During the spring festival in January, some mills arranged investigation of maintenance and production. The supply for 300 series has dropped for 3 consecutive months. In February, the production of 300 series is probably the lowest in a year, which drops by 160 thousand tons and decreases to 883 thousand tons.

Affected by the coronavirus, logistics has been restricted. Moreover, the raw material has been in deficiency, and the inventory of mills increased, resulting in less productivity in some mills and the production plan was postponed, which will bring out 40 thousand tons less in the production of stainless steel flat crude steel in February.

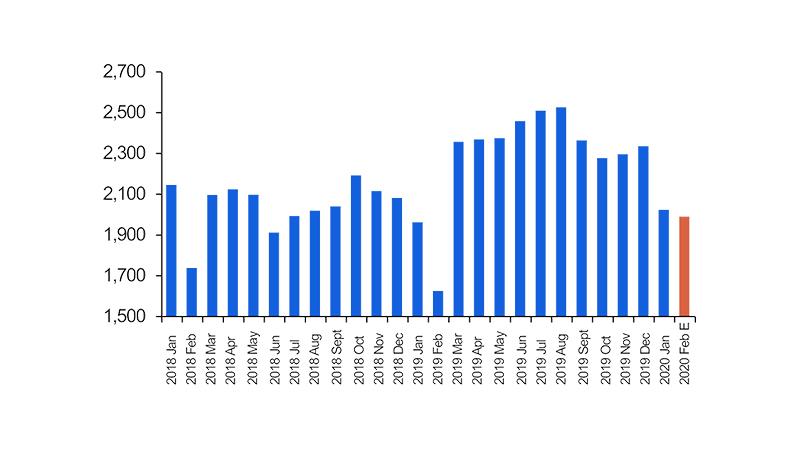

Another decreased production in February after decreasing by over 300 thousand tons of January production

In January, the production of stainless steel flat crude steel was 2,024 thousand tons which were 3,120 thousand tons less than last month and the declining percentage is 13.35%; it has decreased by 62 thousand tons year-on-year and the declining percentage is 3.2%. About wide coil producers, their production of crude steel was 1,797 thousand tons, which decreased by 106 thousand tons compared to last month and the decreasing percentage is 5.6%; year-on-year rose 228 thousand tons and the rising percentage was 14.5%. As for strip producers, the production of crude steel was about 227 thousand tons, which decreased 206 thousand tons month-on-month and the declining percentage is 47.6%, and year-on-year fell 166 thousand tons and the decreasing percentage is 42.2%.

The output of stainless steel flat crude steel (Unit: thousand tons)

In February, during the epidemic prevention and control, logistics has been in suspension and there needs some time to restart. Mills that were to reduce production during spring festival holidays delay return to work and some mills keep reducing production. Therefore, the production of stainless steel flat crude steel is predicted to be 40 thousand tons lower than last month, decrease by 2% and reach to 1,984 thousand tons; Year-on-year increase by 354 thousand tons and the increasing percentage is 21.7%.

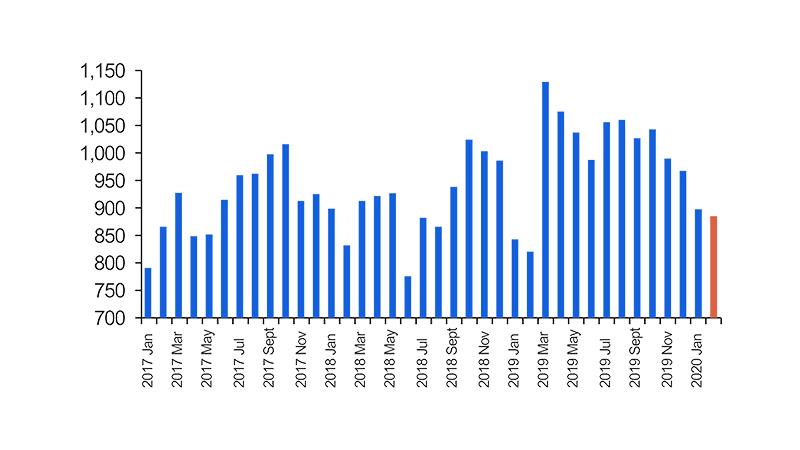

The supply for 300 series keeps falling, which may hit the lowest point in the year

During the spring festival holiday, Tsingshan, Chengde and other mills have been in maintenance, the production of 300 series stainless steel flat crude steel has been dropped for 3 consecutive months. In January, the production of 300 series flat crude steel was about 897 thousand tons, which is 69 thousand tons less than last month and the declining percentage is 71%, but compared to last January, it increased by 54 thousand tons and the rising percentage is 6.4%.

In February, some of the producers have delayed production after maintenance, so the output remains at a lower level, or it may break the bottom line of the year. It is predicted that in February, the output of 300 series stainless steel flat crude steel will follow the falling trend and decrease by 14 thousand tons and the decreasing percentage is 1.5%, drop to 883.6 thousand tons which has decreased by 160 thousand tons after falling for consecutive 4 months; it rises 63 thousand tons year-on-year and the rising percentage is 7.6%.

The output of 300 series stainless steel flat crude steel (Unit: thousand tons)

The output of 200 series strip steel decreased by 62.4%

In January, the production of 200 series stainless steel flat crude steel was 691 thousand tons, which dropped 211 thousand tons month-on-month and the dropping percentage is 23.4%; and year-on-year, it decreased by 41 thousand tons and the declining percentage was 5.6%. Due to the operation of more than 7 strip steel producers have been stopped and other mills in maintenance, the output of 200 series was 185.5 thousand tons less than last month and the declining percentage is 62.4%.

Epidemic prevents and control has been severe. The time for mills that stopped producing to restart is not determined. Some mills postpone their schedules. The output of 200 series stainless steel flat crude steel in February is predicted to be like that in January, which is around 689 thousand tons. It decreases by 2 thousand tons and the declining percentage is 0.3% compared to last month; compared to last year February, it increases by 219 thousand tons and the rising percentage is 46.6%.

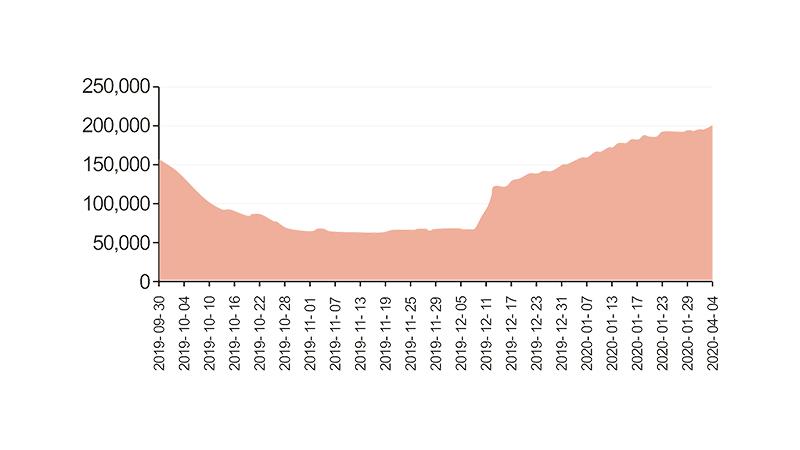

Opinions on Nickel|| Panic attack! The inventory increased by 200%

Recently, while the nickel price has fluctuated, the continuous growth of LME becomes the market focus. According to the London Metal Exchange, the inventory of London Nickel has increased by 4,086 tons and rose to 200,940 tons which is the peak of the year. Compared to mid-November, the lowest point is 64,176 tons which rebound to increase by 213%.

LME inventory (Unit: tons)

Opinions on Nickel|| Panic attack! The inventory increased by 200%

Why does the inventory keep rising? Some experts gave several reasons as below:

1.Because the new-energy vehicle industry gets back to normal, the needs for nickel has shrunk greatly.

Because of less subsidy for the new-energy vehicle industry in the last second half-year, precursor companies have significantly reduced their production schedules due to declining orders and reduced their purchase of raw material nickel sulfate. In June, battery-grade nickel sulfate companies have begun to report poor sales.

By the fourth quarter of last year, this phenomenon was even more pronounced. Especially in November and December, the production and sales of new energy vehicles fell sharply. According to data from the medium-term association, in November, the production and sales of new energy vehicles fell by 36.9% and 43.7% year-on-year respectively. In December, production and sales dropped by 30.3% and 27.4% year-on-year, respectively. Some agencies predict that due to the dual impact of the Spring Festival holiday and the outbreak in 2020, the scale of China's new energy vehicle production and sales in January 2020 is expected to decrease by 30% compared with the same period of the previous year.

The sharp decline in the production and sales of new energy vehicles has forced nickel sulfate companies to reduce their output, which has significantly reduced the purchase of pure nickel, the demand for nickel has shrunk significantly, and the LME exchange inventory pick-up has decreased.

2.Giant mills and some recessive inventory returned to the exchange.

In October last year, LME nickel inventories dropped sharply, falling by nearly 100,000 tons throughout the month. Many people said that their falling inventories were taken away by domestic giant steel mills, and some of the stocks have recently returned to the exchange.

Besides, due to the sharp decline in domestic demand, many manufacturers registered wealthy stocks on exchanges and the inflow of some hidden stocks in the market, which also increased the upward pressure on inventory.

Based on the current situation, most domestic enterprises are still in a shutdown state, the demand is still weak, and there is a possibility that the inventory will rise further.

-------------------------------------------------------------------------Stainless Steel Market Summary in China----------------------------------------------------------------------------------------