What a dramatic and convulsive week. The US Election catches all eyes for sure. Last week, the stainless steel futures market fluctuated to drop and spot transactions were insufficient, spot prices followed to decline. The inventory stayed large, and although there is news that the production and supply to be reduced in July, the price remains gloomy. Sluggish demand and price pushed stainless steel to face profit loss again—— production cost is almost higher than the selling price in some grades of products. The only good news might be the shipping market is cooling down. The SCFI ended the continuous increases in the past 13 weeks, and last week, the index adjusted to down by 1.6%. Keep reading the Stainless Steel Market Summary in China, please rolling up.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,155 | 1 | 0.07% |

| Foshan | 2,195 | 1 | 0.07% | ||

| Hongwang | Wuxi | 2,055 | 8 | 0.43% | |

| Foshan | 2,060 | -4 | -0.21% | ||

| 304/NO.1 | ESS | Wuxi | 1,985 | 4 | 0.22% |

| Foshan | 1,985 | 4 | 0.22% | ||

| 316L/2B | TISCO | Wuxi | 3,670 | 8 | 0.24% |

| Foshan | 3,730 | 11 | 0.31% | ||

| 316L/NO.1 | ESS | Wuxi | 3,530 | 25 | 0.74% |

| Foshan | 3,530 | 22 | 0.66% | ||

| 201J1/2B | Hongwang | Wuxi | 1,365 | -3 | -0.22% |

| Foshan | 1,365 | -4 | -0.33% | ||

| J5/2B | Hongwang | Wuxi | 1,260 | -3 | -0.24% |

| Foshan | 1,265 | -4 | -0.36% | ||

| 430/2B | TISCO | Wuxi | 1,225 | -3 | -0.27% |

| Foshan | 1,225 | -6 | -0.50% |

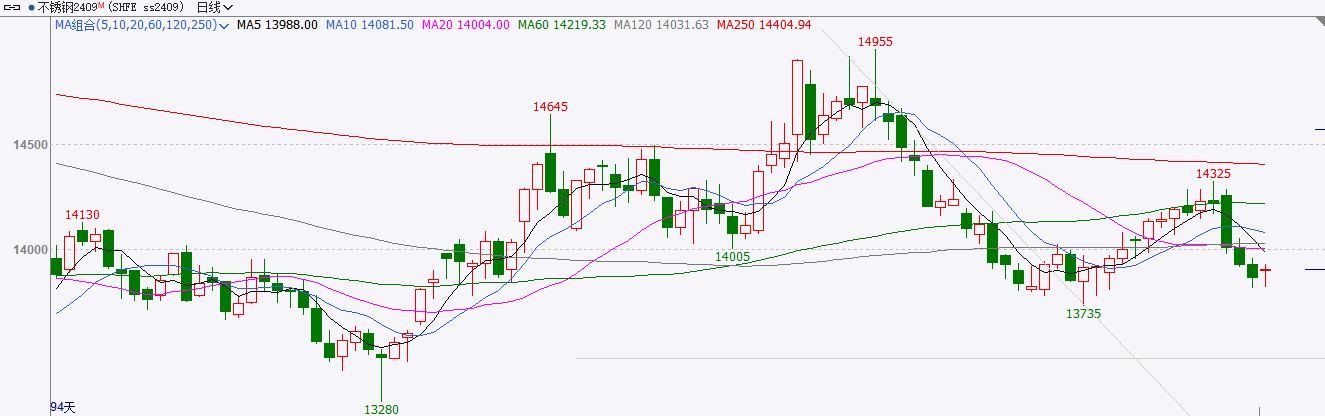

TREND|| Stainless Steel Prices Fall Weakly, Market Trading Sluggish.

Stainless steel prices have been running weakly last week, futures prices have fallen back to previous lows, spot prices have also been adjusted down accordingly, the effect of traders' concessions and promotions is not good, social inventory continues to decline, and steel mills are expected to cut production in July, which may bring pressure on arrivals in the later stages. In the future, it is necessary to pay close attention to the pace of steel mill production and arrivals, the strength of domestic macroeconomic policy stimulus, and it is expected that stainless steel will fluctuate in the later market. The main stainless steel futures contract closed at US$2050/MT last week, down 2.28% for the week, and the lowest price in the week was US$2040/MT. In the spot market, stainless steel spot prices have fallen slightly. Affected by the sharp drop in stainless steel futures last week, spot prices have also been running weakly. At present, downstream consumer demand is still weak, and market procurement is also cautious.

300 Series: Supply Shrinks, Inventory Destocking Slightly.

The price of 304 remained stable last week. As of Friday, the mainstream base price of cold-rolled four feet 304 in Wuxi was US$2010-US$2015/MT, which was the same as last Friday; the price of hot-rolled stainless steel was US$1980/MT, down US$7/MT from last Friday. Last week, the market rushed high and fell back, and the lowest price fluctuated in the range of US$2035/MT-US$2065/MT. The rise of Tsingshan's opening price at the beginning of the week improved the market atmosphere, traders raised their prices, and the enthusiasm of downstream buyers to enter the market warmed up, and the intraday trading was hot. On Tuesday, the futures prices plummeted significantly, and the prices continued to fall throughout the week. Coupled with the further decline in Tsingshan's opening price, the spot prices fell back according to the market. The market sentiment returned to caution, and transactions gradually fell back. Steel mills arrived less last week, and the trading performance was acceptable. Inventory destocked slightly.

200 Series: Inventory Accumulation Continues.

The mainstream base price of cold-rolled 201J1 in the Wuxi market was US$1330/MT, and the mainstream base price of cold-rolled J2/J5 was US$1225/MT; the mainstream base price of five-foot hot-rolled 201J1 was US$1300/MT. Most of the raw materials fell last week, and the non-ferrous metals sector fluctuated downward under the influence of the macro economy. The price of copper in the raw materials fell back continuously, and the price of manganese fell by US$14/MT on Thursday, which weakened the cost support for 201, and the spot price fell again month-on-month.

400 Series: What Should the Price Do with High Inventory and Output?

The guide price of TISCO cold-rolled 430 last week is US$1450/MT, and the guide price of JISCO cold-rolled 430 was US$1600/MT, which is the same as the quotation of last week. For spot goods in the Wuxi market, the price of state-owned cold-rolled stainless steel 430 was between US$1225 and US$1230/MT, down US$2.7/MT from last week; the price of state-owned hot-rolled stainless steel 430 remains stable at around US$1125/MT, which is the same as the quotation of last week.

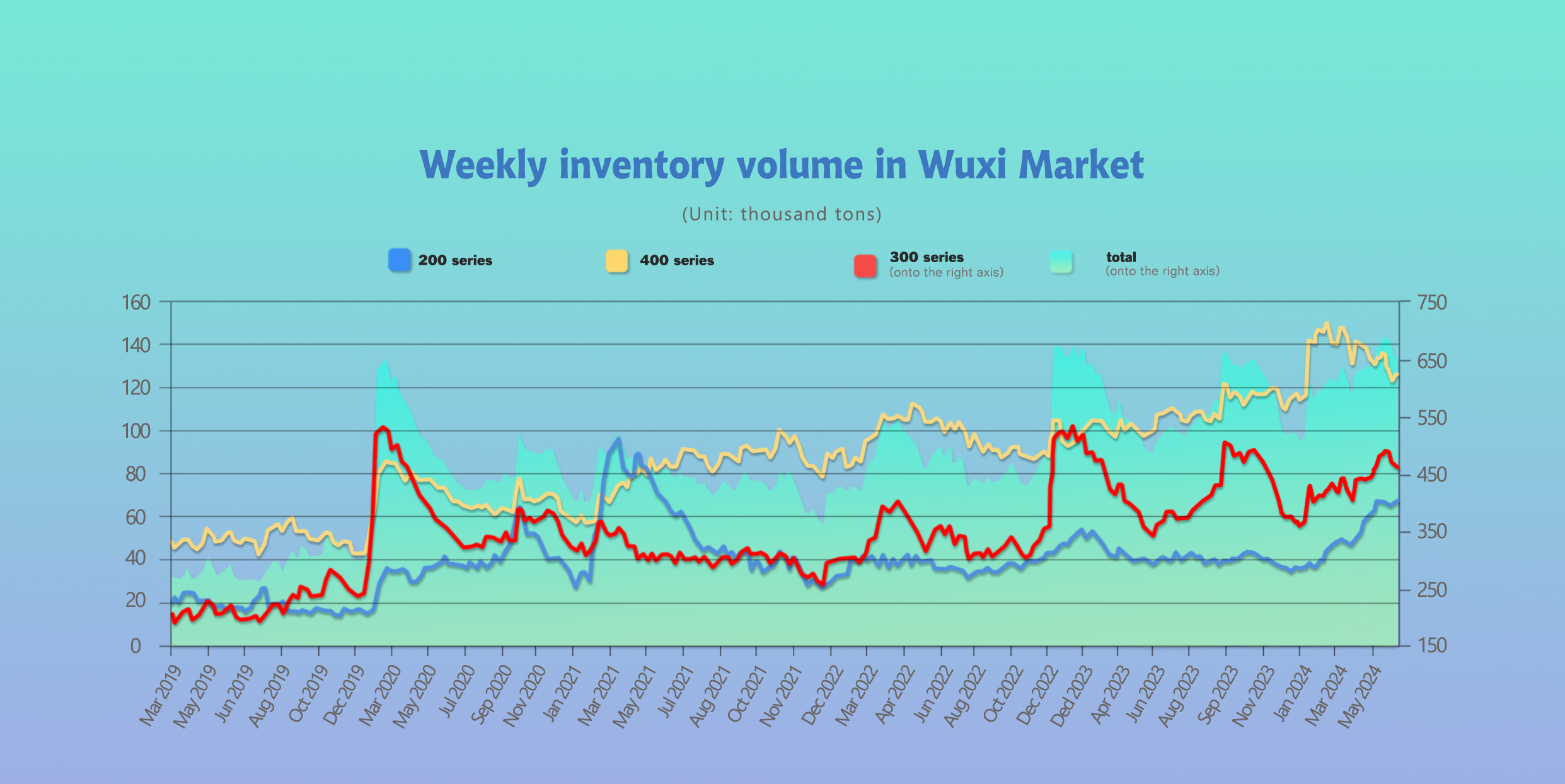

INVENTORY|| Dual High-Pressure Production & Stock Accumulation of Stainless Steel.

The total inventory at the Wuxi sample warehouse downed by 2,715 tons to 651,896 tons (as of 11th July).

the breakdown is as followed:

200 series: 1,325 tons up to 66,788 tons,

300 Series: 7,403 tons down to 459,308 tons,

400 series: 3,363 tons up to 114,472 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jul 4th | 65,463 | 466,711 | 122,437 | 654,611 |

| Jul 11th | 66,788 | 459,308 | 125,800 | 651,896 |

| Difference | 1,325 | -7,403 | 3,363 | -2,715 |

300 Series: Warrant Accumulation, Inventory Decrease.

During this inventory cycle, the main futures prices dropped significantly, and spot prices followed suit slightly. The production of the 300-series in June declined significantly, market arrivals decreased, and the increase in warrants led to a reduction in circulating resources, easing supply pressure. Prices spiked and then retreated, market sentiment cooled, and terminal purchase intentions declined. However, positive macro policies, economic recovery, and strong expectations for the "Golden September and Silver October" period still provide some market support, resulting in a slight inventory reduction. Warrant levels are still on an upward trend year-on-year, but the growth rate is gradually narrowing, and market confidence is slowly recovering. Based on current raw material prices, steel mills are still in a loss-making state. Production has slightly increased, demand has improved but remains mainly just-in-time, and next week's inventory is expected to increase slightly. Continued attention will be paid to steel mill production and market transaction conditions.

200 Series: Continuous Inventory Accumulation of 201.

July production saw a slight increase, and steel mills received normal deliveries. The guide prices of Tsingshan and Hongwang decreased, and agents followed suit, with the mainstream market price for 201J2 cold-rolled remaining at US$1225-US$1240/MT.

Market sentiment is pessimistic, traders are cautious about stocking, and consumer buying enthusiasm is low, resulting in an overall subdued trading atmosphere. The continued decline in copper prices last week weakened the support for 201 production costs. It is expected that 201 spot prices will remain stable to weak in the short term, with no significant improvement in the supply-demand structure, and inventories may continue to accumulate slightly. Future attention will focus on steel mill movements and market transaction conditions.

400 Series: Inventory Shifts from Decrease to Increase.

During this inventory cycle, steel mill resources arrived as normal, and downstream transactions were mainly just-in-time and low-cost resources, with no significant improvement in speculative demand. Inventory digestion in the spot market was relatively slow. July steel mill production increased, and overall output remained high, making it difficult to change the supply-demand imbalance in the short term. Inventory is expected to continue to increase next week, with a focus on market transactions and steel mill arrivals.

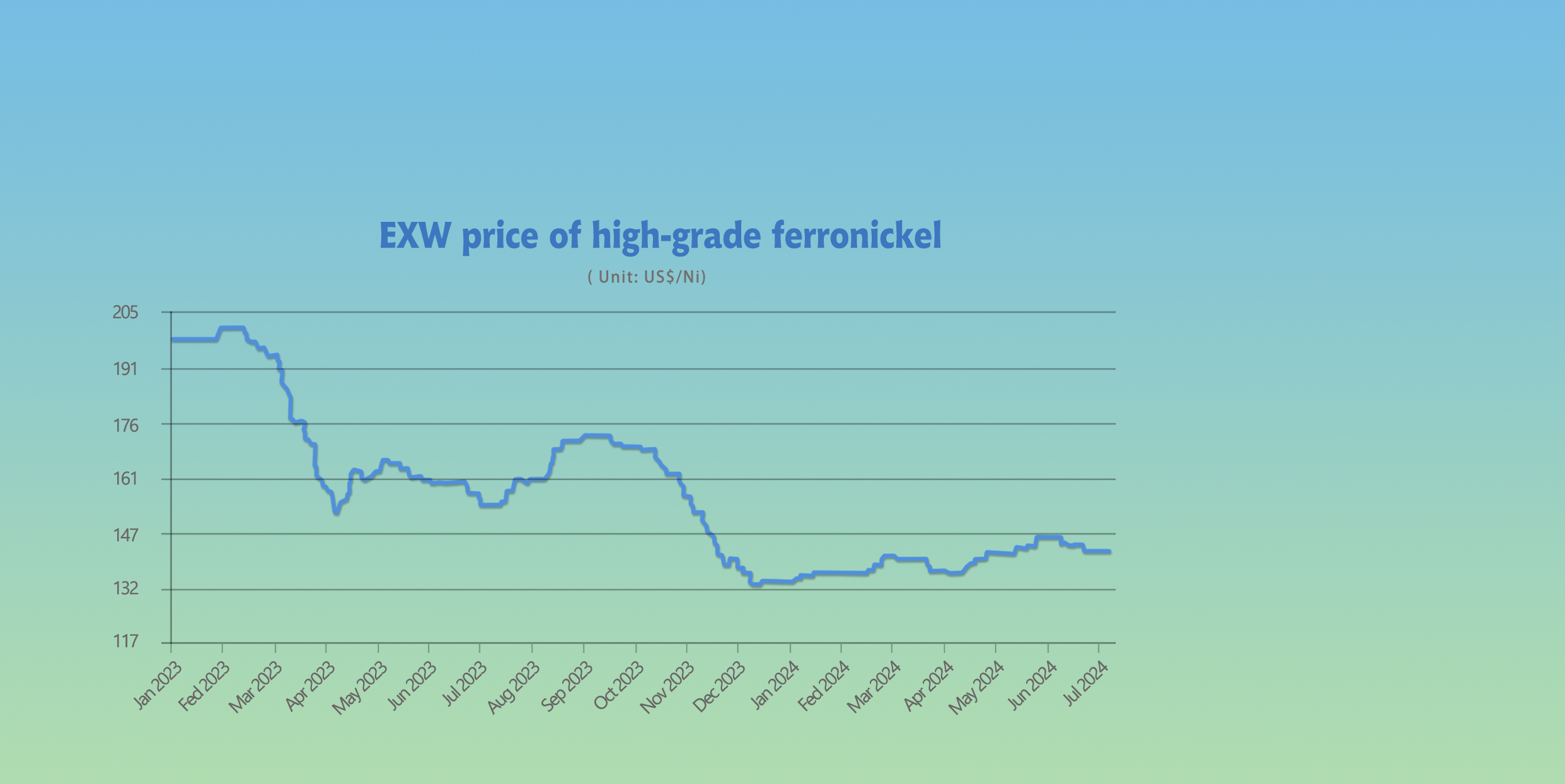

RAW MATERIALS|| Stainless Steel Faces Cost Inversion Again.

Nickel: Nickel ore prices remain firm, ferronickel continues to stabilize.

Last week, the EXW price of high-carbon ferronickel remained stable, reported at US$135/nickel point as of Thursday, unchanged from previous Thursday. Last week, SHFE nickel dropped significantly, giving back all of last week’s gains. By the close on Thursday, the main contract for Shanghai nickel settled at US$18,835/MT, down US$519/MT from last Thursday, a decrease of 2.72%. There were no reports of major steel mills making purchases last week, and combined with falling stainless steel prices and inverted production costs at the mills, as well as the impact of weather, the high-carbon ferronickel market saw light trading. Nickel ore supply remains tight, with premiums staying high. There were reports of high-carbon ferronickel stockpiling, with some domestic iron plants receiving notifications to report their inventories, but the quantity and price of this round of stockpiling have not yet been determined. In recent years, high-carbon ferronickel stockpiling has been frequent, with similar operations occurring in July and November 2023, and April 2024, but the actual stockpiling quantities were relatively limited compared to reported amounts. It is expected that high-carbon ferronickel prices will remain stable to slightly weak.

Chromium: High costs and poor demand make price fluctuations difficult.

With recent declines in high-carbon ferrochrome prices, high-carbon ferrochrome producers are being pushed to the edge of profitability. Since July, some producers have started maintenance, reducing demand for chrome ore, and weakening price support. Last week, the prices of some varieties in the chrome ore spot market saw slight declines. The price of the main variety, 40-42% South African ore, fell slightly to around US$8.5/MT, while the mainstream price of 40-42% Turkish lump ore remained stable at US$10.4/MT, unchanged from last weekend.

According to industry feedback, most varieties of chrome ore have not experienced significant price drops, and the decline in chrome ore prices is relatively smaller compared to the drop in high-carbon ferrochrome prices. Thus, for high-carbon ferrochrome production costs, this reduction is minimal, and most producers still face losses.

From the supply side, high-carbon ferrochrome production in May and June remained above 800,000 tons, and although there might be a slight decline in July, there has not yet been a large-scale reduction in the main production areas, and market supply remains high.

From the demand side, the recent slump in the downstream stainless-steel market has affected the raw material market. Currently, transactions in the high-carbon ferrochrome market remain sluggish, with weak price support, and high costs discourage low-priced sales by producers. As a result, high-carbon ferrochrome prices are expected to remain stable to slightly weak in the short term.

SUMMARY|| Futures Market Trends Significantly Affect Spot Market Confidence.

Last week, nickel stainless steel futures prices fell sharply. The poor performance of the futures market, combined with Tsingshan Steel's reduction in 304 futures prices, resulted in weak volume and prices in the spot market. Although there were reports of national reserves again storing nickel pig iron, the impact on the nickel pig iron market was limited given current supply and market prices.

300 Series: Reduced supply and decreased deliveries from steel mills have facilitated inventory reduction, boosting market confidence and driving spot prices up. However, July production schedules remain high, indicating continued supply pressure in the future. It is expected that 304 spot prices will fluctuate in the short term, with attention to market transactions and inventory consumption.

200 Series: Continuous weakening of futures prices during the week negatively affected market trading sentiment. Traders were cautious about stocking up, and downstream customer purchasing enthusiasm was low. Market inventory consumption was slow, and steel mill production continued to grow slightly, maintaining supply pressure. The ongoing tug-of-war between supply and demand is putting pressure on 201 prices. In the short term, 201J1 prices are expected to range around US$1320/MT to US$1365/MT, while 201J2 prices will fluctuate between US$1225/MT to US$1265/MT.

400 Series: Although steel mill production schedules slightly declined in July, overall output remained high, making it difficult to change the market situation of supply exceeding demand in the short term. The upward potential for 430 stainless steel prices is limited, and it is expected that 430 prices will remain stable and weak in the short term.

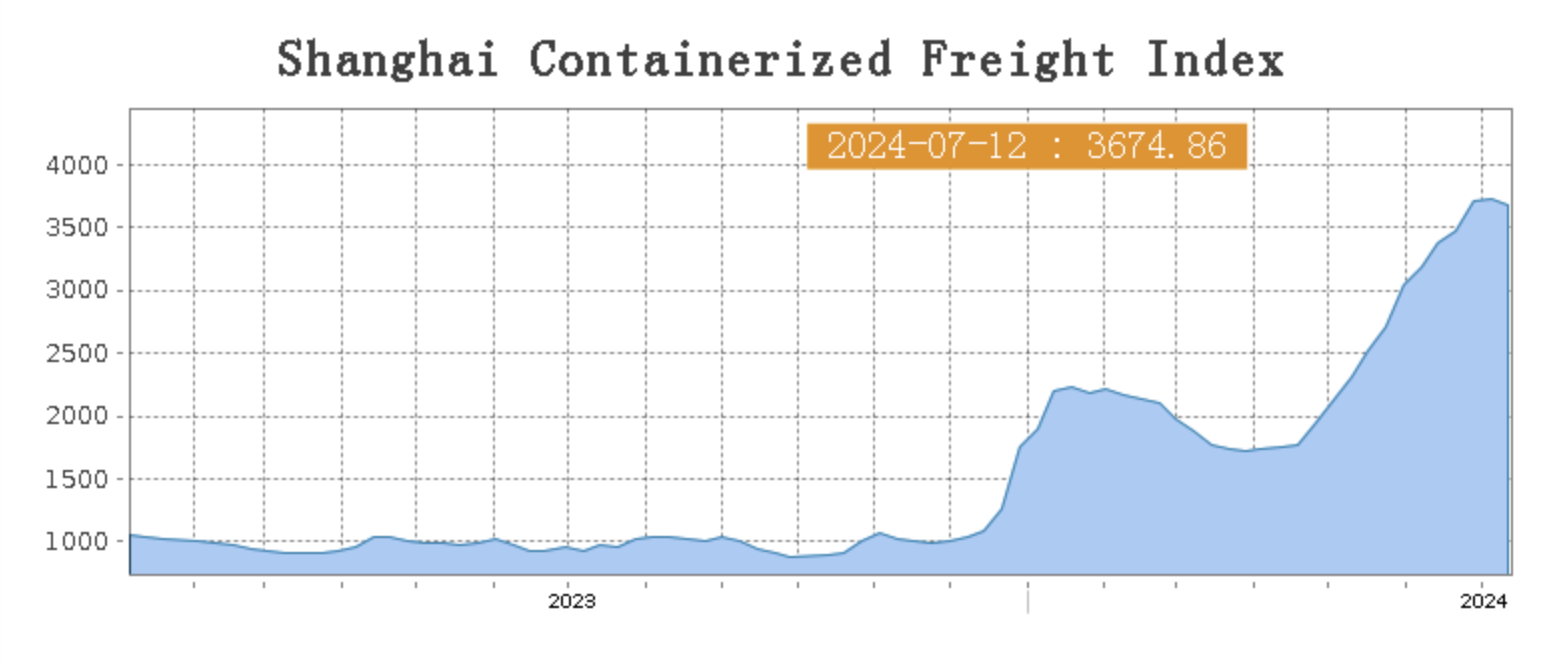

Sea Freight|| Overall Correction in Shipping Market, Diversified Trends in Ocean Routes.

Last week, the overall market trend of China's export container transportation has fallen back. The trends of ocean routes have diverged due to the differences in their respective supply and demand fundamentals, and the comprehensive index has fallen slightly.

According to the latest data released by the General Administration of Customs, in terms of US dollars, China's exports in June 2024 increased by 8.6% year-on-year, and the growth rate accelerated further. In the first half of the year, the scale of China's imports and exports exceeded 2.916 US dollar for the first time in the same period in history, and the momentum of foreign trade has been further consolidated. On 12th July, the Shanghai Containerized Freight Index dropped by 2.9% to 3674.86.

Europe/ Mediterranean:

In the recent period, the market trend has faced various tests due to the EU's policy on exporting electric vehicles from China. Freight rates in the market have risen slightly last week, but the increase is lower than the announced increase by some shipping companies in the previous period.

On 12th July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$5051/TEU, which rose by 4.0%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$5424/TEU, which decreased by 0.1%.

North America:

According to data released by the General Administration of Customs, China's exports to the United States in the first half of the year were 237.5 billion US dollar, a year-on-year increase of 4.7%, and the trade surplus with the United States was US$158.33 billion, an expansion of 8.4%. The overall China-US trade maintained a stable and upward trend. Last week, the support for transportation demand was insufficient, and the market freight rates showed an adjustment trend.

On 12th July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$7654/FEU and US$9881/FEU, reporting a 5.5% and 0.6% slide accordingly.

The Persian Gulf and the Red Sea:

On 12th July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 6.7% from last week's posted US$2273/TEU.

Australia/ New Zealand:

On 12th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1404/TEU, a 2.1% growth from the previous week.

South America:

On 12th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$8760/TEU, an 2.9% down from the previous week.