This is the last Stainless Steel Market Summary in China in the Lunar Year of 2021. We will return on Febuary 10th, 2022. Although most of steel mills have begun their holiday, it doesn't mean that the market is still. The market dynamics in recent days and during the holiday are extra important to the future price trends. Now, it is supposed to be a sluggish time to China's stainless steel market because most factories stop working. However, last week, influenced by the strong nickel price, the stianless steel futures rose significantly and lifted up the spot prices. Due to the growing electric car market and the prosperous stainless steel market, global demand for nickel will remain to increase in future years. Within China's market, because of the environmental inspection for Beijing Winter Olympics, people estimate that the stianless steel and its raw materials out put will reduce. Beyond the stianless steel market, according to REVIEW OF MARITIME TRANSPORT-2021, the sea freight will tend to rise in 2022. For more details and analysis, please keep reading.

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,050 |

38 |

1.34% |

|

Foshan |

3,095 |

38 |

1.32% |

||

|

Hongwang |

Wuxi |

2,950 |

40 |

1.43% |

|

|

Foshan |

2,920 |

43 |

1.57% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,965 |

81 |

2.95% |

|

Foshan |

2,915 |

52 |

1.92% |

||

|

316L/2B |

TISCO |

Wuxi |

4,405 |

52 |

1.23% |

|

Foshan |

4,405 |

64 |

1.52% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,275 |

69 |

1.71% |

|

Foshan |

4,340 |

87 |

2.13% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,860 |

16 |

0.93% |

|

Foshan |

1,830 |

9 |

0.51% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,765 |

17 |

1.08% |

|

Foshan |

1,740 |

6 |

0.37% |

||

|

430/2B |

TISCO |

Wuxi |

1,570 |

0 |

0 |

|

Foshan |

1,575 |

6 |

-0.22% |

Inventory and Prices|| Stainless steel prices increase and inventory drops.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| January 10th ~ January 14th | 28.9 | 263.0 | 80.1 | 372.0 |

| January 3rd ~ January 7th | 30.8 | 272.1 | 82.4 | 385.3 |

| Difference | -1.9 | -9.1 | -2.3 | -13.3 |

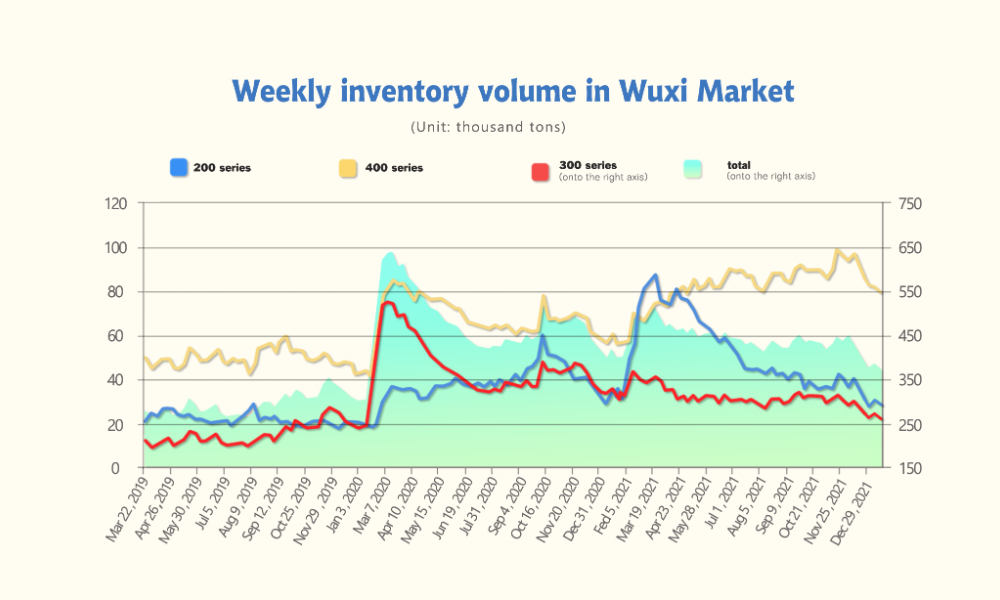

Last week, the total volume of the Wuxi sample warehouse decreases by 13,300 tons, to 372,000 tons. 200 series inventory cuts down by 1,900 tons, to 28,900 tons; 300 series decreases by 9,100 tons, to 263,000 tons; 400 series decreases by 2,300 tons to 80,100 tons.

200 series of stainless steel: Prices increase as some specifications are in shortage.

Last week, the prices of stainless steel 200 series were bullish. LME nickel and stainless steel futures both rose, bringing up the price of the stainless steel 304 spot. Influence by the increasing spot price, stainless steel 201 spot price followed suit.

Until January 14th, in Wuxi market, the base price of the cold-rolled stainless steel 201 increased by US$32/MT, to US$1,850/MT. As for the base price of cold-rolled stainless steel 201J2 rose by US$32/MT, quoting at US$1,755/MT; the hot-rolled 5-foot stainless steel price increased by US$32/MT, to US$1,755/MT.

The trade of stainless steel 201 performed well last week. The hot-rolled 5-foot stainless steel is still in short, so the price continued to increase for 4 days. Some transactions failed to complete due to the shortage, but some larger merchants who have large stock made substantial deals. The cold-rolled stainless steel transaction was hot as well. However, because the spring holiday is around the corner, buyers mostly are not interested in the increasing prices, so some orders are postponed after the holiday.

300 series of stainless steel: The high trading volume cuts down the inventory.

The price of stainless steel 304 remains the increasing trend. Until January 13th, the base price of the cold-rolled 4-foot mild-edge stainless steel 304 was quoted at US$2,955/MT, which is US$72/MT higher than two weeks ago. The hot-rolled stainless steel 304 even rose much. It rose by US$159/MT, to US$3,060/MT.

The inventory of stainless steel 300 series reduced much. The current inventory volume has now hit a low level in recent two years.

Last week, the nickel and stainless steel futures prices increased significantly. The nickel price of the Shanghai Futures Exchange breaks a new record high from its listing on the Exchange. The stainless steel futures price returned to above ¥18,000 (US$3,010), which boosted the stainless steel spot market. Earlier last week, the stainless steel futures started to rise and the spot market followed. Meanwhile, downstream buyers proactively stocked up and the trading volume increased. Once, some specifications of hot-rolled stainless steel 304 were in shortage. The spot prices continued to increase, but the transaction began to slow down.

Last month, a large steel mill in Northern China reduced the production of stainless steel 304, which reduced the resources in Wuxi market. Some products were sold on the way to the market. The inventory of stainless steel 304 returned to drop last week. Approaching the Spring Festival, the logistic system will soon take a break, which will stop sending and accepting. Therefore, it is predicted that the inventory volume after the holiday will remain as now.

400 series of stainless steel: The inventory continues to drop for 5 weeks, as the production reduces.

Last week, the price of stainless steel 430 was maintained. Until January 13th, the mainstream quotation of cold-rolled stainless steel 430 remained as two weeks ago, at US$1,580/MT. The trading price was around US$1,565/MT.

Because fewer new resources were sent to the market, the inventory of the 400 series continues to drop. At the same time, the trading volume increased as well. Thanks to the decreasing inventory volume, the pressure oven large stock were relieved a little bit.

Raw materials|| Tension logistic, and ore supply plus tax imposition boost the cost.

The Spring Festival is around the corner. The raw material costs of stainless steel are getting higher. The price of high chrome increased by US$48~US$64/50 base tons. The EXW price was US$1,340~US$1,356/50 base tons. The prices quoted by factories in Inner Mongolia increased the most because of the environmental inspection in Inner Mongolia.

The environmental inspection is getting stricter as the Winter Olympics is closer. As early as November, some factories in Inner Mongolia said that they will stop working from January 20th to February 20th. Though until now, there has been no official document about the production ban, people said that the environmental protection department takes strong measures to control the pollution. On the other hand, due to the pandemic in Tianjin Port has not finished, they can hardly transport the ores. If transportation continues to be blocked, many factories will face a raw material shortage. That’s why the price of high chrome is increasing.

Another major material of stainless steel, high nickel-iron increased in price as well. On January 13th, the EXW price increased by US$2/nickel to US$217/nickel. The price continues to rise because some trading price has risen to US$223/MT.

Except for the increasing nickel price that brings up the price of ferronickel, Indonesia also gives support to the increase. On January 12, Septian Hario Seto, Indonesia's Deputy Minister of Marine and Investment Affairs, said that the government may begin to impose export tariffs on ferronickel and nickel pig iron in 2022. Seto said that if the nickel price is above $15,000 per ton, a 2% tax will likely be levied, and the tax will increase as the nickel price increase. Besides, The Philippines is stuck in the pandemic. A source reported that the infection rate is as high as 50%, which appeals to high concern on the future nickel ore supply in the industry.

Based on the above factors, it is a high possibility that the raw material costs will remain to rise.

Forecast|| Key notes of REVIEW OF MARITIME TRANSPORT-2021

On November 18, the United Nations Conference on Trade and Development (UNCTAD) released the latest report REVIEW OF MARITIME TRANSPORT-2021, which analyzed and forecasted seaborne trade and global import prices.

The Review of Maritime Transport is an UNCTAD flagship report, published annually since 1968. It provides an analysis of structural and cyclical changes affecting seaborne trade, ports and shipping, as well as an extensive collection of statistics from maritime trade and transport.

1. The high transportation fee will push up the import cost.

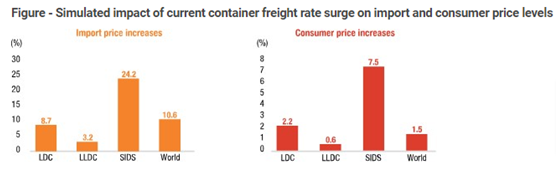

In its Review of Maritime Transport for 2021, United Nations Conference on Trade and Development (UNCTAD) said that the current surge in container freight rates, if sustained, could increase global import price levels by 11% and consumer price levels by 1.5% between now and 2023.

The impact of the high freight charges will be greater in small island developing states (SIDS), which could see import prices increase by 24% and consumer prices by 7.5%. In least developed countries (LDCs), consumer price levels could increase by 2.2%.

2. The transportation fee will remain high.

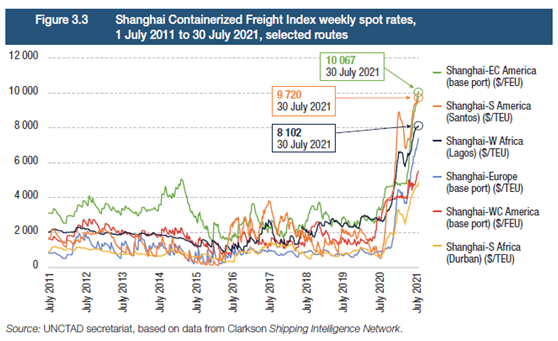

By the end of 2020, freight rates had surged to unexpected levels. This was reflected in the Shanghai Containerized Freight Index (SCFI) spot rate.

For example, SCFI spot rate on the Shanghai-Europe route was less than $1,000 per TEU in June 2020, jumped to about $4,000 per TEU by the end of 2020, and rose to $7,552 per TEU by the end of November 2021.

Furthermore, freight rates are expected to remain high due to continued strong demand combined with supply uncertainty and concerns about the efficiency of transport and ports.

According to the latest report from Sea-Intelligence, a Copenhagen-based maritime data and advisory company, ocean freight may take more than two years to return to normal levels.

3. Prices of some products will increase by more than 10%.

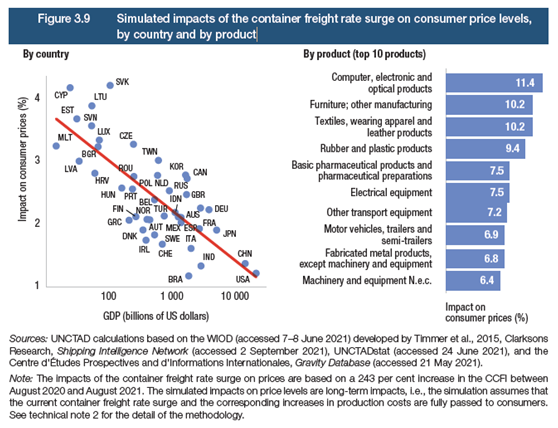

UNCTAD's analysis shows that higher freight rates have a greater impact on the consumer prices of some goods than others, notably those which are more highly integrated into global supply chains, such as computers, and electronic and optical products.

The high rates will also impact on low-value-added items such as furniture, textiles, clothing and leather products, whose production is often fragmented across low-wage economies well away from major consumer markets. The UNCTAD predicts consumer price increases of 10.2% on these.