304/2B: The average price of 2.0*1219*C (slit edge) of ZPSS in the Wuxi market is US$1,895/MT(plus taxes) which is US$3/MT higher than last week and the rising percentage is 0.14%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,935/MT(plus taxes) which is also US$3/MT higher than last week and the increasing percentage is 0.14%.

304/2B: The average price of 2.0*1219*C (slit edge) of Hongwang in the Wuxi market is US$1,810/MT(plus taxes) which is US$6/MT higher than last week and the rising percentage is 0.3%. Besides, the average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,820/MT(plus taxes) which is US$3/MT less than last week and the decreasing percentage is 0.15%.

304/No.1: The average price of 4.0*1520*C (mill edge) of ESS in the Wuxi market is US$1,745/MT(plus taxes) which decreased by US$3/MT compared with last week and the declining percentage is 0.18%. Furthermore, the average price of 4.0*1520*C(mill edge) in the Foshan market is US$1,770/MT(plus taxes) which is US$3/MT higher than last week and the increasing percentage is 0.15%.

316L/2B: This week, the average price of 2.0*1219*C of TISCO in the Wuxi market is US$2,645/MT(plus taxes) which dropped US$11/MT compared with last week and the decreasing percentage is 0.38%. Moreover, the average price of 2.0*1219*C(slit edge) of TISCO in the Foshan market is US$2,695/MT(plus taxes) which remains as last week.

316L/No.1: This week, the average price of 4.0*1500*C(mill edge) of ESS in the Wuxi market is US$2,440/MT(plus taxes) which is US$16/MT less than last week and the decreasing percentage is 0.61%. What's more, the average price of 4.0*1500*C(mill edge) in the Foshan market is US$2,475/MT(plus taxes) which is US$17/MT less than last week and the declining percentage is 0.65%.

201/2B: This week, the average price of 1.0*1219*C(mill edge) of Hongwang in the Wuxi market is US$1,045/MT(plus taxes) which is US$4/MT less than last week and the declining percentage is 0.41%. Besides, the tax-inclusive average price of the Foshan market is US$1,045/MT(mill edge) which decreases by US$4/MT compared to last week and the increasing percentage is 0.41%.

J2, J5/2B: The average price of 1.0*1219*C(mill edge) of the Wuxi market is US$1,000/MT(plus taxes) which is US$9/MT less than last week and the declining percentage is 0.85%. Besides, the tax-inclusive average price of the Foshan market is US$1,000/MT(mill edge) which decreases by US$14/MT compared with last week and the decreasing percentage is 1.34%.

430/2B: The average price of 2.0*1219*C(slit edge) of TISCO in the Wuxi market is US$1,030/MT(plus tax), which is US$68MT higher than last week and the rising percentage is 0.74%. The average price of 2.0*1219*C(slit edge) in the Foshan market is US$1,030/MT(plus taxes) which increased by US$2/MT and the rising percentage is 0.17%.

Stainless steel market in the first six months of 2020

Stainless steel stock

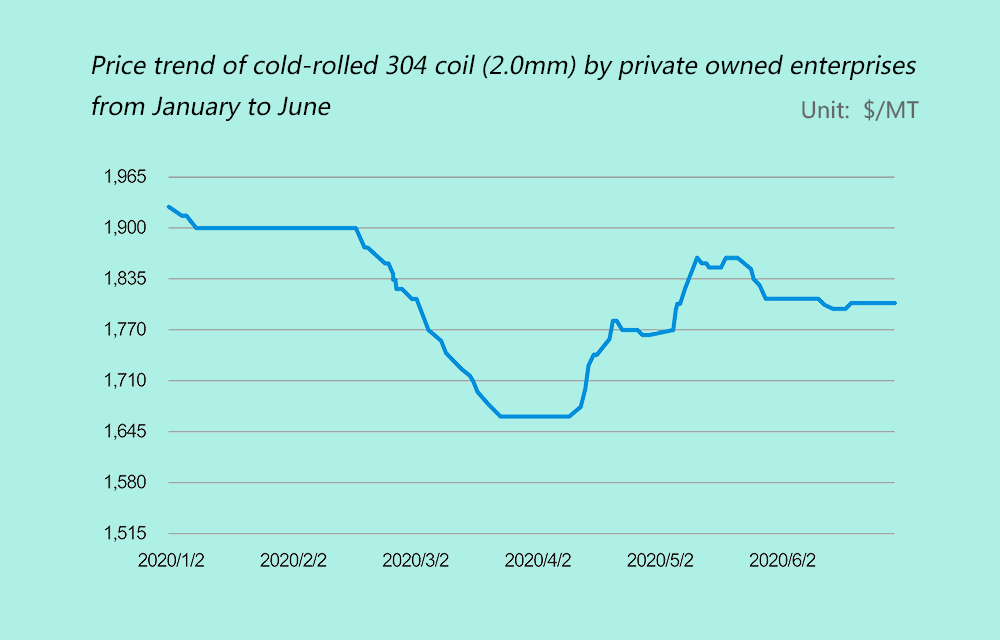

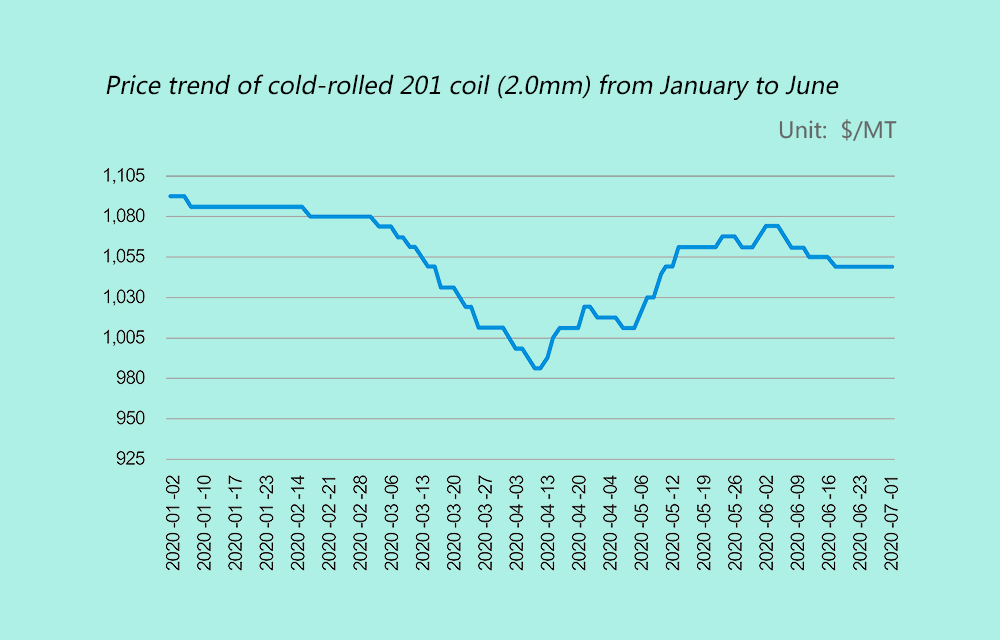

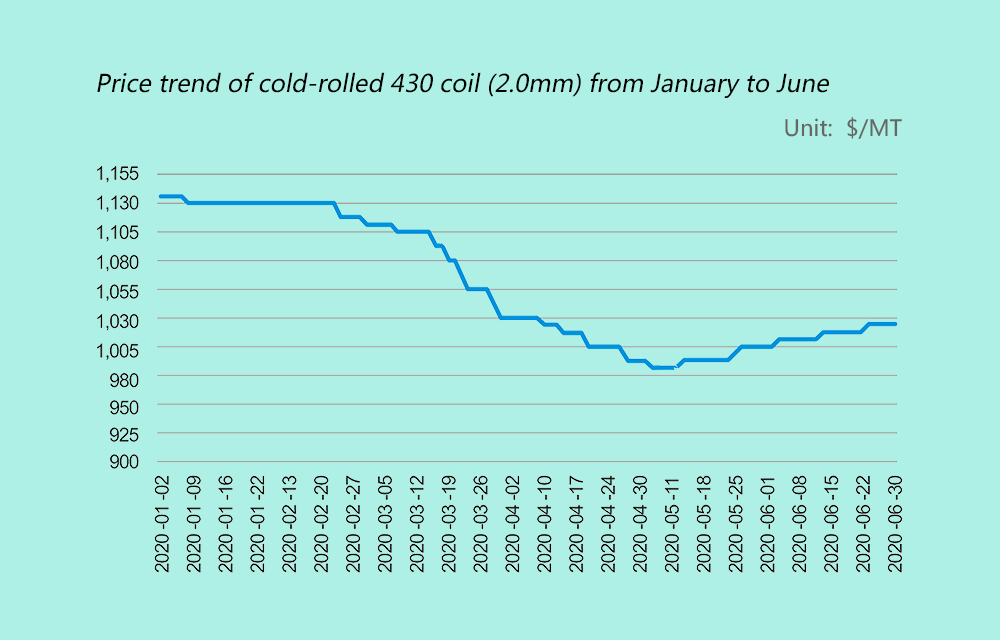

In the first half of the year, although there was a rebound halfway, compared with the beginning of the year, the price decreased. The price of the cold-rolled 304(2.0mm) of private-owned mills dropped from $1,925MT to $1,665/MT; the price of the cold-rolled 201(1.0mm) of Hongwang decreased from $1,095/MT at the beginning of 2020 to $985/MT; 430 price fell significantly from $1,140/MT to $985/MT.

The price trend of 201 is closed to the 304’s. After the lunar new year, the pandemic impeded the stainless steel sales, leading to the accumulation of the inventory in the market, and further, the price crumbled. The decrease lasted until April. Because the price of the bulk metal bounced back, which attracted a round of capital to buy at low, the stainless steel price turned to increase.

The 430 price did not increase until May. Compared with series 300 and series 200, the changing point of the 400 series price trend arrived later. When the mills began maintenance in May and the price of ferrochrome boosted, the price of 400 series stainless steel finally rose. The 430 price has dropped by $171/MT within this year. The price increases by only $57/MT for now. Among many varieties, 430 price rose weaker.

Raw materials

Domestic nickel ore price increased from ¥300/ton to ¥390/ton. The rise of nickel ore price compresses the profit margin of ferronickel. Many ferronickel enterprises who gained excessive profit a few years ago, all faced the edge of the balance of profit and loss within recent months.

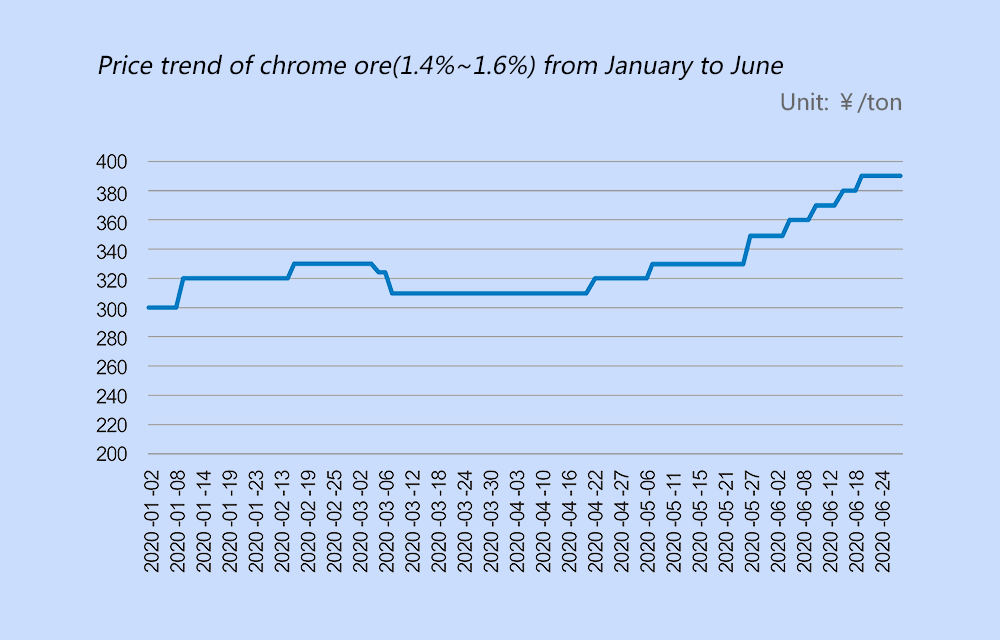

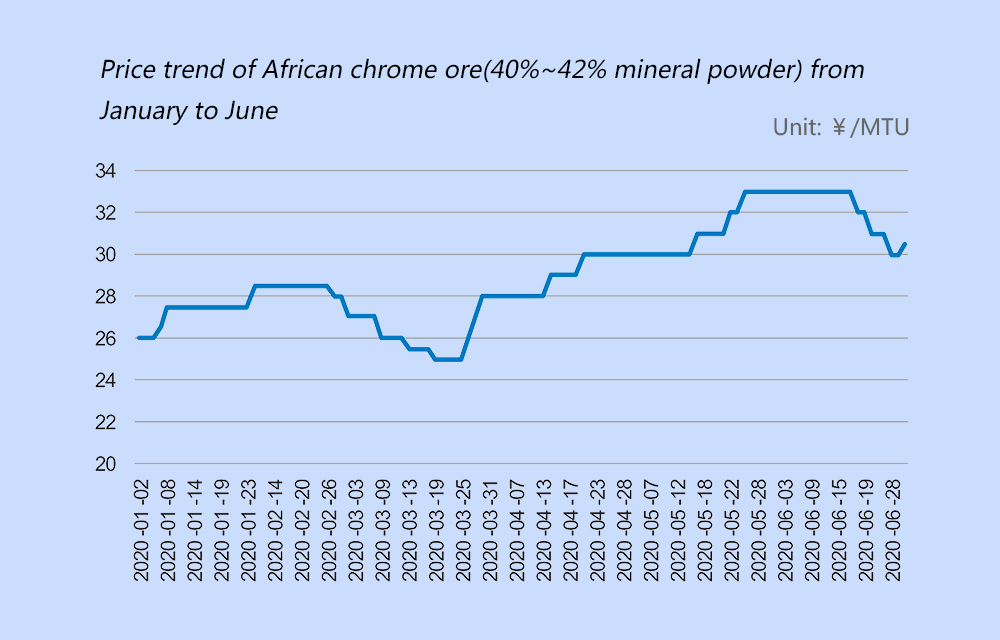

From the perspective of chrome ore, from January to June, the general price trend is on the rise with some fluctuations. After March, with the news of the lockdown of South Africa, the South African chrome ore price, starting at its lowest price of ¥25/MTU, bounced back to ¥33/MTU in June. With the reopening of South African export lately, the price begins to drop and affects the ferrochrome bidding price declining in July.

Industrial Data

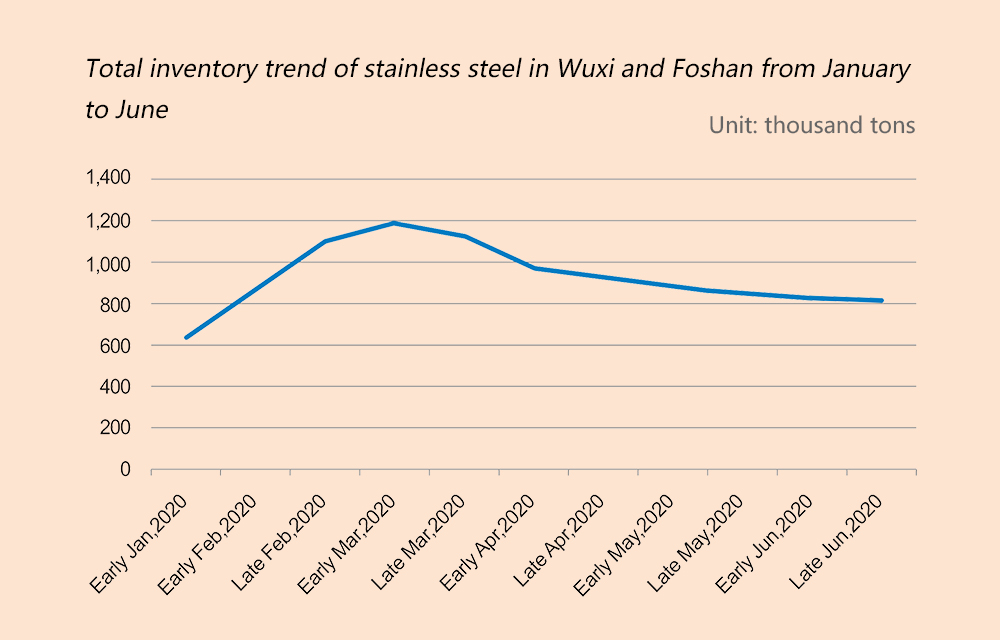

From the perspective of the stainless steel industry, the beginning event of 2020 has told that the challenge in stainless steel is never absent. The epidemic broke down all the production and sales plans. The whole stainless steel industry faced unprecedented difficulty. The production was kept online, but the sales postponed and even stopped. Sales stopped, and the inventory accumulated for a month. The inventory of the market and mills increased greatly. In the first season, the total inventory of the Wuxi + Foshan market increased by 50%.

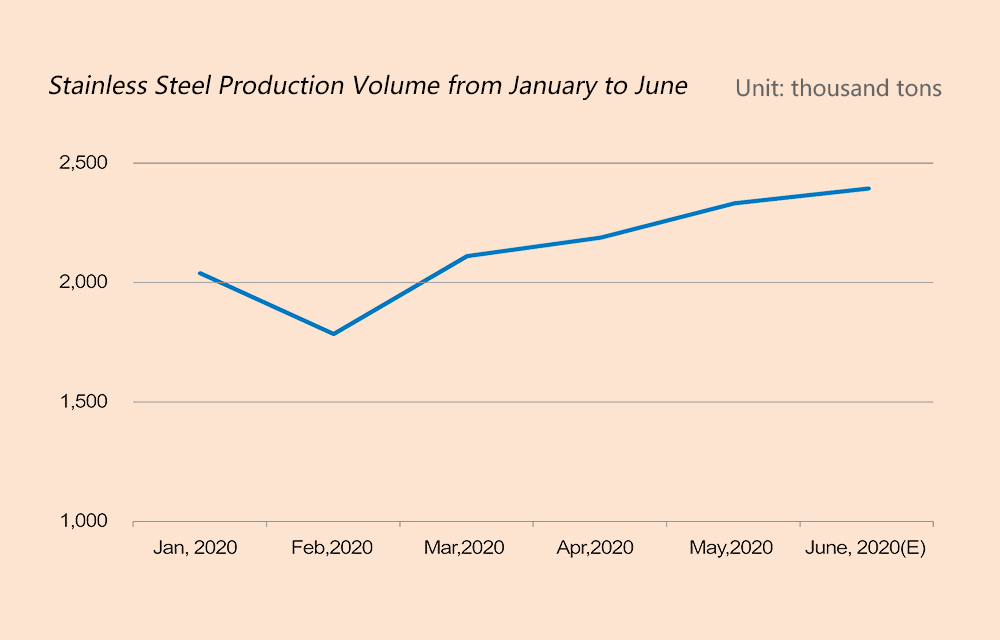

What makes people regain hope is that mills aligned to reduce production which maintains the stainless steel price getting back to normal. Form January to June, the stainless steel sheet production is 12,850 thousand tons, which decreases by 3% compared to the same period of 2019. From different varieties, the 300 series stainless steel coil production 5,980 thousand tons, which increases by 2% YoY; the production of series 200 is 4,640 thousand tons, which is 6% less than the same period of 2019; the production of 400 series decreased to 2,240 thousand tons and dropped by 6% YoY.

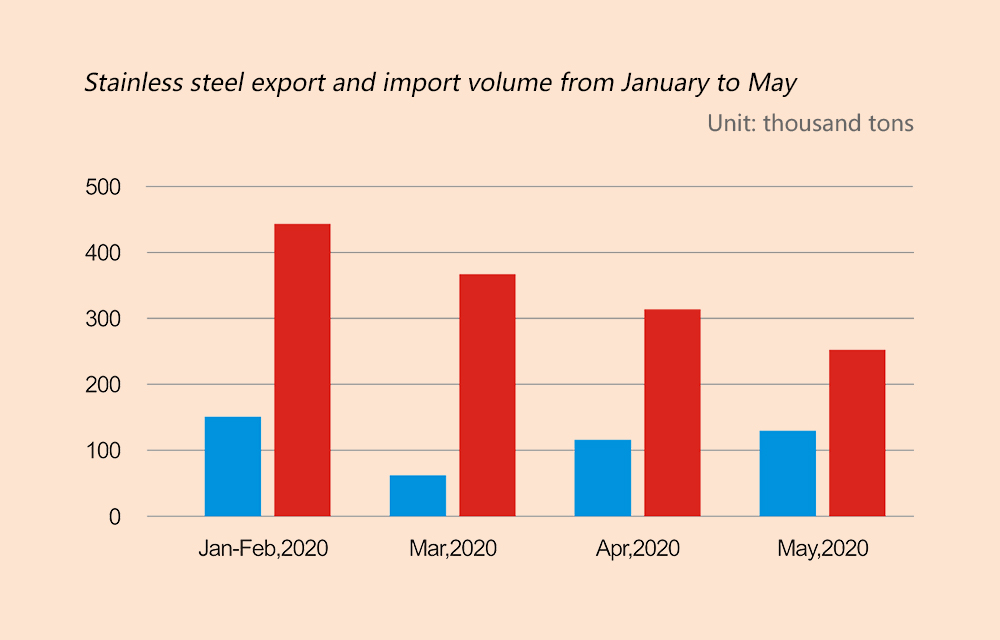

This year, the domestic sales of stainless steel improved after March. In April, May, and June, domestic consumption increase compared with last year. However, stainless steel export is the opposite. The epidemic outbreaks in many foreign countries, resulting in a decrease in stainless steel export. China’s stainless steel export of April decreased by 15% compared with last month; exporting volume in May knocked off 20% compared with April. To predict the situation in June, people believe that the export will get better because the epidemic situation in major foreign export areas is gradually easing.

------------------------------------------------------------------------------Stainless Steel Market Summary in China-------------------------------------------------------------------------------------