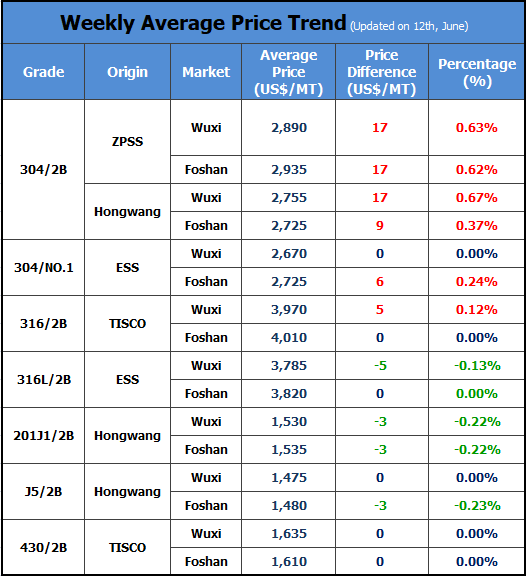

TREND|| SS304 increases by more than US$158/MT.

Both stainless steel futures and spot are increasing. Contract 2107 of stainless steel futures increased by US$166/MT in a week and the price of spot followed suit. Will this trend remain to this week?

304: Futures decreases by US$63/MT after the holiday.

People mostly estimated the price would continue rising, but it shows that the transaction fails to keep up, and people have to reduce the price by US$8/MT.

On the first trading day after the holiday, the bulk commodities all declined. LME Nickel fell by more than US$600 on 15th June, and the major stainless steel futures contracts also fell. Until noon, the closing price of contract 2107 fell by US$20/MT to US$2,690/MT, contract 2108 fell by US$28/MT to US$2,650/MT. Compared to the previous closing prices before the holiday and current price, the decline of the futures is as high as US$63/MT and US$72/MT respectively.

As for the cold-rolling products, in the afternoon (15th June), Chengde, Hongwang, and Delong quoted US$2,755/MT on the 4-feel mill-edge material and US$2,835/MT in 2.0 slit. If the transaction is settled, a discount of US$8/MT can be provided; Yongjin quoted US$2,805/MT on 4-feet mill-edge product, and US$2,880/MT on 2.0 slit; as for the 5-feet hot-rolling mill-edge 304 is quoted at US$2,690/MT.

Because buyers hold a view that the price will decrease, the transaction volume shrinks compared to the past days.

201: Inventory is being consumed, so the price will probably increase.

From the perspective of raw materials, last week, high carbon ferronickel increased by US$32/MT, electrolytic manganese rose by US$47/MT; low nickel-iron increased by US$63/MT compared to the beginning of the month. With these raw materials increasing, the production cost will keep ascending.

As for the inventory, during the first half of June, the inventory of 200 series in Wuxi and Foshan market both reduced. Compared to May, the total inventory dropped to 235,600 tons, 16,900 tons lower. In Wuxi market, it decreased by 5,200 tons, reaching 57,600 tons; in Foshan market, it dropped to 178,000 tons which is 16,900 tons less. If this circumstance lasts, the low inventory volume will support the spot price to increase or at least, remain.

From the supply side, in May, the domestic crude steel production volume of 200-series flat steel is 952,000 tons. Based on our data, in June, the volume will cut down 80,000 tons and lower to 872,000 tons. However, considering the actual producing process, the reduction of production might be less than the estimated volume.

400 series: Increasing high chrome cost coexists with large inventory.

Raw materials: In May, the total production of high chrome is around 528,800 tons. Since June, because of the lack of electric power, the high chrome production was reduced. Power-oriented enterprises in Guangxi and Inner Mongolia have to reduce the power usage, resulting in the lower high chrome production and further boost the high carbon ferrochrome to increase. During last week, the high carbon ferrochrome increased by US$32 and reached US$1,215/50 base tons.

Supply: In May, the overall output of 400 series stainless steel decreased by 62,700 tons and reached 548,000 tons. However, in the second half of June, JISCO started an overhaul, which will reduce the 400 series output. However, the inventory remains high. Last week, the 400-series inventory in Wuxi market increased by 10,000 tons to 82,900 tons. The high inventory will influence the price to decrease.

Summary:

304: After the increase, the price gradually goes down. With the capital withdrawal from the stock market, stainless steel futures drops from the high stock price. Stainless steel spot products were in a shortage, but with a large number of new arrivals delivered in the market, the spot price might continue to reduce.

201: Affected by the spot market transactions, in the short-term, 201 market performance will be tepid, and the market may remain next week. The J2 cold-rolled market in Wuxi may remain at US$1,475/MT. However, as supply and inventory decrease, the market price will turn to increase.

430: Due to the lack of electric power, the high chrome manufacturers strongly hold the price and even it increases. The cost of 430 is increasing while the high inventory volume makes it difficult to enlarge the profit margin. It is expected that next week, the price of 430/2B will remain around US$1,625/MT~US$1,640/MT.

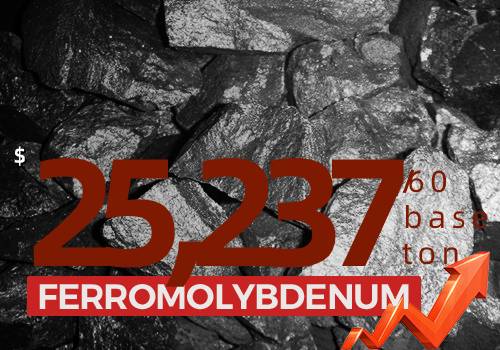

RAW MATERIAL|| Ferromolybdenum keeps rising, getting close to ¥160,000 (US$25,237)

Lately, the price of ferromolybdenum keeps increasing.

The bidding price of steel mills also raised sharply. On 15th June, the bidding price of ferromolybdenum by steel mills increased to ¥154,000 /60 basis tons in cash (US$24,290). Moreover, the quotations are further raised in the afternoon, and many reported above 160,000 yuan/60 basis tons (US$25,237).

According to the factories, the ferromolybdenum has been hot lately, forcing the price to increase. Steel mills also begin to purchase and bid. A northern steel mill giant set the delivery date in late June, but many factories are unable to guarantee the supply to steel mills due to tight inventory.

It is reported that the inventory of many steel mills maintain at a low level and so they have a strong need in purchasing. The supply of ferromolybdenum will remain tight.

From the perspective of raw materials, the price of molybdenum concentrate also rises rapidly recently. The price has increased by US$47/MT. At present, the molybdenum price of 45% concentrate has risen to US$336/MT. According to the previous raw material prices, the factories have profit to earn, but base on the current price, there is no profit margin for factories.

Because the raw materials keep ascending, the cost is difficult to settle. What is meant to be sure is that the cost will maintain the increasing force. Due to the high cost, it is reasonable that the price will boost.

Comparing the transaction price of US$24,290/MT (15th June) with the price at the beginning of June, the increase of ferromolybdenum is as high as 4,732/60 basis ton. The cost of 316 rises more than US$158/MT accordingly.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China