expanded, it still fails to meet up the reduction in Inner Mongolia. China’s ferrochromium supply cannot keep up with the tight stainless steel production schedule. The contradiction between supply and demand is tough.

Supply:

At the end of February, according to our database, in the Wuxi market, 200 series keeps arriving in the inventory, but 300 series is still decreasing, so the total amount of stainless steel inventory only increased by 600 tons.

Some said, now in the Wuxi market, the 300 series inventory remains low, and the recent price is high. Therefore, the downstream buyers are waiting to see what’s going to happen. For now, since the cost of steel mills is high and they manipulate the stock market, if there is more demand, there will be a higher price.

Demand:

A source from the steel mill said: “Currently, the order quantity is sufficient and the profit is considerable. Steel mills are ramping up production. The maintenance that has been delayed may be carried out in late March.”

Others also said: "This year, the loan from the bank has tightened, and funds and deposits of orders have been taken up in advance, which has led to less flexible capital, making traders more rational in buying and selling."

Foreign trade dealers said: "Foreign trade is better than domestic sales because foreign stainless steel supply is limited. For major Chinese foreign trade companies, the volume of foreign trade orders can be described as an explosion. Compared to previous years, the number of orders received during the same period has increased by 2-3 times. Notice, it's futures."

In summary, the profitable stock will lead to lower stainless steel prices in a short term, but with the high cost of raw material and the control of steel mills, stainless steel prices may still rise in March.

-------------------------------------------------------------------------------Stainless Steel Market Summary in China-------------------------------------------------------------------------------