TREND|| Risks cautious when the prices are increasing.

Recently, the stainless steel stock market is volatile and affects the spot market. OOS (out of stock) keeps heating up and the price of SS304 also goes all the way up. Under this trend, mills receive more forward contracts. While 200series has a small profit margin and 400series has weak demand, the gains of 300series stainless steel are as high as US$156/MT. Due to the high profit, steel mills turn their production more into 304.

201: Cost increases and inventory reduces.

Production cost: The prices of ferrochromium, electrolytic manganese and low-nickel iron have risen. Low-nickel iron rose from US$680/MT to US$742/MT; high-chromium iron returned to around US$1,250/MT. Therefore, the production costs of steel mills are still rising. At present, the production of steel mills is near the break even point. Mills’ production enthusiasm is low, and the investment is significantly reduced.

Inventory: Last week, the 200series in Wuxi market digested 3,300 tons of inventory, and the inventory volume fell to 55,200 tons. Although the new supplement of Baosteel Desheng and Beigang New Material have successively arrived last week, the quantity has decreased compared to last week. Besides, the 201 input of Tsingshan decreased in June. For now, the overall inventory pressure of 201 is released in Wuxi market.

As the profit of the 200 series continues to maintain at a low level, steel mills continue to reduce the production. According to market news, Guangqing will thoroughly switch to producing plain carbon steel at the end of June, which may last for two months. Supply pressure of 201 will be reduced, and it is expected to the market will maintain the destocking trend.

However, the demand is in the off-season, and both supply and demand are weak.

304: OOS becomes normality but the risk is hidden behind.

Raw Material: At present, nickel metal is lacking supply. Because stainless steel production increases in Indonesia and China, leaving a shortage in ferronickel.

Supply: In recent days, some steel mills are busy producing warehouse receipt products, some supplies to the downstream manufacturers, reducing the market circulation and some postpone the delivery. In the status quo, OOS becomes normality in the market. In the Wuxi market last week, inventory of the 300 series dropped by nearly 10,000 tons. The inventory of the 300 series now still remains at the low point during the year. It is not difficult to sell and even more, people expect the price to keep increasing and unwilling to sell.

Risk:

1. Lately, 304 spot market is greatly affected by the futures market. Because the futures’ price increase sharply during a short time, the price difference of spot and futures narrows down to US$109/MT. It is not good for the stock price to increase, otherwise, it will bring negative effects to the spot market. Sellers may sell-off, causing high pressure onto the market and forcing the price to decrease.

2. Although the price of ferronickel and ferrochrome is also rising, the profit of 300 series is over US$156/MT now, attracting the steel mills to reduce the production of 200 and 400 series to produce more products of 300 series. Baosteel Desheng Phase 2 begins producing. It is predicted that the new capacity can reach nearly 60,000 tons. When the new resource enters the market, the OOS will be released.

3. The warehouse receipts of the 2107 contract of a large domestic private steel mill have been prepared, and spot resources will be delivered to the market in the future.

400 series: The cost of high chromium rises and steel mills expect to boost the price.

Raw material: The legacy of the “shortage of electric power” is still influencing the high chrome production. Except for Inner Mongolia and Guangxi province, now Sichuan is also affected. Due to the rapid growth of electricity consumption, the government has begun to reduce the electricity load for enterprises’ production. Therefore, the production of high chromium has turned from increasing to declining. People expect that the output of high chromium in June will be less than 510,000 tons. Last week, the price of high chromium increased by US$16/50 base ton. In June, the price increases by US$94/MT. In a short period, the increase of high chromium won’t present in the price of 430, but steel mills will increase the stock price.

Supply: The maintenance of Jisco in June lasted for 20 days. About 25,000 tons of 400 series production was reduced, but the overall inventory of 400 series in the Wuxi market is increasing because of the demand decline. The export volume of 400 series in quarter one was surprisingly good, which overdraft overseas demand. With the increase in vaccinations in other countries, the epidemic got controlled. Stainless steel production abroad has gradually recovered. Besides, due to the uncertainty of the Chinese "export policy", the demand for the 400 series declines.

Summary:

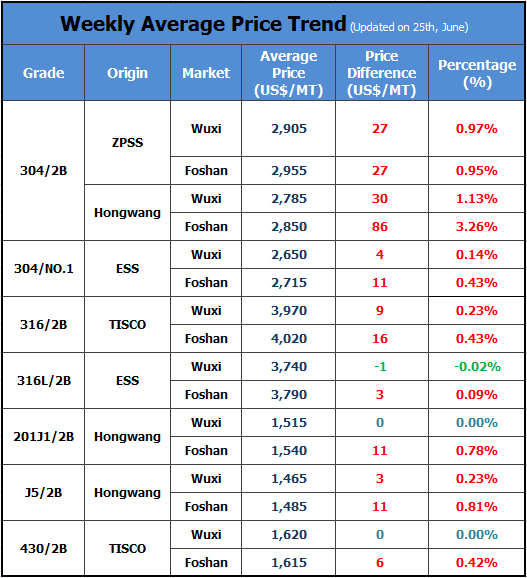

The inventory of the 200 series remains low, but demand affects the price. It is expected that the price of the 201J2 will remain at around US$1,470/MT. The price won’t fluctuat largely. The 300 series may still rise in the short term, but in later days, steel mills will increase their investment and the futures will ramp up. At present, the inventory of 400 series stainless steel is still high, which is supported by the high cost of ferrochrome. In addition, steel mills are unwilling to decrease prices, which has pulled up. The transaction price of 430/2B rose slightly, to around US$1,620~US$1,635/MT.

ANALYSIS|| 304 rises to US$2,950/MT, but it is still out of stock.

On June 24, 2021, LME nickel rose by US$365, reaching US$18,445/MT. The SS2108 contract rose by US¥32/MT and closed at US¥2,740/MT in the evening.

On the 25th, the increasing trend maintained. During the day, LME nickel hovered around US$2,755/MT, and the stainless steel futures 2108 contract got closed to US$2,750/MT in the afternoon. The spot price of stainless steel 304 continues to rise, and it was not far from US$2,950/MT (some thickness of products of Yongjin has been to US$2,690/MT). Therefore, the delivery of stainless steel 304 is getting slower and slower.

The OOS situation refers to the lacking of steel coil. Except for the increasing export and domestic demand, and the operations of steel mills, we analyzed other reasons that lead to this situation.

1.Production structure is changed in the steel mills. More steel sheets are produced, which squeezed the inventory volume of the coil.

Tsingshan starts his sheet business in 2020, and more agents of giant steel mills follow suit, On one hand, the production volume of sheets by Tsingshan and Beigang New Material is rising this year. On the other hand, there are many new sheet manufacturers appearing this year, such as the agent of Chengde, Foshan.

The expanse of sheet industry implies a larger inventory volume of sheet, which swifts part of the inventory of coil to sheet’s. As for the sheet resources, are further passed down to the next procedures such as surface processing. With more detailed classifications, what presents in the warehouses is that the coil is out of stock. Actually, it is because of the change of production structure.

2. The bad behaviors of steel mills disturb the market.

Some steel mills refuse to deliver products of low price or postpone the delivery time. To the downstream manufacturers, the delay greatly affects their production, forcing them to search for timely stock products. This is like a loop, seems like the demand was enlarged.

In recent fays, some sheet manufacturers who bought coils said that some steel mills’ agents demand to deliver sheet products to them or the delivery would be postponed.

“I ordered coil and am going to do the following procedures. There are employees in my factory that I have to earn a living. The sellers want us to become a sheet trader instead of a sheet manufacturer? When we signed, we signed for coils; when they deliver, it is sheets? Unbelievable!”—— A sheet manufacturer

“Delivery of coil is delayed. The rhythm of production is disturbed, forcing us to purchase temporarily. I have been in the sheet industry for more than 10 years, and I have never seen such chaos like this. The coil industry now is expansive into our client groups and we have to buy coils from them but they cheat on us. Because there are many people have to repeat purchasing due to the bad behavior of the coil sellers, the market seems like is out of stock.”—— A sheet enterprise.

3. Irrational production schedule of steel mills makes some specifications of products are extremely lacking.

In Foshan, a steel mill specialized in four-foot 304 stopped rolling production this year. Another major steel mill has been producing 201 for a long time. As a result, there is a shortage of 304 of different thicknesses, which has long been the pillar business of local steel mills.

However, because of different strategies, Tsingshan and Delong tend to maximize their production volume, which means that they do not cover many specifications. Typically, Delong has a smaller range of specifications. It makes some thicknesses of products lacking for a long time in the market, such as 0.92mm which is extremely expensive.

While sometimes some thicknesses of products spill over in the market but suddenly it turns to OOS. In the same production area, of different thicknesses, the price gap can go to US$80-US$90/MT.

4. More new traders enter the business.

Thanks to the positive development and larger profit of trading enterprises last year, this year, there are more new trading businesses entering the market.

Under global inflation and tightening property market, capital flows to the actual industries like the steel industry. The issue is that the pie is divided into smaller pieces and it will easily lack stock.

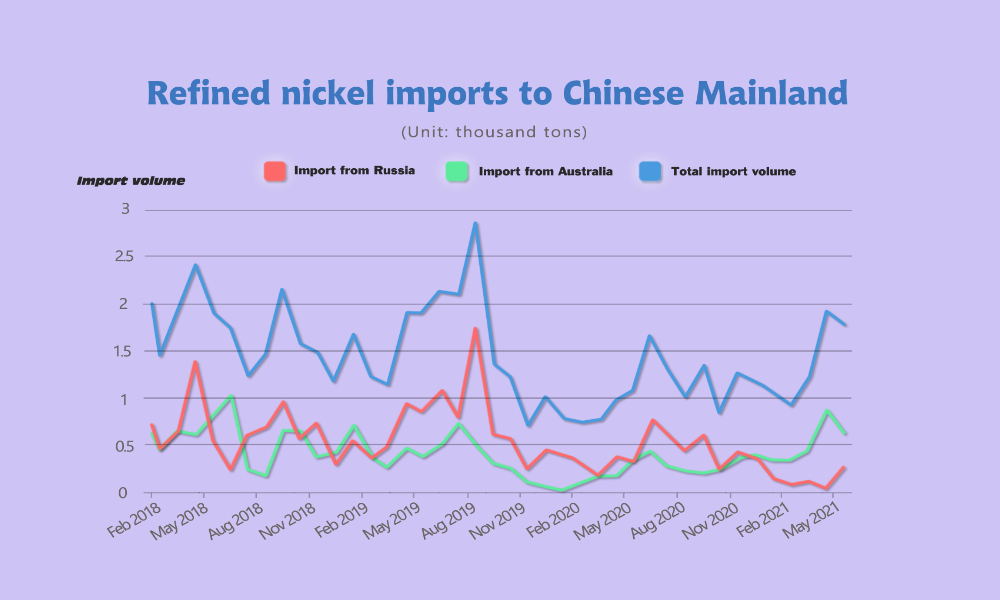

5. Russia will impose a US$2,321/MT tariff on nickel export. Chinese import of refined nickel will be greatly influenced.

On June 24th, the Russian Government announced the imposition on ferrous and non-ferrous metal export to countries out of EAEU. The prices of Russian metal products have kept increasing, so tax imposition is a temporary and lax measure to protect his domestic market.

About the policy, in detail, based on the average price of the past five months, the tax on copper is US$1,226/MT, nickel US%2,321/MT, and aluminum US$254/MT.

Nickel imported from Russia is mostly used in forging stainless steel and alloy in China. The tax imposition will affect Chinese imports. In 2020, China imported 130,700 tons of refined nickel, 40% was from Russia.

In May of 2021, the Chinese import volume of refined nickel is 18,000 tons which are 6.38% lower than April, but 66.54% higher than May of 2020. Imported from Russia is 2,700 tons, increased by 478.16% compared to April but decreased by 22.91% YoY. As for Australia, the import volume is 6,400 tons, reduced by 26.67% MoM but YoY increased by 79.11%. Influenced by China’s economic policy to Australia, the import from Australia reduced larger, and thereby the import from Russia rose significantly.

Because of the policy, LME nickel increased significantly.

On June 24th, LME nickel increased to US$18,550/MT, a new high lately.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China